Radiant Logistics said it expects soft market headwinds to persist into 2025 but provided a couple of positive trends for the current quarter on a call with analysts Tuesday evening.

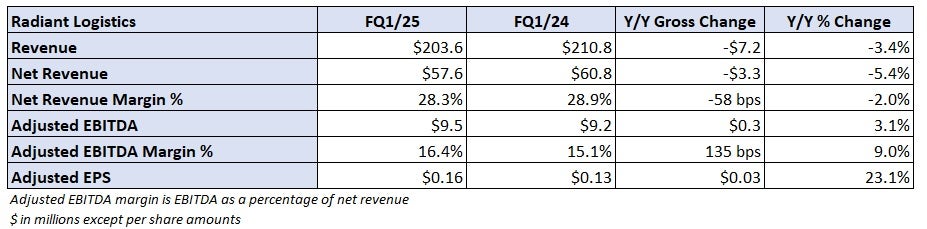

The Renton, Washington-based 3PL reported revenue of $204 million for its fiscal first quarter ended Sept. 30. That was a 3.4% year-over-year decline. Adjusted earnings per share of 16 cents was 2 cents higher than the consensus estimate and 3 cents higher y/y.

Revenue net of purchased transportation expenses fell 5.4% y/y to $58 million, resulting in a net revenue margin of 28.3%, which was 60 basis points worse y/y.

Management from Radiant (NYSE: RLGT) told analysts that the company will benefit from some incremental project freight in the last quarter of the year, most of which is tied to air charters for relief freight following the hurricanes. It also said it has seen capacity on the West Coast tighten given the volume uptick and that ocean rates are likely to remain elevated given ongoing disruption in the Red Sea and as some shippers pull freight forward ahead of a potential change in U.S. tariff policy.

The forecast for its fiscal second quarter ended Dec. 31 is for gross profit dollars to increase but overall margins to decline as the charters carry lower margins.

Adjusted earnings before interest, taxes, depreciation and amortization was $9.5 million in the quarter, a 3.1% y/y increase. A 16.4% adjusted EBITDA margin was 130 bps better y/y.

Management said the company will continue to make acquisitions of operating partners and pursue other organic growth initiatives. It believes Radiant could double EBITDA ($31 million in the fiscal year ended June 30 and $56 million in the prior fiscal year) without altering its existing capital structure.

In October, it completed its seventh acquisition in a little more than a year.

Radiant ended the quarter with $10 million in cash, little debt and no outstanding balance on a $200 million credit facility.

Radiant repurchased $700,000 in stock during the quarter ($4.1 million repurchased last year.) The company has a $337 million market cap.

“We remain focused on delivering profitable growth through a combination of organic and acquisition initiatives and thoughtfully re-levering our balance sheet through a combination of strategic operating partner conversions, synergistic tuck-in acquisitions, and stock buy-backs,” Radiant CEO Bohn Crain said in a news release. “Through this approach we believe, over time, we will continue to deliver meaningful value for our shareholders, operating partners, and the end customers that we serve.”

Shares of RLGT were off 2.9% in after-hours trading on Tuesday after closing the day down 3.2%.