In the mid-2000s, an entire subindustry emerged in New York to help raise capital for shipowners. Investment banks, lawyers and accountants raked in fees on initial public offerings (IPOs), follow-ons, takeovers and restructurings. Private fund managers bought equity and sold credit products.

In 2020, you could hear the crickets in these circles. Deal flow was even worse than last year.

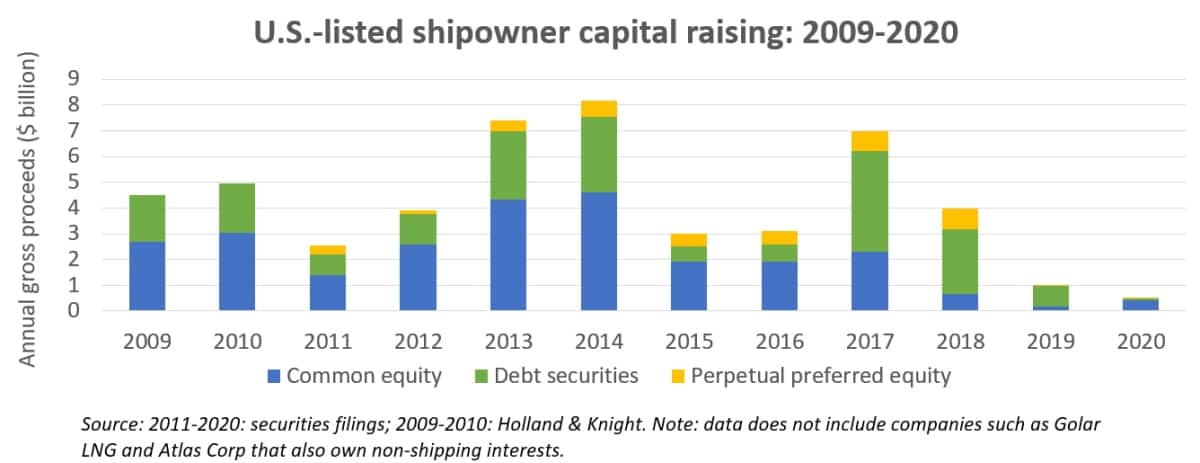

According to analysis of public filings by American Shipper, U.S.-listed owners of pure commercial shipping assets (excluding conglomerates with non-shipping interests) raised a mere $501 million in 2020.

That is the lowest annual total in the modern era. It’s half the $1.02 billion raised in the second-lowest year — 2019 — and one-sixteenth of the $8.16 billion raised in record-high 2014.

Meanwhile, there has not been a U.S. shipping IPO since 2015. Prospects appear dim for next year, but not dead. Amid the booming container market, liner operator ZIM might head to New York for its IPO.

Shares too cheap to sell

Most shipping stocks are now trading at double-digit discounts to net asset value (NAV), the market-adjusted value of the fleets plus other assets, minus liabilities.

It makes no sense for management of listed owners to issue new shares at steep NAV discounts unless they have to — for example, to appease lenders — or unless they favor something else over share price — for example, related-party deals or fleet growth.

In 2013-14, when shipping follow-on offering activity was exceptionally high, many of the issuers raised equity as part of loan renegotiations — not because they wanted to but because they had to.

That’s not the case today, which is good news for shareholders. Tankers owners are still flush with cash from the rate spike earlier this year. Many dry bulk owners repaired balance sheets over the past decade. Owners of gas carriers and container ships are currently enjoying very high rates.

“This does not look like a time when there will be emergency equity issuance,” said Jefferies shipping analyst Randy Giveans in a recent interview with American Shipper. “Balance sheets are good. No one’s cash-strapped right now and shares are trading at massive discounts to NAV.”

Some owners issued shares anyway

Not all shipowners abstained from equity sales in 2020.

Scorpio Bulkers (NYSE: SALT) raised $75.7 million in a follow-on offering on June 9. Its shares fell 13% over the following two days. Last Thursday, Eagle Bulk (NYSE: EGLE) announced a share sale to raise $25 million to fund ship acquisitions. Its stock fell over 10% on the news.

Most of this year’s equity sales were by micro-cap owners whose equity often trades for pennies per share. While almost all larger shipowners shunned capital markets this year, these smaller owners were unusually active.

Top Ships (NASDAQ: TOPS), Castor Maritime (NASDAQ: CTRM), Globus Maritime (NASDAQ: GLBS) and Seanergy (NASDAQ: SHIP) conducted 25 equity offerings between them — mostly registered direct offerings — raising an aggregate $272 million.

Castor, Globus and Seanergy used proceeds to buy ships from nonaffiliated parties. Top bought ships from a related private company owned by its CEO, Evangelos Pistiolis.

As of Tuesday, shares of Castor, Globus, Seanergy and Top Ships were all down over 90% year-to-date.

New listings since 2015

The last shipowner to conduct a U.S. IPO was Gener8 Maritime in June 2015, over a half-decade ago. That’s by far the longest dry spell since the turn of the century.

Yet the public shipping space is more crowded than ever. Newcomers are listing without doing IPOs.

Since the Gener8 IPO, nine owners have gone public in the U.S. via either direct listings, reverse mergers or spin-offs: Pyxis Tankers (NASDAQ: PXS) in late 2015; International Seaways (NYSE: INSW) in 2016; Torm (NASDAQ: TRMD) in 2017; Castor, Grindrod (NASDAQ: GRIN), Navios Containers (NASDAQ: NMCI) and Eurodry (NASDAQ: EDRY) in 2018; and Diamond S (NYSE: DSSI) and Flex LNG (NYSE: FLNG) last year. There were no newcomers in 2020.

A China-driven demand boom fueled the initial shipping IPO wave in the early and mid-2000s, rendering fleets more valuable if public than private. As Seward & Kissel partner Gary Wolfe recalled in an earlier interview: “You had bankers going to Greece and telling owners: ‘Do an IPO! It’s like selling your ship for twice the price!’”

For most owners, doing an IPO today would be like selling your ship for two-thirds the price. “It doesn’t look like a ripe market for shipping IPOs,” acknowledged Giveans.

Wolfe told American Shipper, “It [2021] does not look like it will be a year for offerings of common shares in IPOs. However, it does appear that it will be a year in which inventive shipowners and investment bankers are able to make use of direct listings and registered direct offerings.”

Shipping IPO prospects for 2021

Container shipping could offer the most likely prospect for a 2021 IPO.

Almost all U.S.-listed companies in the container space are ship lessors or box-equipment lessors. The only liner operator with U.S.-listed common stock is Matson (NYSE: MATX). Its stock is up 37% year-to-date. The world’s largest liner operator, Maersk, trades in Copenhagen but does have American depositary receipts (ADRs) in the U.S. over-the-market (OTC: AMBKY). Maersk’s ADRs are up 54% year-to-date.

Could another liner operator debut on NYSE or NASDAQ in 2021?

Israel-based ZIM seems the most likely contender. In August, the Israeli news site Globes reported that ZIM is considering an IPO in either London or the U.S.

Alphaliner reported in October that ZIM was buying back bond debt “as the company takes the next step towards a potential IPO.” Alphaliner added, “ZIM may not find a better time in the current cycle to attempt an IPO.”

On Nov. 18, ZIM reported “all-time record” earnings for Q3 2020. In its quarterly release, it confirmed it was exploring options including “public equity and/or debt issuance.”

ZIM held a special meeting of shareholders on Tuesday. A document discussed at that meeting stated that “subject to a determination by the board that a reasonable market capitalization could be achieved following an IPO, the company shall use its commercially reasonable efforts to effect an IPO within 24 months.”

There are multiple references in the document to the U.S. Securities and Exchange Commission (SEC). It also referred to the possibility of “circumstances where an IPO was not effected under the [U.S.] Securities Act but rather under the laws of another jurisdiction.”

In other words, the IPO venue has yet to be decided, but Wall Street is in the running. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON SHIPPING STOCKS: Container rates are on fire. How can you invest in that? See story here. Wall Street’s incredible shrinking shipping stocks: see story here. Lost decade for shipping shares: see story here. Shipowners with shares worth pennies rake in millions: see story here. Robinhood’s topsy-turvy Top 10 shipping stocks: see story here.