In a Monday note to clients, Morgan Stanley analyst Ravi Shanker identified three key themes for the third-quarter earnings season, which begins Oct. 15 when J.B. Hunt reports. Hurricane Ida’s impact on the period, 2022 rate expectations and labor issues throughout peak season are the areas that will get the most attention, according to Shanker.

Hurricane unlikely to materially alter Q3 results

The report said only two companies, truckload carrier Werner Enterprises (NASDAQ: WERN) and Union Pacific (NYSE: UNP), have warned that the storm would impact results, with most others noting that the weather event was “par for the course” for a third quarter.

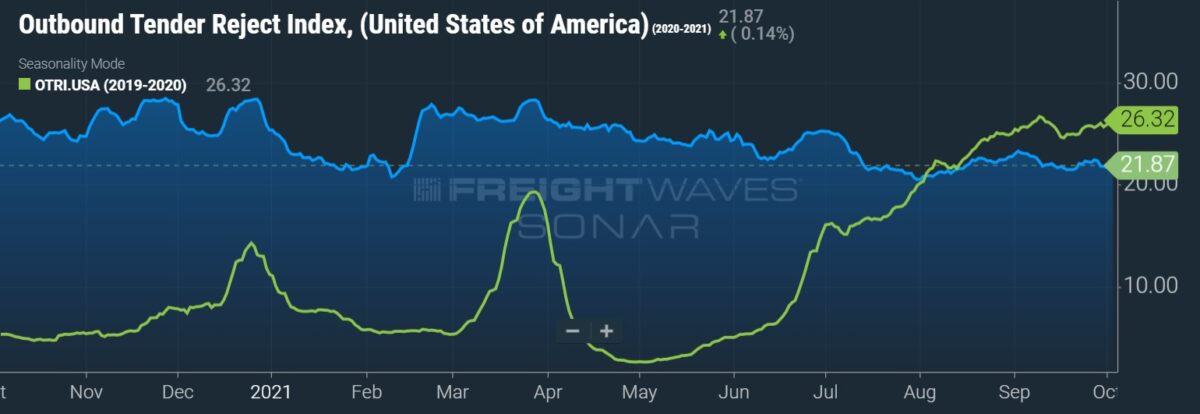

Shanker said that rates increased in the days following the hurricane and haven’t receded materially since. “A healthy 5% rate bounce during the Hurricane in late August has largely held up which shows that the market remains very tight with little sign of letting up,” the report stated.

At a Morgan Stanley (NYSE: MS) investor conference, management from Werner indicated that its dedicated operations would see a bit of a cost headwind as the company compensated drivers who were unable to haul loads for a couple of days due to the storm.

Shanker lowered his earnings estimate for Werner by 7% to 88 cents per share and reduced his UP forecast by 4% to $2.51 per share.

Myriad of factors likely to push TL rates higher again in 2022

High demand for TL capacity has kept spot rates on an upward trajectory with contract rates, the bulk of revenue for most large carriers, stepping higher as well. Contract rates are expected to increase by a midteen percentage in 2021, and the initial marker for next year, plus-5%, appears too light.

A robust level of consumer spending along with retailers pulling forward merchandise ahead of the holidays continues to fuel this inventory restocking cycle. Elevated freight demand has been met by a reduction in drivers as many have retired or left the industry for work in other sectors with comparable wages. Additionally, almost 100,000 violations have been recorded by the Drug & Alcohol Clearinghouse, with only 20% of those drivers returning to a “not-prohibited” status.

Shanker said recent favorable commentary from management teams suggest rate increases in 2022 will likely come in ahead of 5%, driving “meaningful upside to TL estimates.”

He noted that carrier Knight-Swift Transportation (NYSE: KNX) will likely beat the consensus estimate for the quarter and that it could issue better-than-expected 2022 guidance. “We believe the market is pricing in flat to down 2% rates for next year when KNX mgmt is expecting at least a HSD% [high-single-digit percentage] increase in pricing which could drive big upside relative to consensus.”

He raised his earnings forecast for Knight-Swift by 5%, to $1.11 per share.

Brokers to see more of the same

Brokers likely experienced the same trend that has been in place for a few quarters now again during the third quarter, according to Shanker.

The group should benefit from strong revenue trends due to elevated load counts and high rates. However, margin compression likely continued in the period as the cost of capacity (spot rates) remained high. The lag with which contractual rates capture changes in the spot market has hurt brokers with a high percentage of contractual agreements in place.

However, C.H. Robinson (NASDAQ: CHRW), which had 55% of its TL revenue under contract during the second quarter, could be poised for an earnings beat, according to Shanker. Even though margin pressures were present during the period, he believes better-than-expected revenue growth and strong results in its forwarding segment could beat the “unusually low” consensus estimate.

He raised his estimate for C.H. Robinson by 6% to $1.49 as “the surge in the current spot market has likely pushed the inflection point on the number of negative loads out.”

Shanker believes most of the conversations around brokerage this earnings season will center on the recent spate of M&A in the space — ArcBest (NASDAQ: ARCB) acquiring MoLo Solutions, Echo Global Logistics (NASDAQ: ECHO) being taken private in a $1.3 billion deal and Transfix’s announcement that it would go public through a special purpose acquisition company agreement.

His estimate for ArcBest was raised 20%, to $2.53 per share.

The same day the company announced the acquisition, it provided a favorable update on the quarter. Most notably, its LTL segment recorded 200 basis points of operating ratio improvement from the second quarter to the third due to sizable yields gains. Historically, ArcBest sees little sequential change in OR during the third quarter.

Shanker lifted expectations for other LTL carriers as well. Old Dominion’s (NASDAQ: ODFL) earnings forecast was raised 2%, with Saia’s (NASDAQ: SAIA) lifted by 4%.

Shanker is calling for an earnings beat by TFI International (NYSE: TFII) given the “stunning progress” made with its integration of UPS Freight. He raised TFI’s forecast for the quarter by 2%.

Labor pressures abound this peak season

Shanker noted that most transportation providers are “less stressed about peak season capacity vs demand this year” but cautioned that “extreme labor shortages/wage inflation could pressure 4Q/FY guidance and even 2022 commentary.”

From driver hiring headwinds to a lack of dockworkers to unload the freight, the result has been a steady increase in recruiting, hiring and wage expenses. Shanker expects “the net impact of cost inflation on incremental margins will be top of mind” as analysts take a pencil to 2022 expectations.

All in all, Shanker is calling for “lackluster 3Q results across the group” due to “a mixed set of early results and pre-announcements/guidance updates.” He noted that across his coverage, valuation multiples remain high (except for TL) and that “any company that does not see 2022/23 numbers revised higher after 3Q results could see the stock under pressure.”

His forecast includes 12 beats, seven misses and two in-line results for the third quarter.