Anyone who thought that UPS Inc.’s 2024 rate and surcharge adjustments would be distorted by the significant labor cost increases in the first year of its contract with the Teamsters union will be disappointed by next year’s rate table.

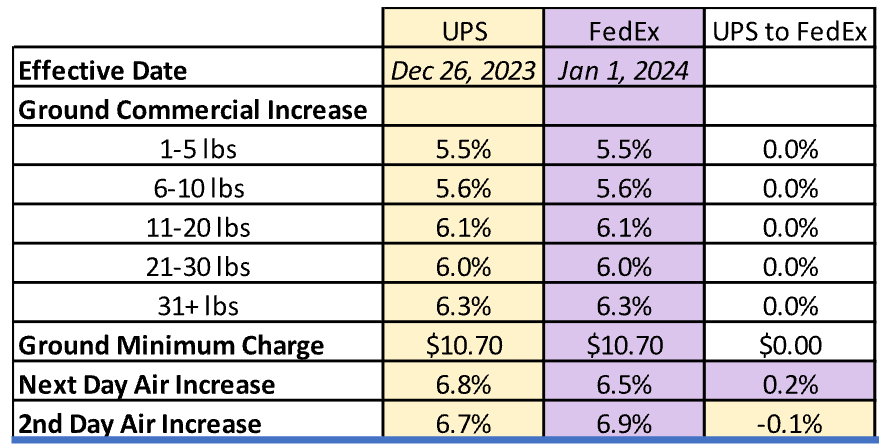

UPS’ (NYSE: UPS) 2024 rate breakdown, which the shipping giant made public late Friday, looks comparable to those published by rival FedEx Corp. (NYSE: FDX) more than a month ago. The carriers’ rate increases on ground commercial shipments are identical across the board, according to an analysis from consultancy Shipware LLC (see graphic below). The carriers’ minimum charge for a ground commercial shipment, which all shippers will pay regardless of any rate discounts they negotiate, is the same at $10.70 per shipment. UPS’ minimum charge increases range from 4.52% for its three-day delivery service to 7.91% for its next-day air service.

Of 40 delivery surcharges identified by Shipware, 24 are identical between the two carriers. Of the 16 surcharge items that contain price differentials between the two, only four have differentials of $5 or more per shipment.

The carriers will also go to market with similar increases on shorter-haul traffic, shipments 600 miles or less that are priced based on seven delivery zones. Rates for both carriers will be at or below the 5.9% general rate increases (GRIs) both have already announced. Rate increases will be particularly muted for short-haul ground commercial traffic. Rate hikes will be roughly equivalent to the GRI for shorter-haul ground residential traffic that has become the majority of all parcel carriers’ traffic mix.

The lower rates on shorter-haul moves are likely a nod to the increasing competition from regional delivery carriers as well as Amazon.com Inc., (NASDAQ: AMZN) which has morphed its delivery operations from a national hub-and-spoke network to eight regions.

By contrast, rates on longer-haul shipments moving under UPS’ second-day air and three-day services will climb as much as 8%, based on Shipware’s analysis. In fact, most rates, regardless of the type of service, weight and distance, will either meet or exceed the 5.9% GRI.

Paul Yaussy, the Shipware executive who prepared the analysis, said FedEx and UPS will continue to demonstrate their “oligopolistic” pricing behavior they’ve exhibited over at least the past decade. Yaussy wrote that “there are very few differences between the two carriers’ most common services and surcharges.”

UPS’ five-year contract with the Teamsters union calls for 9% to 10% rate increases in its first year. That will be the steepest year-over-year hike over the contract’s duration. Given the timing of the rank-and-file’s ratification — which took place in late August — there was speculation that UPS would go to market with higher-than-normal rate increases for 2024 to offset its increased operating costs. The speculation was further fueled by the 25 business days that elapsed between FedEx’s published rate breakdown and UPS’, though FedEx did publish its increases earlier than usual.

Mixed meanings

UPS’ challenge in building its 2024 rate-setting strategy is to balance the need to boost yields with the desire to not alienate shippers whose volumes it is trying to recapture in the wake of the contract negotiations. About 1.1 million daily parcels were diverted to rivals in the weeks and months of often-volatile negotiations. UPS may have been willing to give up some yield on 2024 business in exchange for improving its chances to win back diverted parcels, according to Yaussy.

The impact of GRIs, even those with detailed breakdowns, is decidedly mixed. On the surface, GRIs mean little because they apply to noncontractual traffic that represents a fraction of all parcel business. However, they do serve as a benchmark of sorts for negotiations between shippers and carriers that are commonplace in the industry.

Yaussy cautioned shippers to focus on the bevy of costly surcharges imposed by both carriers. The combined cost of surcharges can collectively comprise as much as 40% of a shipper’s total annual parcel spend, according to industry data. At UPS, for example, only two of 37 surcharges listed by Shipware will increase by less than the GRI. Surcharges for Collect on Delivery (COD) and Residential Air delivery services will increase by 5.56% and 5.41%, respectively.

By contrast, shippers of large packages that require additional handling will face surcharge increases ranging from 18% to 21% depending on the service, according to Shipware’s analysis. Including rate and surcharge adjustments, shippers will face double-digit rate increases unless they succeed in negotiating the increases down or away, Yaussy said.

Yaussy also advised UPS shippers to be on the lookout for “hidden cost increases” from the carrier’s announcement of changes to the number of ZIP codes that could be hit by delivery surcharges, as well as any shrinkage in the number of ZIP codes aligned to Zones 2 and 3. The latter action could result in more deliveries falling into the Zone 3 bracket, thus resulting in higher rates, he said.

Yaussy said UPS shippers will not have visibility into the impact of these steps until the 2024 rates take effect. “Most shippers will not have the immediate ability to analyze these ZIP code changes, which has the potential to be a sneaky way for UPS to increase yield,” he said.

Yaussy said he was unaware if FedEx was making similar moves, but that it would be too early to tell until its new rates take effect. UPS 2024 rates take effect Dec. 26. FedEx’s rates go into effect Jan. 1.