Booming U.S. retail demand has played an outsized role in container shipping’s historic bull run. A plunge in consumer demand and import orders will have a highly negative effect on spot shipping rates.

Surging inflation and a 0.3% decline in May sales versus April have spurred headlines on a retail “slump.”

To put the latest figures in context for container shipping, American Shipper interviewed Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business.

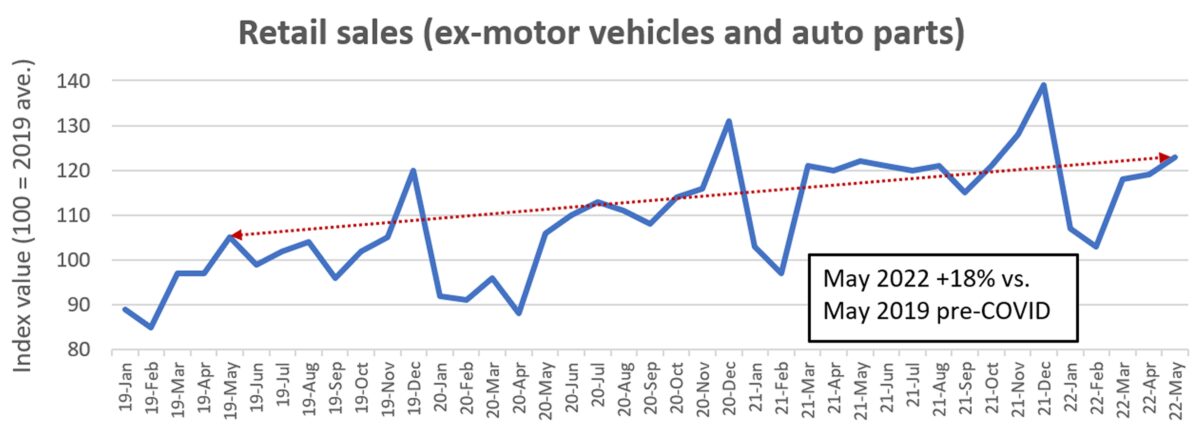

Retail sales still way above 2019

AMERICAN SHIPPER: This 0.3% decline in May reported Wednesday sounds bad. But in terms of container imports, instead of the headline number, you’d look at retail sales excluding motor vehicles and parts, because that segment has completely skewed the numbers and cars do not go by container. And it would make more sense to compare current sales to 2019, pre-COVID, because the last two-plus years have been such outliers. What are you seeing with the new numbers?

MILLER: “If you look at the numbers that just came out for May, ex-auto, and you strip out inflation, and look at nonseasonally adjusted — because seasonally adjusted data has been so volatile since COVID hit — we’re still 18% above May 2019.”

“But I think an even better way of doing it is to look at specific sectors.

“One sector I’m looking at right now is furniture and home furnishings, because that’s obviously a heavily containerized sector. Sales this May relative to May 2019 were still up 4%.”

That’s one I thought would have really pulled back, given the rising pressures on housing and the sudden demand drop in late February reported by Restoration Hardware.

“It’s still up. Another category is electronics and appliances. That’s dead even with May 2019. That has come down from the highs but I’d put an important caveat here: A lot of the sales have shifted over to another category called non-store retail. That’s your e-commerce. The electronics and appliance category is literally people buying these items in the stores.

“The category for building materials and garden equipment is up 11% from May 2019. That’s still a very strong category. The fact that the building materials data is doing so well is telling me that work on houses is still strong.”

“And then there’s clothing — an import category for imports. That’s still running crazy hot. That’s up 15.5% from May 2019.”

That makes a lot of sense. The type of clothes people are wearing now are completely different from what people were wearing in the first year of COVID.

“Clothing is a huge one. And there’s another category, one of my favorite discretionary spending categories: sporting goods, hobbies, musical instruments and books. Those are all combined together. Sales were up 30% in May relative to May 2019. This category has been crazily pumped up since June 2020.”

“If we look at the other general merchandise category — the Walmarts [NYSE: WMT] and Targets [NYSE: TGT] of the world — they’re up 8.4% from May 2019.

“Then comes the wild card in the world of government statistics: non-store retail. This is very much e-commerce-related, and it includes e-commerce from everybody, not just pure plays. This category is up a stunning 60% from three years ago. There’s a little bit of uncertainty here [due to changes in government benchmarking] but it doesn’t change the fact that non-store sales are running well above 2019 levels, no matter how you cut it.”

Services rebound has not replaced goods trade

On quarterly calls in May, ocean carrier execs said volumes were still strong but the cargo mix was changing. Fewer bikes and goods bought for work from home, more goods used in services industries.

“That certainly makes sense. It’s not like a sporting event doesn’t require goods transport. I think we may be overstating this idea that the transition to recreation services [erases goods trade]. There’s still demand for freight of some sort. We’re also seeing that people are still spending a greater share of their wallet on goods.”

One of the big theories during the pandemic was that when consumers could move freely again, they’d switch back to services and goods spending would snap back down to pre-COVID levels. This hasn’t happened yet. Spending on services has recovered but goods spending stayed elevated.

“We have not seen spending on goods suddenly revert back. I think it simply comes down to the fact that the amount of stimulus we plowed into the system was just so immense. Certainly, things are tougher for people now than they were last year. But I believe that sentiment data right now is just so overrated. Just because people don’t feel good about inflation doesn’t mean they’re going to stop spending.”

National inventory-to-sales ratio hasn’t recovered yet

Another big topic now is inventory levels. There’s been a huge amount of focus on this following quarterly reports by Target and others on excess inventories. Retail stocks were hammered. There’s a clear belief among container investors that this could temper import demand. The latest government data we have on this is for April. How did the national inventory-to-sales ratio in April compare to pre-COVID?

“Actual inventories were well above where they were before COVID. But for retail trade ex-auto, believe it or not, the inventory-to-sales ratio was still below where it was before COVID, which is almost shocking to hear given all this discussion about inventories. It has come back. Last October it was 1.05 [ratio of real inventory to real sales] and it was up to 1.15 in April. But it was 1.23 back in April 2019. This April, it’s down around 6% from that.”

I assume the inventory-to-sales ratio varies a lot between different segments. Different businesses can be way above or below that national number.

“Oh yeah. There’s a category for furniture, furnishings, electronics and appliances. This one is dead even with the ratio in April three years ago. Same for building material and garden equipment.

“But clothing stores are actually still way down. The inventory-to-sales ratio for clothing is still down 13% from where it was in April 2019. And then there’s one that really stands out for being high: other general merchandise.

“That’s up 20% [in April 2022 vs. April 2019] and boy does that sound a lot like what Target and Walmart and all of those companies have been reporting.”

Another popular theory during the COVID era — besides the one about service spending replacing goods spending, which hasn’t happened yet — was that inventory-to-sales ratios are pulled by a kind of gravity. Either back to their pre-COVID ratio, or to a higher ratio, because the supply chain crisis showed that “just in time” doesn’t work so we need to switch to “just in case,” thus more inventory in relation to sales. What do you think about this?

“I think that for the public retailers, the gravity’s going to be their historical financial performance. We saw how badly Target’s stock got hit. The financial analysts, at the end of the day, are not going to tolerate this just-in-case argument.

“For [companies] in the other general merchandise [category], inventories to sales are really, really high. It’s clearly one sector of retail that needs to burn down some inventory.”

But even for those companies whose inventories are high, looking to second-half container imports, there’s still the holiday goods to bring in — peak season imports. The high inventories don’t solve that, right?

“Oh no. The holiday stuff is the holiday stuff. Retailers have been stuck with some things but that doesn’t change the fact that they still need to bring in their holiday stuff.”

Click for more articles by Greg Miller

Related articles:

- Los Angeles port: Peak season coming soon, strong imports ahead

- Boom times not over yet: US container ports still near highs

- US import demand is dropping off a cliff

- Container shipping jackpot continues: CMA CGM profits soar

- Blockbuster container shipping results collide with sinking sentiment

- Retail boss warns on supply chain, likens demand risk to ‘Big Short’