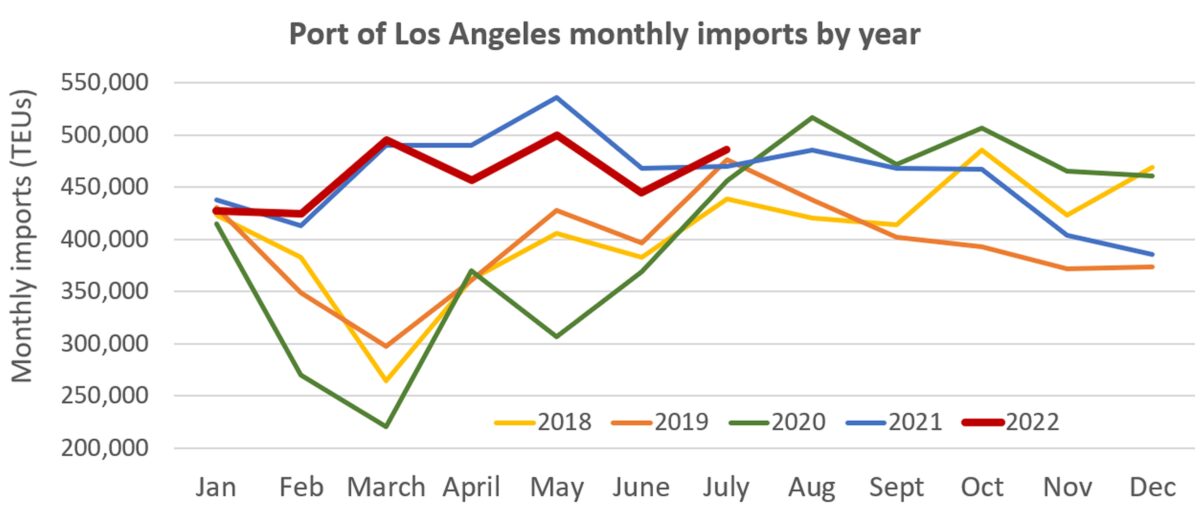

Los Angeles, America’s largest container port, saw no letup in imports in July. But the numbers could finally start to pull back this month, according to Gene Seroka, executive director of the Port of Los Angeles.

Seroka reported Wednesday that Los Angeles handled 935,345 twenty-foot equivalent units last month, making it the port’s best July on record. Overall volumes, including imports, exports and empties, were up 5% year on year.

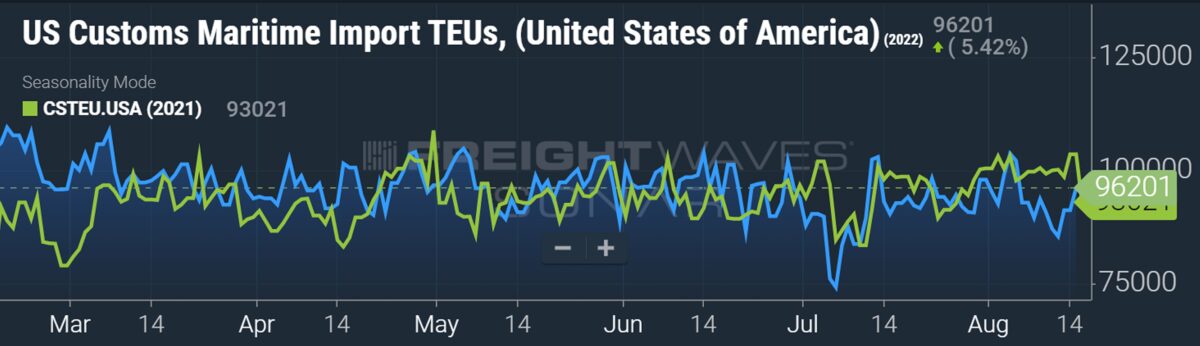

Imports totaled 485,472 TEUs, up 3% year on year and up 9% compared to June.

“Imports will begin easing somewhat,” said Seroka. “I expect to see that reflected in our August cargo numbers. China factory orders are slowing and some retailers continue to have elevated inventories. You’ll start to see a tapering of some imports, specifically the commodities that won’t be repeatedly purchased every year: appliances, fixtures, furniture, sporting goods.

“But I still like our chances for a strong back half of the year. The cargo that’s coming in the months and weeks ahead will look different than the inventory that’s already on the ground: more seasonal products and the all-important year-end holiday products.”

Landside issues easing — except for rail

Terminal fluidity continues to improve in Los Angeles.

According to Seroka, “Even with today’s rail challenges, our container terminals are in pretty good shape. We’re down to about 2,000 containers waiting nine-plus days for trucks versus more than 32,000 units last October. Dwell time for truck-bound containers is now at four days, close to more traditional times and a significant decline from the high of 11 days.”

On the more problematic rail side, he said, “Inland rail terminals look just like the port did last year — stacks of cargo, folks not picking it up quick enough, and importers who are allowing containers to dwell for a longer time than they normally would. With that, we struggle to load the next train and move it out of Los Angeles.

“We’ve now got more than 33,700 cargo containers designated for rail sitting on Port of Los Angeles docks. In more normal times, that number should be about 9,000. And of those 33,000-plus boxes, more than 20,000 have been sitting nine days or longer. We never used to see that much cargo sitting for nine days. We’ve got to continue to encourage the importers to pick up their cargo [from inland rail terminals] faster so we can get the next trains in.”

Southern California ship queue down

Meanwhile, the queue of container ships waiting offshore has fallen to very low levels. According to the Marine Exchange of Southern California, there were 15 container ships in the Los Angeles/Long Beach queue as of Wednesday, down from 109 in January. The count hit a low of nine ships on Aug. 10.

Cargo volumes were rerouted to the East and Gulf coasts starting in the second quarter due to concerns about Los Angeles/Long Beach peak season congestion, as well as fears of work slowdowns after the West Coast port labor contract expired July 1.

Now, the tables have turned. MarineTraffic ship-position data shows queues are higher on the East and Gulf coasts than on the West Coast. As of Wednesday afternoon, there were 33 container vessels off Savannah, Georgia, 23 off Houston and 19 off New York/New Jersey.

Seroka made a sales pitch to shippers and suggested they reconsider their decision to avert the West Coast.

“At many other ports around the country, ships are waiting for space, yet here our terminals have capacity. So, for cargo owners looking to rechart their course, come to Los Angeles. We’re ready to help.”

Long Beach volumes also still high

The adjacent Port of Long Beach reported its July numbers on Aug. 9. Long Beach handled total throughput of 785,845 TEUs last month, making it the port’s best July on record.

Long Beach posted its third-highest tally ever for imports in July. Imports came in at 376,175 TEUs, down 1.5% year on year.

The import decline versus the preceding two months was steeper. Long Beach imports hit a year-to-date high of 436,977 TEUs in May. July’s total was 14% lower.

Click for more articles by Greg Miller

Related articles:

- Container line Zim hit by exposure to falling spot rates

- Hapag-Lloyd CEO: US consumer still ‘holding up,’ demand not collapsing

- Maersk: Shipping profits stay ‘super strong’ as supply chain pain persists

- Record container ship traffic jam as backlog continues to build

- Los Angeles port boss: Fix rail service or risk ‘nationwide logjam’