“How much percentage of a play can there be altogether?” Max Bialystok asked his accountant Leo Bloom in the movie “The Producers.”

“Max, you can only sell 100% of anything,” said Bloom.

“And how much of ‘Springtime for Hitler’ have we sold?” wondered Bialystok.

Bloom: “25,000%.”

Of course, it’s illegal to sell more than 100% of anything at once. But you can sell more than 100% of existing shares by increasing the total number of shares.

A lot more.

The key is to find enough buyers who don’t care they’re getting a smaller slice of an ever-expanding pie — the kind who are not investing in future profit streams but buying stocks as if they were lottery tickets or casino chips.

Welcome to ocean-shipping capital markets circa 2020.

Stock offerings pile up

The shipping penny stocks — the listed owners with shares that usually trade under a dollar — are now in high demand among day traders, particularly as the coronavirus crisis inflates retail trading volumes. Retail demand has allowed micro-cap shipping companies to sell highly dilutive equity to fund vessel acquisitions.

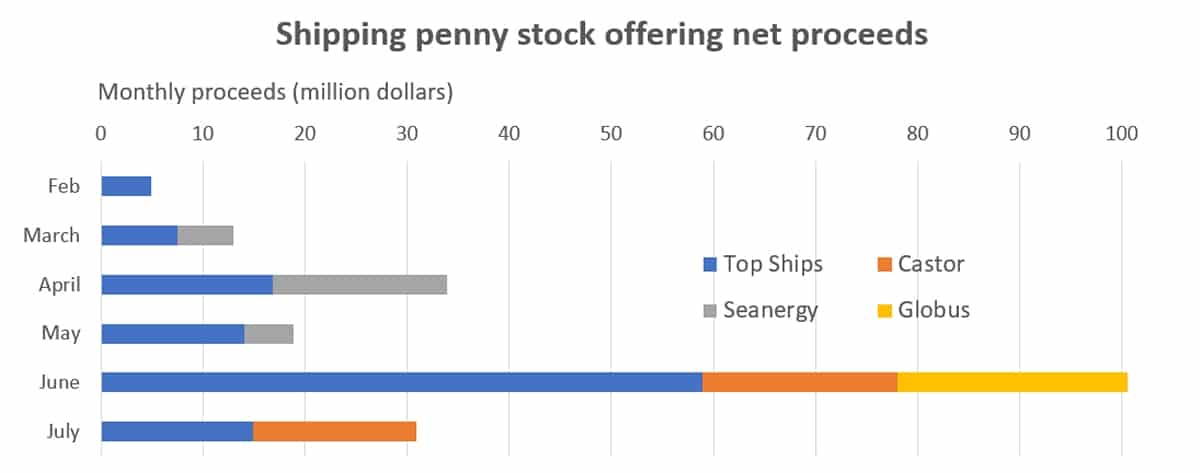

Top Ships (NASDAQ: TOPS), Seanergy (NASDAQ: SHIP), Castor Maritime (NASDAQ: CTRM) and Globus Maritime (NASDAQ: GLBS) have raised combined net proceeds of $202 million since February, including one offering that has yet to close.

To put this in perspective, the aggregate market cap of these four companies — what the stock market deems they’re worth — was only around $160 million as of Wednesday.

There have been 21 equity sales by these four companies so far, all handled by New York investment bank Maxim Group, which served as either underwriter or placement agent. Aggregate placement, underwriting and other fees total $14.1 million.

Penny stocks have dominated overall shipping equity offerings in New York in 2020. The only other common equity sales have been by Scorpio Bulkers (NASDAQ: SALT), for net proceeds of $71.9 million, and a private placement by GasLog Ltd. (NYSE: GLOG) for $36 million.

Top Ships leads the pack

Tanker owner Top Ships, founded by Evangelos Pistiolis, is the reigning king of shipping penny-stock capital raising (now that George Economou’s DryShips is no longer public).

Top Ships had 10 million shares outstanding as of early February, with Pistiolis owning 51%. Assuming the latest offering is closed, there will be 995.8 million shares outstanding, with Pistiolis owning less than 1%.

As the fictional accountant Bloom might put it, Top has sold 9,958% of its initial share count.

The company conducted an at-the-market offering in February, then switched to registered direct offerings (RDOs), in which the investor is pre-identified. It has done 10 RDOs since then and is in the midst of its 11th, all with the same group of institutional buyers.

Including the RDO that has yet to close, net proceeds total $117 million. Top’s current market cap is just $92 million — $25 million less than it just took in.

While the founder’s common shareholdings have diluted away, he retains control through special voting shares and he benefits through related-party fees and private transactions with the public entity. Top Ships paid $45 million in April and May to buy vessel interests from Pistiolis.

Seanergy, Globus, Castor deals

Dry bulk owner Seanergy did five sales of shares and warrants between March and May, bringing in net proceeds of $21.9 million. At the beginning of the period, it had 29.4 million shares. After, it had 480 million shares (since reduced to 30 million via a reverse split that has brought Seanergy’s price at least temporarily out of the penny zone).

Following its capital raising, Seanergy bought a 15-year-old, 177,536-deadweight-ton bulk carrier for $11.4 million from an unaffiliated third party.

Dry bulk owner Globus Maritime raised net proceeds of $22.6 million through two sales of shares and warrants in June.

Dry bulk owner Castor Maritime raised net proceeds of $35.1 million from two sales, an underwritten offering of stock and warrants in June, and a registered direct offering this month. On June 30, it announced the purchase of a 2007-built bulker from an unaffiliated third party for $7.85 million.

Is there anything wrong with this?

Shareholders filed suit when Top Ships and DryShips conducted highly dilutive fund-raising transactions in 2017. DryShips and Top Ships sold discounted shares to an intermediary, Kalani Investments, which then sold the shares on to retail traders. The class-action filing alleged securities fraud.

The suit against Top Ships and DryShips was dismissed in August 2019. Plaintiffs appealed. The appeals court ruled in favor of the shipowners in April.

The legal argument of shipping companies in such cases is: All of the risks are clearly disclosed.

Indeed, prospectuses for the latest shipping offerings clearly state that investing in the shares involves “a high degree of risk and uncertainty,” that buyers could suffer “significant dilution” and that the company may issue additional shares going forward.

The legal question was addressed by Gary Wolfe, partner of New York law firm Seward & Kissel, in an interview published in the shipping magazine Fairplay in 2017. Seward & Kissel is frequently the owners’ legal representative in capital raises by micro-cap shipping companies.

“The entire U.S. system of securities law is pointed at disclosure,” he said. “It’s about accurate disclosure, not ‘is my deal good?’ The SEC doesn’t regulate that.” Asked whether you can do practically anything, as long as you disclose it in the prospectus, he joked, “You can say, ‘I’m a crook and I’m going to steal all your money.’”

Day traders’ view

The extent risk disclosures discourage demand for shipping offerings hinges on who the prospective stock buyer is. Institutional investors and fund managers are extremely concerned about such issues.

But individual day traders do not appear to care that much, if comments on the message boards are any indication. Their focus is on when the stock will pop so they can make a quick score, and when “pumpers” will pump the price.

Day traders on StockTwits are now heavily focused on Top Ships, Seanergy, Castor Maritime and Globus Maritime:

“Need pump here,” one requested. “Man, I hope I can sell my car on time tomorrow to buy even more below $0.11,” said another. “You’d be crazy to not load up at these prices,” added a third.

“Anybody else getting nervous because the Baltic Index has been dropping every day?” one wondered. Reply: “Man, forget the Baltic Index. It absolutely does not influence the stock whatsoever.”

Another theorized: “Most vessels for Seanergy are around 170,000 DWT. Glencore has a mining facility based in the Congo and supplying Tesla factories. Roughly 11,000 nautical miles at 12 knots makes the trip about 38 days at least. So simply do the math my friends …. and smile!!!!!”

“This is a high-risk, high-reward stock,” asserted yet another stock-picker. “Not a stock for your retirement. This is a stock to buy instead of playing craps in Vegas. My Atlantic City roll of the dice.”

“Be positive! Never know — you might be a millionaire.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE FROM SHIPPING STOCKS: The “Robinhood effect” on tanker stocks: see story here. The case of Dave Portnoy buying Seanergy stock because he liked the ticker symbol ‘SHIP’: see story here. An interview with Deutsche Bank transportation analyst Amit Mehrotra on intrinsic-value investing: see story here.