Union Pacific (NYSE: UNP) set an all-time record for its operating ratio in the second quarter despite lower freight volumes and a decline in freight revenue.

The western U.S. railroad reported an operating ratio of 59.6 percent for the second quarter, compared with 63 percent for the same period in 2018. Operating ratio can gauge the financial health of a company, with a lower operating ratio implying more profitability.

“We delivered record second quarter financial results driven by exceptional operating performance, including an all-time best quarterly operating ratio of 59.6 percent,” said Lance Fritz, UP chief executive officer. “These results are a testament to the dedication of the men and women of Union Pacific, who are embracing Unified Plan 2020 and who worked closely with our customers to overcome numerous weather challenges.”

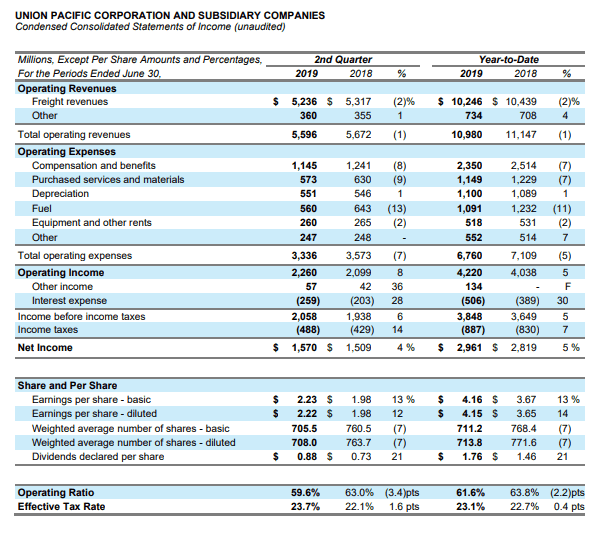

Net profit grew 4 percent to $1.57 billion, or $2.22 per diluted share, in the second quarter of 2019, compared with $1.51 billion, or $1.98 per diluted share, in the second quarter of 2018. Operating revenues fell 1 percent to $5.6 billion amid a 4 percent decrease in total revenue carloads and a drop in overall volume.

But operating expenses dropped 7 percent to $3.3 billion, compared with $3.6 billion in the second quarter of 2018, as UP deployed Unified Plan 2020, its version of precision scheduled railroading (PSR). PSR is an operating model that seeks to streamline schedules and operations.

UP said declines in energy and premium volumes, as well as flat volumes for agricultural products, weighed on overall second quarter volumes, although industrial volumes rose for the company.

But in terms of freight revenue, agricultural products were actually up 4 percent to $1.16 billion, while industrial revenue was up 4 percent to $1.5 billion. Energy revenue was down 13 percent to $966 million while premium revenues were down 2 percent to $1.6 billion.

Meanwhile, some service metrics improved. Quarterly freight car velocity totaled 195 daily miles per car, up 4 percent from the second quarter of 2018, although average train speed slowed 6 percent to 23.1 miles per hour compared with 24.7 miles per hour in the second quarter of 2018. But average terminal dwell time fell 14 percent to 25.5 hours from 29.5 hours in the second quarter of 2018. Terminal dwell time is the amount of time a train spends at a terminal.