Editor’s Note: Updates with comments from Great Dane

Preliminary orders for new trailers topped 50,000 for the second consecutive month in October. Fleets booked equipment to replace older units, add capacity in a consumer goods-driven freight boom and out of concern that material shortages may crimp trailer production.

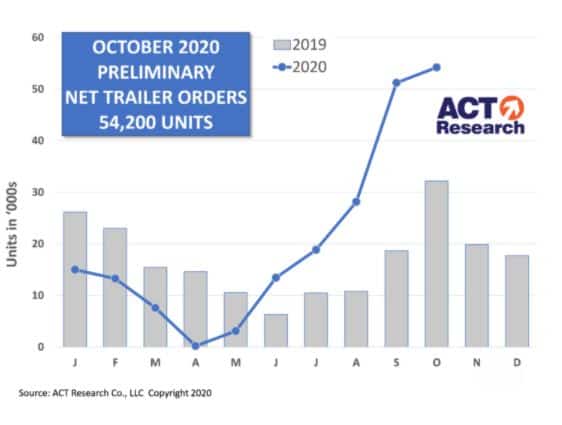

After setting a record for the second-highest monthly orders in history in September, bookings for new trailers rose to 56,500 units in October, 9% higher month over month and 68% greater than October 2019, according to FTR Transportation Intelligence.

Competitor ACT Research reported 54,200 net orders after subtracting cancellations. Both new and net orders rank as the third-best month in industry history. Final orders should be within plus or minus 3%.

“We’ve experienced large order intake in both vans and reefers again this past month and it has continued into November. We’ve even seen a little life in the flatbed sector although nothing like vans and reefers,” Chris Hammond, executive vice president of sales at Great Dane trailers, told FreightWaves on Friday.

Much of the equipment is for delivery in the second half of 2021. Fleets project consumer demand for goods needed for home-based existence during the coronavirus pandemic will continue strong, FTR said.

Worker shortage

Fleets are raking in money from record-high rates averaging $2.41 a mile and topping $3 a mile on some routes. The chaotic environment is leading to replacement orders for older dry vans and refrigerated units. Carriers are using more drop-and-hook runs to make up for an ongoing driver shortage worsened by drivers failing drug tests.

Build rates should rise in 2021. But trailer makers, like for-hire motor carriers, are struggling to find workers.

“The labor market is unlike anything we’ve seen before,” Wabash National CEO Brent Yeagy said on the company’s third-quarter earnings call Nov. 5. “A 10% unemployment rate is now more like a 3% rate of unemployment. For a multitude of reasons, labor has become exceptionally difficult to find.”

For that reason and because fleets fear being shut out of build slots, FTR expects backlogs to rise to mid-2019 levels. Those were the last strong months of production following a 2018 ordering frenzy. On a rolling 12-month basis, trailer orders now equal 249,500 units, FTR said.

“We’ve been able to add people but certainly need more,” Hammond said. “Quickly hiring people is always something we have to manage carefully to be sure we are putting the right employee in the right place at our facilities. We’ll continue hiring well into 2021 I suspect.”

Concern over components

Frenzied ordering is reminiscent of the same months two years ago, said Don Ake, FTR vice president of commercial vehicles.

“Then, it was because the hot demand was outstripping [manufacturer] and supplier capacity.” Now, the pandemic has disrupted the supply chain, he said. “Some essential components are having trouble making it through the pipeline fast enough.

“We would expect these bottlenecks to be resolved over the next few months, resulting in some of the large orders of the last two months being canceled or pushed out next summer as happened in 2019,” Ake said.

The swing from record low to record high orders in just seven months shows the volatility of equipment demand. Manufacturers rarely penalize fleets for canceling orders. So less-than-firm reservations are an accepted part of the business.

Builders remain optimistic

Dry van trailer leader Hyundai Translead is unconcerned about a surge in cancellations.

“Assuming the activity seen since August holds, we are very confident that we will continue to see low levels of cancellations into 2021,” Sean Kenney, chief sales officer for Hyundai Translead, told FreightWaves on Friday.

“While there is some level of growth from almost all fleets, the majority of their purchase is intended to cover planned 2021 replacements as well as those not replaced in 2020, he said.

Wabash National said its backlog for dry vans stood at nearly $1 billion at the end of the third quarter. Wabash shipped 8,415 trailers in the July-September period.

“I think we can look at 2021 as being a relatively significantly improved year from 2020,” Yeagy said on the earnings call.

Related articles:

Wabash National trailer order backlog suggests strong 2021

September trailer orders go bonkers at 52,000 units

2018 redux: Truck buying binge borrowing from future business