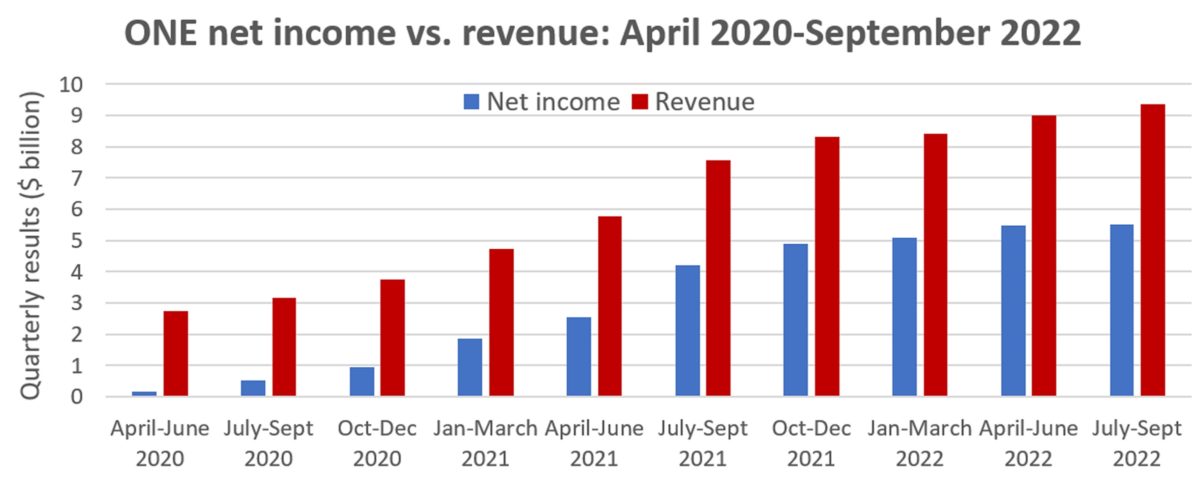

Another quarter, another astonishingly high record profit for a shipping line. Amid all the bleak talk of sinking demand and a “hard landing,” results and projections announced Monday by Ocean Network Express (ONE) highlight how much shipping lines will continue to rake in as the COVID-driven consumer boom winds down.

ONE, the world’s seventh-largest carrier by fleet size, reported net income for July-September (its second fiscal quarter) of $5.52 billion. That’s up 32% year on year (y/y) and just above the $5.5 billion earned in the preceding three months.

The latest period also boasted the company’s highest-ever revenues: $9.37 billion, up 24% y/y and 4% versus April-June.

Smaller fleet, lower volume but higher revenues

Revenues have continued to rise despite a reduction in fleet size and cargo volume. ONE’s fleet capacity was 1,526,999 twenty-foot equivalent units as of the end of September, down 4% y/y and 5% from the peak at the end of March 2021. ONE handled 2,898,000 TEUs of cargo in July-September, down 9% y/y and 1.4% from April-June.

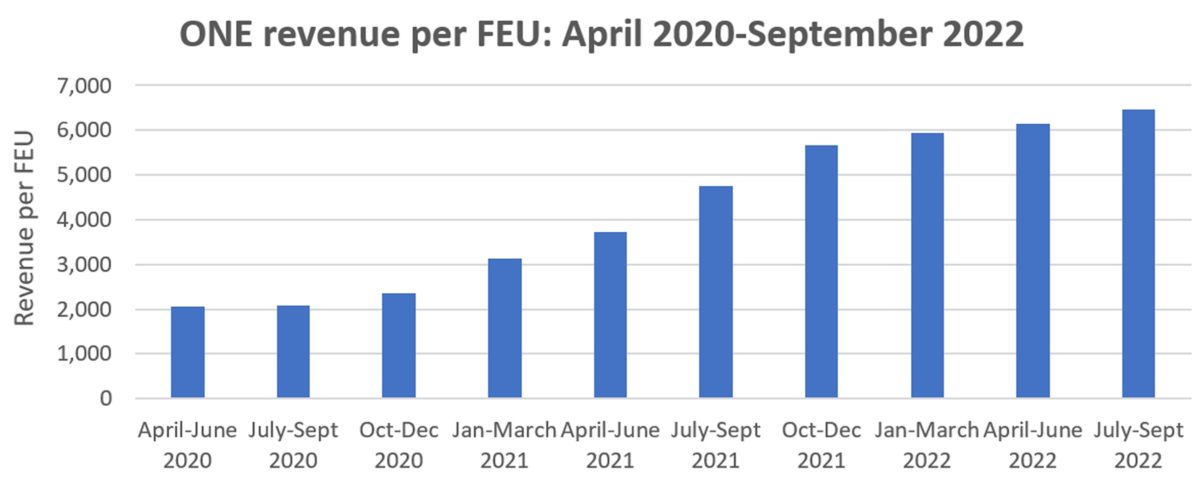

The reason revenues and profits rose despite falling volumes: Revenue per container continued to increase. ONE achieved an average revenue of $6,464 per forty-foot equivalent unit in the latest quarter, up 36% y/y and 5% from April-June.

Rising revenue-per-FEU performance sharply contrasts with spot rate indexes, which show large decreases over the same time frames.

The average Drewry global composite index of spot rates per FEU averaged 40% lower in July-September 2022 than in the same period last year, and 24% lower than in April-June.

This dichotomy underscores the pitfalls of using spot-rate indexes as a guide for ocean carrier earnings. Carriers have more volume on contract rates than spot rates, and their mix of business is different than the mix of global indexes.

ONE’s rising contract rates more than offset the decline in spot rates. “Spot rates fell … but the average rate levels remained high,” said the company in its earnings release. “Freight rates remained firm [in the latest quarter].”

Profits to fall but remain far above pre-COVID levels

ONE conceded that the most recent quarter will be the high point. The reversal has already begun. It cited “steady cargo movements” in July, followed by “a sudden decline in transport demand in August and September.”

Going forward, it warned that “due to the inventory build-up situation in North America and Europe’s entry into recession, it is expected to take some time for cargo movements and short-term freight rates to recover.”

In the second half of ONE’s fiscal year — October 2022-March 2023 — it projects profits to be $4.25 billion, down 61% sequentially from the prior six months and down 57% y/y.

Those are huge percentage declines, but they’re off a historically high base driven by a one-off pandemic-induced cargo spike.

Even with predicted reductions, ONE expects its fiscal-year profits to total $15.3 billion, down 9% y/y but still its second-best fiscal year ever. (ONE was formed in 2017 via the merger of the container fleets of Japan’s MOL, K Line and NYK.)

To put the forecasted decline in perspective, ONE’s average quarterly net income in March-December 2019, pre-COVID, was $43.7 million. The average quarterly profits ONE expects in the next six months amid “deteriorating conditions” is 49 times higher. That’s a forecast most CEOs would envy, and one that does not meet the definition of a “hard landing.”

Click for more articles by Greg Miller

Related articles:

- Shipping lines still raking in billions despite sinking cargo demand

- Shipping rates are no longer plunging. Is ‘new normal’ near?

- Did US slash imports too much, setting stage for shipping rebound?

- Here’s how container shipping lines can escape a crash in 2023

- Shifting tides: The fall of container shipping stocks, the rise of tankers

- Container imports to Los Angeles and Long Beach are plummeting

- Global trade at the crossroads: Risks from geopolitics, inflation loom