As the first half of 2022 draws to a close, shipping fortunes are mixed. Container shipping is the biggest winner from a profit perspective while product tankers are the biggest winners in the stock market.

Pain at the pump is coinciding with a boom for owners of tankers that carry petroleum products. Freight rates and stocks have been fueled by the Ukraine-Russia war as well as the post-COVID scramble for diesel, gasoline and jet fuel.

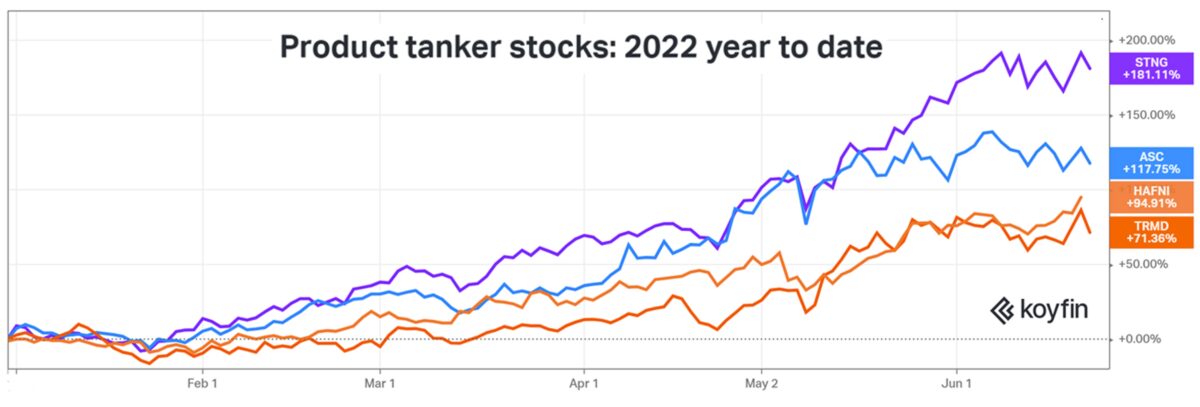

Despite recent stock market turmoil, shares of Scorpio Tankers (NYSE: STNG) are still up 181% year to date. Product tanker owner Ardmore Shipping (NYSE: ASC) is up 118%, Oslo-listed Hafnia Tankers 95% and Torm (NASDAQ: TRMD) 71%.

In contrast, shares of container shipping stocks are down year to date. Dry bulk stocks shed much of their 2022 gains this month.

War versus fundamentals

The question for product tanker investors is: How much of this is about the war and how much is fundamentals?

“Some are still skeptical of the sustainability of an upturn under the premise that the recent strength is purely a function of disruption resulting from Russia’s invasion of Ukraine,” said Evercore ISI analyst Jon Chappell in a client note.

“This is not war,” countered executives of Scorpio Tankers during a presentation on Tuesday hosted by Evercore ISI.

Scorpio’s head of chartering, Lars Dencker Nielsen, acknowledged that changing flows due to the war in Ukraine are having an effect. But he argued that “much of the market recovery today was already underway even before the war began and that the true impact of the redrawing of the product trade map [due to the war] is yet to come later this year.”

Scorpio has a long history of talking its book. But Chappell sees evidence of fundamental strength from channel checks elsewhere.

“After meeting with several commodity traders, oil majors and rival shipowners over the last several weeks, [we see] a strong and accelerating demand for long-dated time-charter contracts that imply that many industry players, on both side of the chartering desk, believe current market strength has significant legs,” he said.

Chappell noted that in the product tanker trade, the cost of shipping “has always been a sliver of the cost of the commodity. Today, with product tanker rates nearing all-time highs, the cost of freight still pales in comparison to the arbs [arbitrages] the traders make from moving the cargo, given trade dislocations and regional shortages. Traders have to move cargoes and almost no level of product tanker rates is going to change their profit calculus.”

Spot rates far exceed breakeven rates

“Product tankers continue to be the standout performers,” affirmed Clarksons Platou Securities analyst Frode Mørkedal.

Clarksons’ rate assessments for Wednesday:

- Larger product tankers in the long-haul trades known as LR2s (80,000-119,999 deadweight tons or DWT) built in 2015 or later are obtaining spot rate equivalents of $62,900 per day. The average breakeven for this vessel type is $25,000 per day. Crude tankers in this size category are earning around half the LR2 rate.

- Spot rates for modern LR1s (55,000-79,999 DWT) were $54,600 per day. Breakeven is $19,000.

- MRs (25,000-54,999 DWT), which mainly operate in regional trades, are the workhorses of the product tanker business. Modern MRs were earning spot rates of $60,300 per day, more than triple the average breakeven of $18,000.

Tanker insurance ban raises questions

Chances have faded for a quick resolution of the war and a snap back to prewar supply relationships between Russia and Europe, the U.S. and the U.K.

Earlier this month, the EU agreed to cease seaborne imports of crude from Russia by Dec. 5 and refined products by Feb. 5, 2023. These measures would be positive for tanker rates. Shipping demand is measured in ton-miles: volume multiplied by distance. The EU import ban would increase the distance traveled by both Russian exports and EU replacement imports.

However, the EU decision also banned EU insurance and reinsurance for Russian crude and product cargoes going to other countries. The U.K. is expected to follow suit. If the insurance ban goes into effect, it could be a negative for product tanker ton-miles, because it may limit cargo volume.

Brokerage BRS believes that an EU/U.K. insurance/reinsurance ban “will see mainstream tanker owners essentially prohibited from carrying Russian oil.” Cargoes would shift to Russia’s sanctioned tanker fleet and the so-called “shadow fleet.” The shadow fleet is composed of older tankers with opaque ownership engaged in sanctioned Iranian and Venezuelan trades.

The problem for Russian exports of clean (finished, refined) exports is that there are not enough Russian-controlled tankers and shadow tankers to handle the load, according to BRS.

“Russia has a very small clean tanker fleet with its LR vessels almost exclusively trading dirty [transporting fuel oil]. Its smaller tankers are too small to make the shipping of large volumes of Russian clean products over long distances economic.

“Meanwhile, the shadow fleet is almost exclusively lifting crude or fuel oil, which makes these units unsuitable for clean products. This suggests that Russian clean product exports will slow to a trickle in the event of an insurance ban.”

Click for more articles by Greg Miller

Related articles:

- Batten down the hatches: Shipping stocks ‘unable to escape the torrent’

- How new EU sanctions on Russia will shake up global energy trade

- Container shipping jackpot continues: CMA CGM profits soar

- Russia tanker business is alive and well. Oil exports ‘remain strong’

- The world is ‘crying out for diesel.’ Product tankers could win big

- Blockbuster container shipping results collide with sinking sentiment

- Commodity shipping stocks are trouncing Dow transport average

- COVID-era shipping stocks: The (super) good, the bad and the ugly