TFI International (TSX:TFI) boosted its full-year earnings estimate for 2019 largely on the improved performance of its U.S. truckload business despite a soft freight market.

The Canadian transportation company projects it will earn C$3.90 to C$4 per share – a $0.10 increase from February, CEO Alain Bedard told analysts on July 26 as he discussed second-quarter earnings. He said the earnings could hit C$4.20 per share, but that the lower conservative estimate reflected the U.S. freight market and tariffs with China. (A Canadian dollar equals US$0.76.)

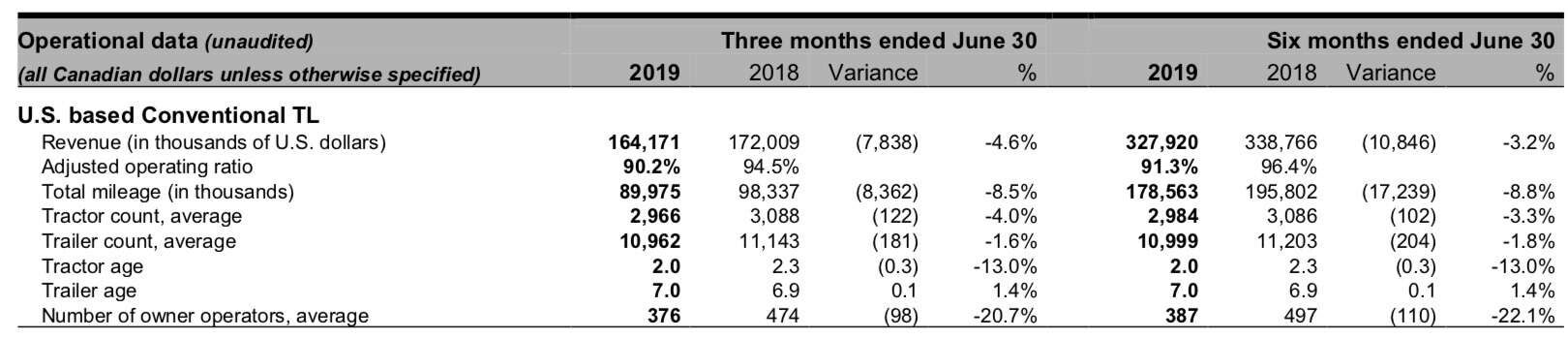

Improved efficiency in TFI’s U.S. truckload business stood out in a quarter that saw the company grow profits by 13 percent and reach a record C$1.34 billion in revenue. The adjusted operating ratio dropped to 90.2 – compared to 94.5 percent a year earlier – and a staggering 103 percent in 2017.

“It’s quite an accomplishment,” Bedard said. “Compared to two years ago, this is just magic. How is that possible? We’re very proud of our team in the U.S.”

The company’s U.S. truckload segment generated C$21.44 million in operating income during the quarter, an increase of more than 80 percent compared to the same period in 2018. It happened even as revenues declined slightly to C$219.48 million.

Bedard said the key to the improvements in the U.S. truckload businesses, primarily consisting of carriers CFI and Transport America, boiled down to keeping costs down. That imperative will continue as U.S. management predicts that the U.S. freight market will continue to be weak until late 2019 or early 2020.

TFI expects to spend at least C$200 million on “tuck-in” acquisitions in 2020. Bedard said a “big whale” acquisition could also be in the cards in 2020 or 2021.

“You’ve got to patient,” he said.

Busy fixing BeavEx

Bedard also made characteristically blunt comments about the integration of bankrupt U.S. courier BeavEX, whose assets TFI acquired during the quarter.

“It’s still early. Those guys didn’t make any money for many reasons.”

TFI CEO Alain Bedard on BeavEx.

“It’s still early. Those guys didn’t make any money for many reasons,” Bedard said. “When you have a weak management team, you also have sh—y rates with customers. We’re busy fixing the situation.”

Bedard has characterized BeavEx as a nuisance to the market and its struggling U.S. final mile division. TFI recently tapped the head of its Canadian final mile business to also oversee the U.S. counterparts.

Dismissive of Purolator growth

Bedard was dismissive of competitor Pulolator’s recent announcement that it will invest C$1 billion to boost capacity.

“They made a choice – going to piggyback off the largest e-tailer,” Bedard said, apparently making a thinly veiled reference to Amazon (NASDAQ: AMZN).

Bedard said TFI had made a choice to not do business with the unnamed e-tailer in Canada’s largest markets, suggesting the margins were too small.

“We are investing in customers where you can make money,” he said.

Tariffs hurt flatbed business

U.S. tariffs on Canadian steel, while lifted, hurt TFI’s flatbed business in Ontario. While the overall specialized segment had a strong quarter, the operating ratio increased by a full basis point to 87 percent from a year earlier.

“Our flatbed division is the largest hauler of steel in Ontario,” Bedard said. “That was not good news for us. Those tariffs have been removed now. But you can’t turn a ship on a dime.”