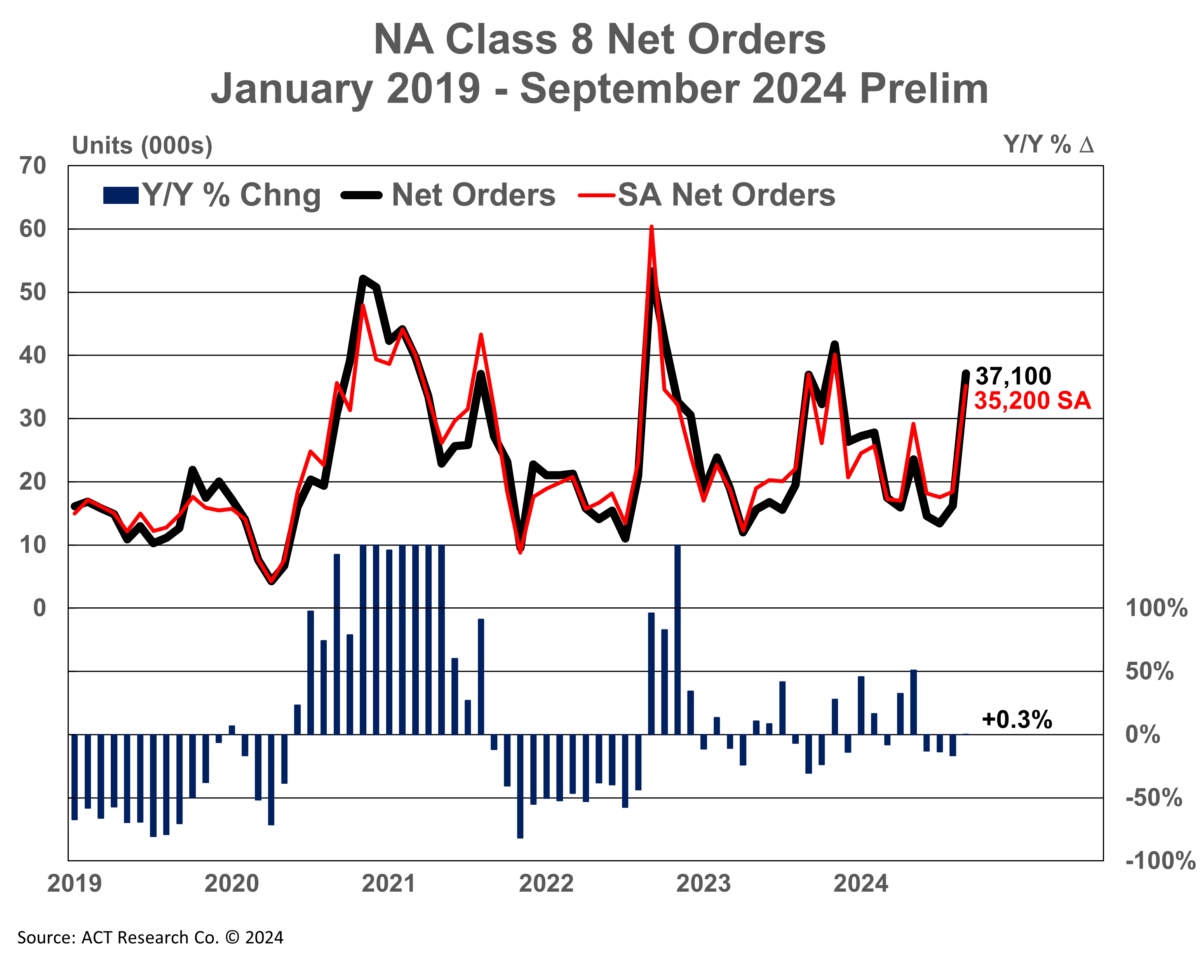

Strong Class 8 orders beat seasonal expectations

Class 8 preliminary truck orders roared back to life as OEMs’ 2025 order books opened up, according to recent data from both ACT Research and FTR Transportation Intelligence. ACT reported that September saw 37,100 initial orders, double the number compared to August and up 0.3% year over year. Kenny Vieth, president and senior analyst at ACT Research, noted the Class 8 order jump was “well above trend and seasonally elevated expectations in September.” Compared to August, seasonally adjusted Class 8 orders jumped 92% to 35,200 units.

Rival firm FTR Transportation Intelligence reported an increase of 107% m/m compared to August, with September reaching 30,000 Class 8 net orders. The report noted the figure is in line with seasonal expectations when looking back at seven years’ worth of data, which saw the average September order level at 32,170 units. The report adds, “Given the current stagnation in the truck freight market from a volume and rate perspective, this is a very balanced order number and suggests an initial, healthy level of demand for new trucks in 2025 as September is typically the opening of order boards for the following year.”

Dan Moyer, senior analyst for commercial vehicles at FTR, said in the report that despite the freight market being stagnant, demand remains as fleets continue investing in newer equipment at replacement levels. Excess Class 8 inventory continues to be a development to watch. Moyer adds, “With inventory remaining near record levels, we also expect further downward pressure on build rates through the end of 2024.”

LMI reaches highest level of expansion since September 2022

On Tuesday, the Logistics Managers’ Index released its September report, which saw its overall index increase for the 10th consecutive month to its highest level since September 2022. The LMI’s overall index rose 2.2 points from an August reading of 56.4 to 58.6 in September. One positive trend impacting the overall average was a continuation of August inventory levels into September. The report said, “We saw a continuation of August’s trends in September as Inventory Levels increased (+4.1) to 59.8. This is largely driven by the long-expected restocking of Downstream retailers. After several months of contraction, Downstream respondents are reporting expansion for Inventory Levels at a rate of 55.7.”

Regarding the East and Gulf Coast port strikes, the report cautioned that a prolonged work stoppage could have a meaningfully negative impact on capacity. The report highlighted a recent example where an imbalance of freight capacity relative to demand caused a massive boost in transportation prices in 2021. Prolonged port strikes have the potential to create a disproportionate demand for capacity as goods are rerouted to West Coast ports, potentially taking capacity out of other areas in the country and driving up prices.

The report adds, “It is likely that a prolonged strike would push us back towards that imbalance, artificially depressing available Transportation Capacity and inflating Transportation Prices across the country. This price growth is due to demand and not costs.”

Market update: August For-Hire Trucking Index – volumes rise, capacity still abundant

ACT Research recently released its September For-Hire Trucking Index, which saw higher volumes in August from growing goods demand and increases in inventories. The survey uses a diffusion index, with a reading above 50 showing growth, while below 50 shows degradation. The Volume Index saw a 4.8-point increase from 49.7 in July to 54.5 in August.

The report notes: “Consumption of durable goods rose 4.2% q/q SAAR in Q2, imports and inventories are growing, and cross-border shipments are increasing. Though, pre-positioning ahead of potential east coast port strikes is part of the story.”

ACT’s Capacity Index fell 1.1 points m/m from 47.6 in July to 4.6 in August. This is the 14th consecutive month that ACT’s capacity has declined, the longest streak since the survey’s inception in 2009. Private fleets adding capacity continues to cause added pressure on for-hire fleets and their capacity.

The report adds, “Overall, the supply-demand between fleets and capacity looks set to gradually begin to rebalance. As for-hire conditions have yet to pick up much, it’s hard to see capacity turning positive in the coming months, especially as for-hire fleet purchasing intentions remain under pressure.”

Driver availability remains elevated, with August marking the 27th month in a row the index has shown an expansion over 50 points. August saw an increase of 55.4 points compared to 53.1 points in July. The report said, “Driver availability remains persistently elevated and far from a shortage, partly supported by older drivers sticking around to help with higher living costs, and partly by the rise in migration in the past few years.”

FreightWaves SONAR spotlight: Outbound tender rejection rates muted as port strike begins

Summary: Nationwide outbound tender rejection rates remain depressed as the impacts from a major hurricane and East and Gulf Coast port strike begin to be felt. OTRI fell 17 basis points week over week from 4.72% on Sept. 23 to 4.55%. In contrast, the dry van segment continues to underperform the combined average but posted a 1-bp w/w gain from 4.39% to 4.4%. Lower tender rejection rates appear to be one impact on nationwide dry van spot market rates, which remain depressed but saw a 1-cent-per mile all-in w/w gain from $2.20 on Sept. 23 to $2.21.

Supply chain disruptions and their impacts on contracted tendered freight volumes will be a key concern for truckload carriers in the coming days to weeks. While parts of Tennessee, the Carolinas and Florida work through Hurricane Helene damage, East and Gulf Coast labor strikes and the resulting work stoppage pose a major risk to freight volumes if a settlement cannot be reached quickly.

The waterfall theory of freight, in which a shipper tenders loads to a primary incumbent carrier or further down the routing guide, dries up in the absence of load tenders. Beginning with port drayage volumes, a strike lasting days into weeks can move upstream to warehouses those drayage carriers deliver into. No drayage deliveries means no transloading into 53-foot dry van or 53-foot rail containers, robbing both segments of committed volumes at a time when capacity remains abundant. The worst-case scenario would be large for-hire and private fleets, starved of committed tender volumes, moving their capacity on the spot market, undercutting smaller fleets, owner-operators and the freight brokerages that attempt to solicit for them.

For carriers and freight brokerages exposed to shippers who are impacted by the strike, finding solutions to a sudden drop in committed freight volumes may result in soliciting current and former customers to offset for missing volumes.

The Routing Guide: Links from around the web

Closures continue on I-40 and I-26 in North Carolina, I-40 in Tennessee (FreightWaves)

Trucking firm exits inch closer to equilibrium (Trucking Dive)

J.B. Hunt, UP.Labs create FreightTech lab (FreightWaves)

Truckstop spot rates shifted ‘as expected’ last week, FTR says (The Trucker)

‘Down for the foreseeable future’: Truckers grapple with Hurricane Helene’s aftermath (Trucking Dive)

Freight market green shoots fade heading into October (FreightWaves)