Universal Logistics Holdings “had its share of challenges” during 2021. Port and supply chain congestion and a tough labor market weighed on production at the auto and truck OEMs, the Michigan-based asset-light transportation provider’s primary customer base.

“Yet, despite these challenges, Universal’s business model continued to deliver impressive results,” CEO Tim Phillips stated in a press release. The company reported record full-year revenue in 2021, up 26% year-over-year to $1.75 billion, with net income climbing 53% to $74 million.

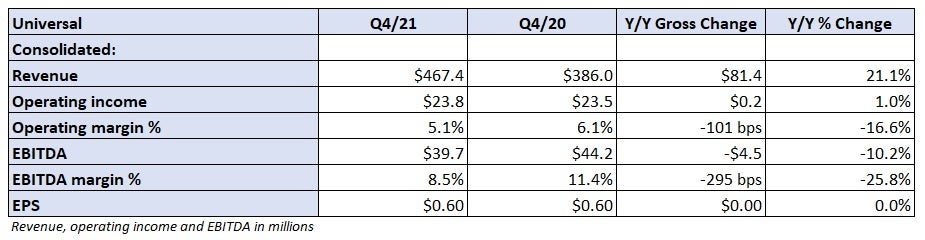

Universal (NASDAQ: ULH) reported fourth-quarter earnings per share of 60 cents, 10 cents better than the consensus estimate but flat year-over-year. The period was negatively impacted by $6 million in auto liability claims, which are expected to settle above the company’s policy limits, and $5 million in startup losses from a new contract logistics account.

Fourth-quarter operating income was up only 1% year-over-year even though revenue increased 21%, which was ahead of management’s guidance calling for a 7% revenue increase at the midpoint of the range. The operating margin declined 100 basis points to 5.1%, in line with guidance of 4% to 6%. Excluding the $11 million in combined charges, the operating margin would have been 7.4%. The incremental costs equated to roughly a 31-cent hit to EPS in the quarter.

2022 guidance implies 20% upside to consensus EPS

Universal has seen some disruption at the OEMs it serves as a major cross-border artery linking Detroit and Windsor, Ontario, has been blocked by protesters. Suppliers have been forced to use alternative routes to get parts across the border.

“We have seen a little bit of disturbance as a result of the border blockade,” Phillips told analysts on a Friday call. “There’s been no complete shift shutdown, but there’s been some short-shifting at a couple of the facilities that we service.”

The company’s full-year 2022 revenue guidance was unchanged at $1.8 billion to $1.9 billion, a 6% year-over-year increase, and bracketing consensus of $1.82 billion. The consolidated operating margin guidance was raised 100 bps at the bottom end of the range to 8% to 9%.

The guidance implies 2022 incremental margins greater than 50% and EPS of roughly $3.90 at the midpoint of the ranges (excluding other nonoperating income/losses tied to marketable securities). Guidance is notably higher than the current consensus estimate of $3.25.

Shares of ULH were up 7.2% at 12:40 p.m. Friday compared to the S&P 500, which was down 0.3%. The stock was down 30% in the one-year period heading into the print.

First-quarter revenue was forecast in a range of $430 million to $450 million, 6% higher year-over-year and in line with consensus. The operating margin for the period is expected to be between 7.5% and 8.5%. Implied EPS in the high-80-cent range is roughly 20 cents ahead of consensus.

“I see this [the bridge blockade] as being a this-week blip on the radar, and we’ll continue to push forward with what I think to be a very good first quarter,” Phillips added.

Q4 segment results and expectations

Contract logistics revenue increased 21% year-over-year to $161 million in the quarter. Value-added revenue was up 13% as the company had five more programs in place than it did in the prior-year period and revenue per program was 4% higher. Dedicated revenue increased 40%, with loads up 7% and revenue per load 31% higher.

The contract logistics segment recorded a 3.8% operating margin, 520 bps lower year-over-year. Even without $5 million in contract losses, the margin would have only been 6.9% compared to 9% in the fourth quarter of 2020. Full-year launch losses and downtime cost the company $23.7 million in total, a 380-bp margin hit.

Universal is working with its customers to address implementation challenges and higher labor costs.

The contract logistics segment will benefit from the recent addition of a 250-worker contract in the Midwest and a 150-driver dedicated contract, which has a $30 million annual revenue run rate. The unit will also onboard an aerospace contact logistics center early in the second quarter.

Congestion and equipment shortages resulted in a 14% year-over-year decline in intermodal loads. However, intermodal revenue increased 34% to $142 million as revenue per load (ex-fuel) was up 32% and fuel surcharges and assessorial charges (detention, demurrage and storage) moved roughly 80% higher. The operating margin was up 240 bps to 9.7%.

Revenue per load is expected to stay high, “maybe a tad better” as Universal continues “pushing premium pricing” due to network congestion.

The company hopes to add 500 chassis during the year but acknowledges production constraints will likely only yield 250 units.

Trucking revenue increased 26% year-over-year to $102 million as revenue per tractor was up 30% and average tractors in service dipped 3%. A 22% increase in brokerage revenue to $38 million and higher fuel surcharges drove the revenue increase as well. The excess auto liability claims hit the trucking segment and drove the operating margin down to just 1.1%, 330 bps lower year-over-year. The claims were a 590-bp hit to the margin.

Company-managed brokerage revenue declined 6% year-over-year to $62 million. Loads were down 19% as Universal continues to weed out certain freight and reprice the book of business. Revenue per load excluding fuel surcharges was 10% higher in the quarter. The operating margin increased 360 bps to 4%.

Net debt was $407 million to close the year, 2.3x earnings before interest, taxes, depreciation and amortization. Capital expenditures were constrained at $39 million in 2021 due to delayed production schedules at the OEMs. The company forecasts capex to more than double to between $80 million and $90 million in 2022.

The FREIGHTWAVES TOP 500 For-Hire Carriers list includes Universal Logistics (No. 23).

Click for more FreightWaves articles by Todd Maiden.

- Forward Air on pace to hit 2023 targets early

- Maersk adds US final-mile network in $1.8B deal

- Schneider raises margin targets; Q4 ahead of expectations