The highlights from Thursday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Watch: Demonstrating the power of TRAC

Exectuive Publisher Kevin Hill and Sultan of Sonar Zach Strickland outline the power of TRAC — a resource designed to help users know the freshest data regarding spot rates on trucking lanes.

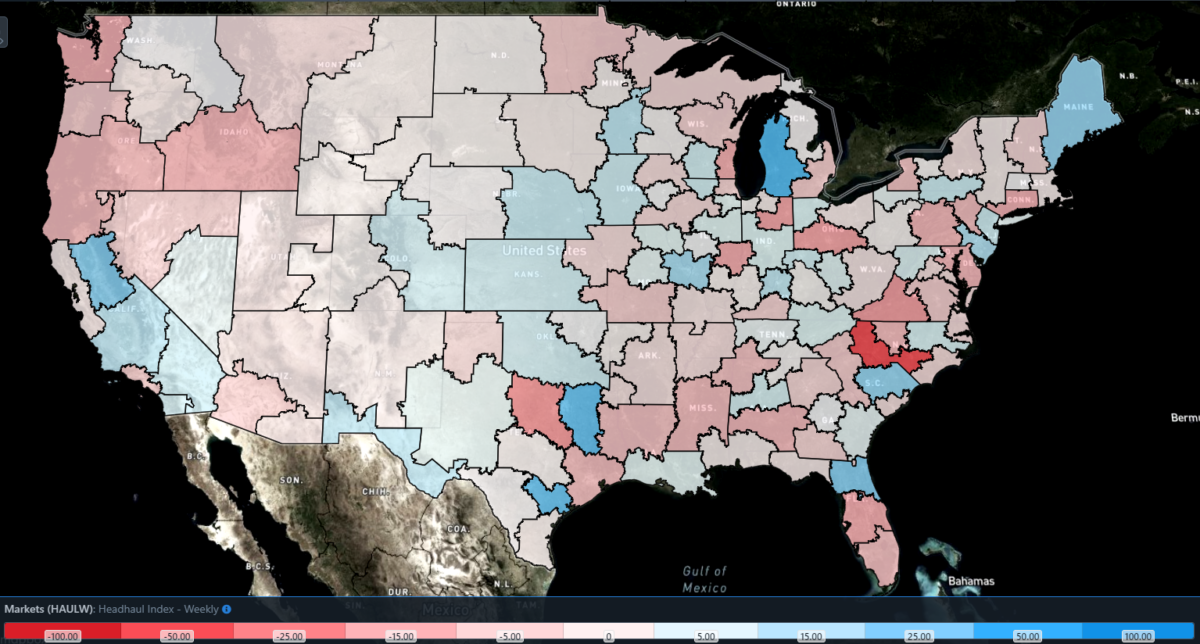

Focus on … Headhaul Index weekly change

Capacity flooded into the largest markets following the holidays, leading to load imbalances that are starting to intensify as capacity leaves the markets.

The Headhaul Index – Weekly Change (HAULW) shows where load balance is changing, signaling where capacity is likely to tighten or loosen.

When HAUL increases rapidly week-over-week (w/w), capacity is likely to tighten as outbound tender volumes are growing faster than inbound tender volumes.

In two of the largest markets in the country (Dallas and Ontario), HAULW is intensifying, signaling that capacity in the markets is likely to tighten in the coming days.

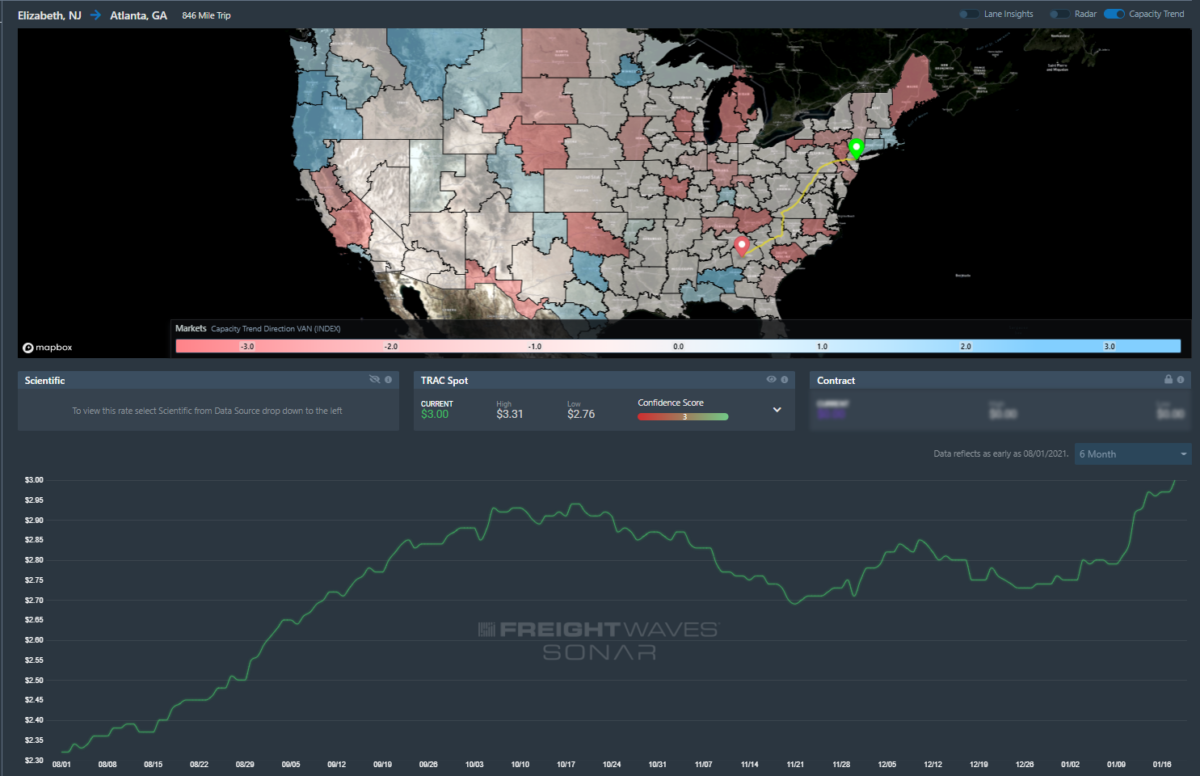

Lane to watch: Elizabeth (N.J.) to Atlanta

Overview: Spot rates are up over 20 cents per mile this week.

Highlights:

- Elizabeth to Atlanta spot rates have increased over 20 cents per mile over the past week (to $3.00/mile).

- Elizabeth’s outbound tender rejection rate spiked once again this week, climbing from 17.3% on Sunday to 19.1%.

- Atlanta’s outbound rejection rate has barely moved over the past week, hovering around 17%.

What does this mean for you?

Brokers: Continue to pad margins on loads coming out of Elizabeth and do not take this normally easy lane to cover for granted with spot rates on the rise.

Carriers: Scour the spot market for loads if you have no preplan waiting for you in Elizabeth. Capacity continues to tighten in upstate New Jersey. Atlanta has stabilized after the holidays; however, rejection rates are still higher than they were in mid-December.

Shippers: Keep lead times above three days out of Elizabeth and make sure to check with your carriers on any loads contracted to move well below $3 per mile.

Lane to watch: Harrisburg (Pa.) to Chicago

Overview: Rejections and spot rates have increased due to winter storm disruption.

Highlights:

- Harrisburg to Chicago rejection rates increased 11% w/w – from 21.75% on Jan. 12 to 24.48% on Jan. 19.

- Spot rates from Harrisburg to Chicago increased 26 cents to $2.84 per mile compared to $2.60 on Jan. 1.

- Winter storms continue to impact the region with Harrisburg market outbound rejections at 24.76%.

What does this mean for you?

Brokers: Higher tender rejections and spot market moves means greater risk to margins. Be cautious when spot quoting loads in and out of the Harrisburg area, because some carriers may charge a premium to move into weather-affected areas.

Carriers: Communicate winter weather delays early and often, as winter storm systems will impact transit times in the Northeast. While spot rates provide an attractive option for ad hoc opportunities, timing between weather systems will be the best strategy in the event of shipper or receiver closures.

Shippers: Winter storm disruption will impact shipping operations as well as inbound loads. Prioritize “must go” freight before storms approach and give updated facility hours in the event of closures. These actions will help carriers and brokers provide timely service and minimize disruptions.

Lane to watch: Columbia (S.C.) to Chicago

Overview: Outbound tender rejections are up 155 bps w/w, and that could send spot rates past their year-to-date highs.

Highlights:

- Columbia outbound tender volumes are up 15% w/w, signaling that demand for outbound capacity is increasing.

- The Headhaul Index in Columbia is up 21% w/w, signaling that capacity is likely to tighten due to the growing imbalance between inbound and outbound volumes.

- Columbia outbound tender rejections are already up 155 bps w/w, and are likely to increase further in the days ahead.

What does this mean for you?

Brokers: Columbia outbound tender rejections have increased 155 bps over the past week, and due to the growing imbalance between inbound and outbound tender volumes, rejections will likely continue to increase in the days ahead. Spot rates are already at their highest levels in a month, so be sure to adjust your pricing accordingly.

Carriers: Spot rates from Columbia to Chicago are already at their highest levels so far in 2022, and the good news for carriers is that pricing power is likely to shift even further into your favor due to the 21% surge in the Headhaul Index w/w. The 155 bps increase w/w in outbound tender rejections is also proof that the Columbia market is likely tightening further.

Shippers: Your shipper cohorts in Columbia are currently averaging 3.1 days in tender lead times, but with outbound volumes and the Headhaul Index on the rise, it would be wise to push your tender lead times closer to 4 days for the next couple of weeks to help give your team the best chance of securing available capacity.