Canadian Pacific’s (NYSE: CP) proposed acquisition of Kansas City Southern (NYSE: KSU) will result in new service lanes across North America, the heads of both companies asserted in a Sunday afternoon call to investors explaining the proposed transaction.

Both companies announced Sunday morning that CP would seek to acquire KCS in a deal worth $29 billion, pending approval from the Surface Transportation Board. The U.S. agency could finish its review process in mid-2022.

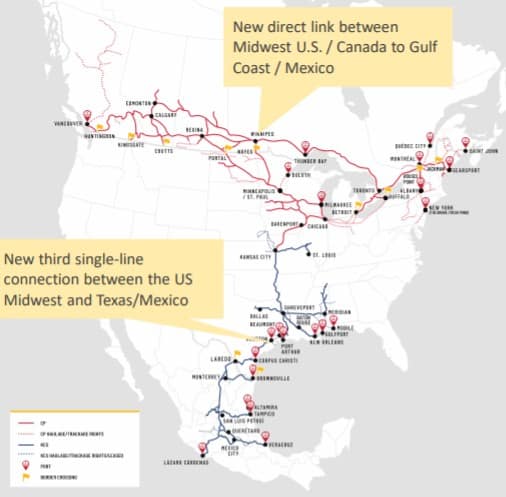

The merger would connect customers with six of the seven largest metropolitan regions in North America, potentially reduce transit times and provide new product offerings, such as a possible new intermodal service between Dallas and Chicago, executives said. The merger would also enable north-south customers to avoid congestion-prone Chicago via CP’s network in Iowa.

“It just feels like the right time and the right circumstances to put these two companies together,” said Kansas City Southern (KCS) President and CEO Pat Ottensmeyer. CP and KCS don’t compete head to head in any location, and shippers’ options would be enhanced because CP’s and KCS’ networks don’t overlap, he said.

They currently share a rail yard in Kansas City, Missouri, and they are working together to ship Canadian crude oil to the Gulf Coast.

The proposed merger comes against the backdrop of two macroeconomic factors: the passage of the trade-related United States-Mexico-Canada-Agreement (USMCA) and manufacturers’ growing appetite for nearshoring in the wake of the COVID-19 pandemic.

The North American supply chain is continuing to be an attractive source of investment, and Mexico has the ability to attract foreign investment in manufacturing and industrial activity, railroad executives said.

“The stars have aligned to make this deal happen … . Creating this network at this moment just makes tremendous sense to help participate and drive all those opportunities,” said CP President and CEO Keith Creel.

The proposed merger would entail combining the two smallest Class I railroads from a revenue perspective, the two companies said, and it would connect Canada’s origination network with KCS’ destination network.

The merger is “not about cuts, line rationalizations or cutting [headcounts]. It’s about growing this business, growing our network,” Creel said.

Unlike an interchange agreement between the two companies, a merger allows for opportunities to invest in capital projects for new lanes and asset turnarounds, executives said.

CP will seek to acquire KCS under a regulatory provision that would treat the merger differently from a traditional major or minor transaction. KCS’ exemption allowing for this kind of treatment occurred when consolidation in the rail industry was occurring at a rapid pace, with much of the consolidation occurring around and overlapping with KCS’ network, Ottensmeyer said.

Creel was confident that STB would approve the merger, saying there are no situations where a shipper or a market is going to lose rail operations. Meanwhile, the acquisition will not need approval in Canada, while both companies expect to meet Mexico’s antitrust provisions.

“This is going to create a new option for single line rail service for markets that don’t exist today,” Creel said.

The railroads’ stock prices will likely benefit from the proposed acquisition, according to Initial reaction from Wall Street.

“At a high level, this is clearly a blockbuster deal, as it combines the two best railroads from a growth perspective, with growth being the key driver for margin expansion given the highly fixed cost nature of the industry,” said Deutsche Bank analyst Amit Mehrotra in a Sunday note. “But it relies on significant assumptions for revenue synergies ($800 million, of which $600 million is expected to drop to the bottom line).

“To be sure, there is clearly significant synergies potential, with both companies currently interchanging traffic at a shared facility in Kansas City; a more seamless interchange and better breadth of single-line service would lower cost, but more importantly, improve service and transit times which would help draw more volumes to the network.”

Meanwhile, the initial shipper reaction is wait-and-see.

“It’s too early to take a position on the favorability of this merger to the rail shipping community. While the National Industrial Transportation (NIT) League and our members have outstanding relationships with both Canadian Pacific and Kansas City Southern, and are optimistic about this new venture, any merger in this industry and on this scale will be viewed with healthy skepticism based on prior history and experience of rail mergers,” said NIT League President Jennifer Hedrick in a statement. “Our members look forward to hearing more from both Canadian Pacific and Kansas City Southern as more specific details on how the combined operation will affect service and competition, which remains a priority to the NIT League.”

Subscribe to FreightWaves’ e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.

Related articles:

Breaking News: Canadian Pacific intends to acquire Kansas City Southern

CP: Land assets and partners provide growth opportunities

Kansas City Southern eyes lower operating ratio

What Keystone pipeline cancellation means for crude-by-rail

Construction of Alberta crude unit expected to start in April