For months, Ree Automotive tested its integrated electric braking, steering and motors that sit at the four corners of a chassis. Finally convinced the one-of-a-kind Reecorner system could be certified, the Israel-based company contracted British engineering consultant Horiba Mira to find out.

Horiba Mira has pre-certified the Reecorner “x-by-wire” system, giving the startup confidence it would satisfy regulators and be clear to integrate it into an electrified chassis for production of Class 3-5 work trucks by the fourth quarter of 2024 at a rate of 300 trucks per quarter. Pilot trucks are expected to be delivered to customers by the end of Q4 this year.

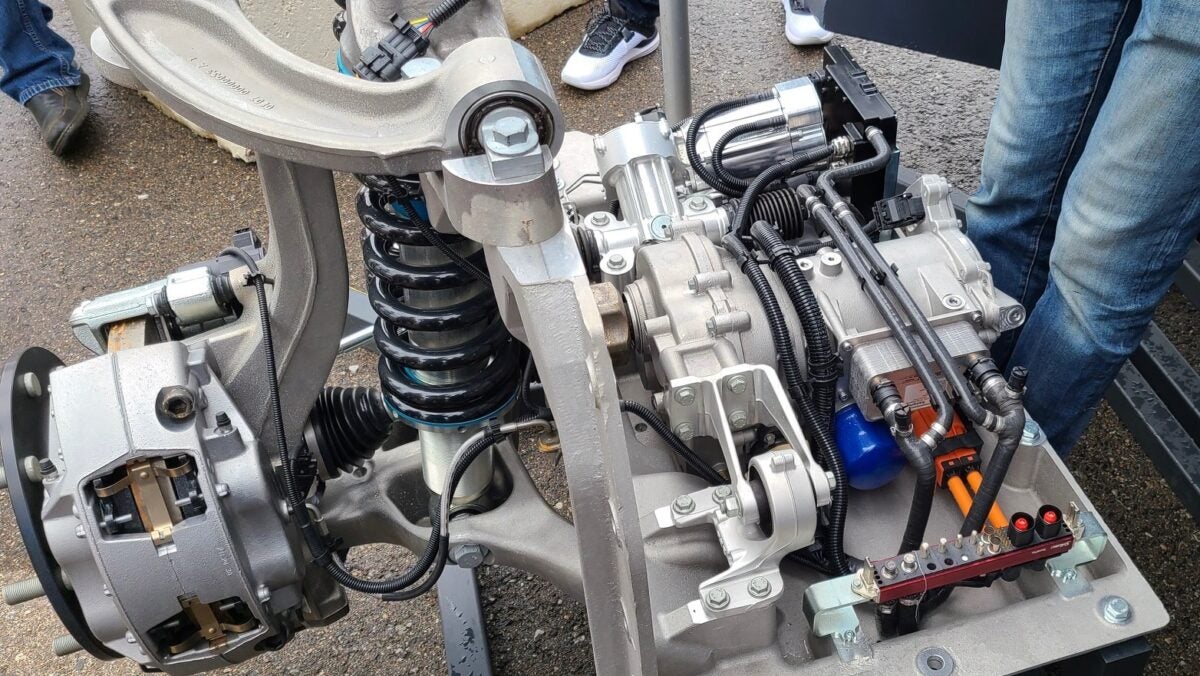

Understanding what Ree has done requires some explanation. By packing electronically driven motors, braking and steering into a single module controlled by a central computing system, Ree is at the bleeding edge of making mechanical components obsolete.

“You have electrical, electronic and software redundancy, which is the equivalent of mechanical redundancy,” said Peter Dow, Ree vice president of engineering.

So, instead of electric power steering backed by a traditional steering shaft and mechanical pump, Ree provides redundancy through power electronics. A driver will “feel” like he is steering, but computer programming is merely replicating what the driver thinks he is experiencing.

First to full by-wire system

“We are the first one ever to be able to certify a full by-wire system,” CEO Daniel Barel told me. “This is really complicated, but not because of the requirements. The requirements and the regulations do not differentiate between by-wire and non-by-wire.”

When it comes to Federal Motor Vehicle Safety Standards testing, regulators will be looking at how a complete vehicle with the Reecorner works, not at the Reecorner itself.

“We are the first to do it without a full mechanical backup,” Barel said. “When the regulators come to us, they say, ‘We don’t care how you do it. When you show us that if your front brake doesn’t work, show us that you can brake.’”

That’s what Horiba Mira showed: Electronic redundancy was just as effective as a mechanical backup.

Closing in on production

The Reecorner is loaded with intellectual property. Ree will not build trucks, just the module.

“Our core competence is the Ree corner, the by-wire. This is the secret sauce. This is the heavy lifting [and] the majority of the complexity,” Barel said.

Ree has assembled a cadre of well-known subcomponent suppliers. Microvast provides the lithium iron phosphate battery embedded in the skateboard-style steel chassis. Brembo makes the brakes. American Axle uses lightweight electric drive units featuring fully integrated high-speed motors and inverter technology.

Reecorner units will ship from a factory in Coventry, England, to the U.S.. Once here, a contract manufacturer will assemble chassis and cab chassis for upfitting. Bodybuilders Morgan Olson and Knapheide will create walk-in vans and cargo boxes to customer order. Each is a leader in their respective specialties. U.S. assembly qualifies the trucks for federal and state incentives.

“We’re not an OEM and we’re not a Tier One,” Barel said. “We’re a new breed.”

No debt and cash in the bank

Ree became a public company in July 2021. It did a reverse merger with 10X Capital, a special purpose acquisition company (SPAC).

Ree is unlike many de-SPACed companies that have struggled to raise capital in a tough market. It has has $105 million and no debt. Ree has raised less than $500 million from inception. Its cash burn of about $20 million a quarter is minimal because of its capital expense- and asset-light strategy.

Investors have not treated Ree well. Its pre-merger SPAC price of $11.40 in February 2021 closed just under 20 cents on Thursday. The Nasdaq warned Ree (NASDAQ: REE) in November 2022 that it faces delisting on Nov. 6 if its share price remains below $1 as it has since September 2022.

Barel did not seem too concerned. If the stock does not rebound, a reverse split — swapping a certain number of existing shares for one new share — would artificially propel the price into the Nasdaq safe zone. Other startups have executed that play with varied results.

Making the case for liquified hydrogen

Hyzon Motors is making the case for liquified instead of gaseous hydrogen.

The high-power hydrogen fuel cell technology developer completed its first successful commercial run with zero-emission liquid hydrogen for Performance Food Group. Engineered equipment maker Chart Industries supported the effort.

The run started in Temple, Texas, completing deliveries to eight PFG customers near Dallas. The total distance of more than 540 miles occurred over a 16-hour run that included temperatures above 100 degrees.

“With increased range and no added weight in comparison to our gaseous hydrogen trucks, we believe this liquid hydrogen demo run has demonstrated potential viability for the future of liquid hydrogen in commercial trucking,” Hyzon Chief Executive Officer Parker Meeks said in a news release.

Hyzon expects its 200-kilowatt fuel cell could cover 650 to 800 miles using liquid hydrogen because it could carry significantly more fuel on board due to energy density, with no changes to vehicle weight or payload.

Chart Industries developed a tank system capable of storing liquid hydrogen at negative 400 degrees Fahrenheit with the ability to deliver it to the fuel cell system at the necessary pressure.

How to get a battery-electric truck for free

Trevor Van Egmond is quite a negotiator. He managed to get a Nikola Tre battery-electric vehicle essentially for free.

Before he started as president of his own business, Clean Freight Consultants Inc. in Canada, Van Egmond worked for the Alberta Motor Transportation Association (AMTA). He arranged a cost share in which Prairies Economic Development Canada paid $2.8 million Canadian ($2 million) for a Nikola battery-electric and a hydrogen-powered fuel cell electric vehicle.

Nikola ponied up 50% of the cost through in-kind contributions of a Hyla mobile fueling trailer for the fuel cell truck that is pending delivery, plus hydrogen fuel and a ChargePoint charging station for the battery-electric truck. The Hyla trailer will be leased by AMTA in four rural Alberta locations. Bison Transport is currently using the battery-electric truck.

Canada offers some good rebates for electric truck purchases as well as electric infrastructure, but this deal far exceeds the $150,000 to $200,000 available for trucking companies.

“The association got a really good deal on it,” Van Egmond told me.

Briefly noted…

Wabash completed the conversion of a refrigerated trailer manufacturing plant to double the capacity to make 10,000 dry vans a year.

Lightning eMotors received overwhelming support to sell up to 20% new shares to a hedge fund that will give Lightning access to tap up to $200 million in cash in exchange for equity.

Mercedes-Benz Trucks reports positive results from hot weather testing of its eActros 600 heavy-duty electric truck in Spain.

That’s it for this week. Thanks for reading. Click here to get Truck Tech via email on Fridays. And keep up with the latest Truck Tech TV conversations on the FreightWaves YouTube channel on Wednesdays at 4 p.m.

Next week’s scheduled guests are Tom Ashley, vice president of government and utility relations at Voltera and Mark Esguerra, director of distribution system planning and strategy for Southern California Edison.