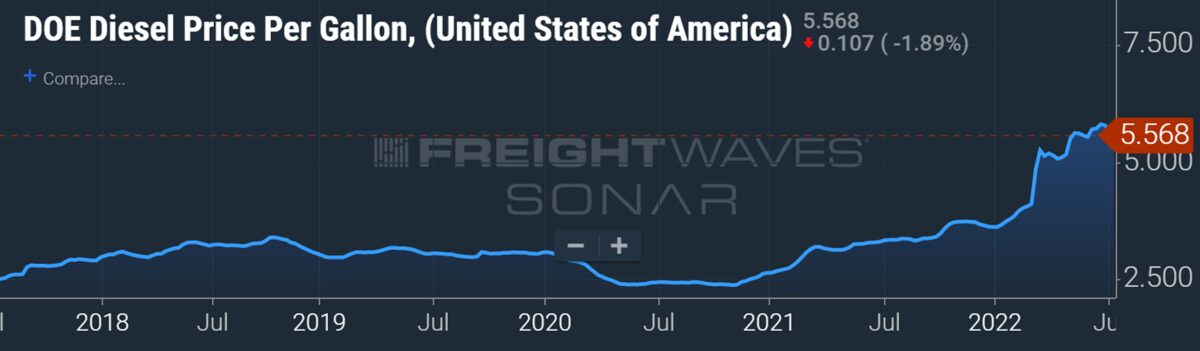

At-the-pump prices for gasoline and diesel may be down from all-time peaks but they remain exceptionally high. Meanwhile, as domestic energy resources flow to the highest bidder, more U.S.-produced crude is being loaded on tankers bound for Europe, and more U.S.-refined diesel aboard ships headed to Latin America.

“Rising [diesel] exports shipments have drained domestic supply,” reported Argus on Monday.

Citing ship-movement data from Vortexa, Argus said that diesel exports averaged 1.45 million barrels per day (b/d) from July 1-13, more than in any month since July 2017.

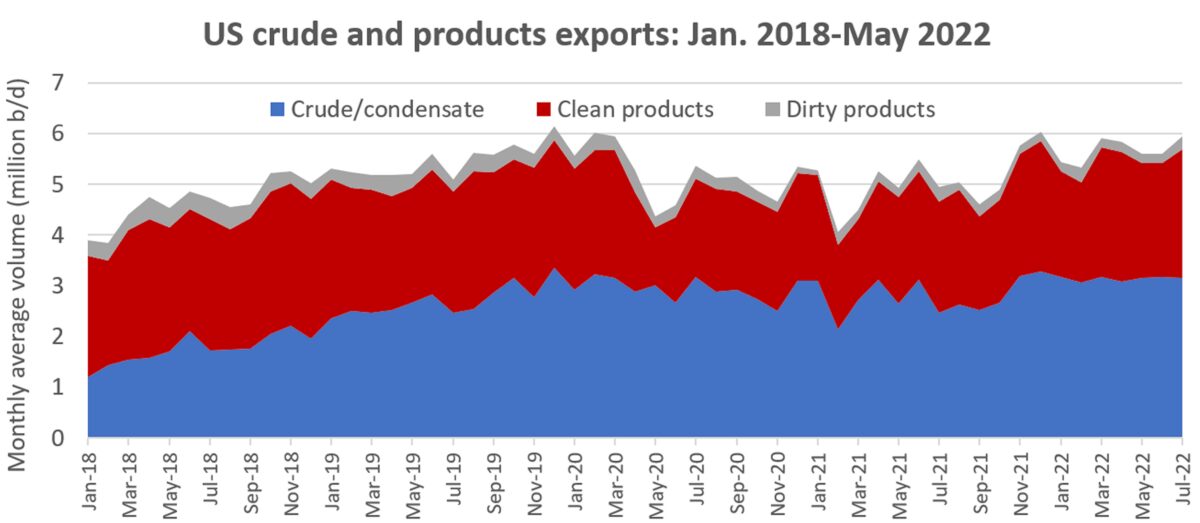

According to data from Kpler, total clean products exports (including diesel, gasoline, jet fuel and other products) averaged 2.5 million b/d in the first half of July, one of the highest monthly averages since August 2019.

U.S. refined products heading south

Reid I’Anson, senior commodity analyst at Kpler, told American Shipper, “On the clean product side of the ledger, exports are pretty much back in line with pre-pandemic levels, with most of these barrels ending up in Latin America, especially Mexico.”

Argus said that U.S. diesel exports to South America are now at their highest level in a half-decade.

Kpler puts total U.S. tanker exports — including crude, clean products and dirty products (such as fuel oil) — at 5.95 million b/d month to date, up around 5% from May-June levels. The average for the first half of July is within shooting distance of the all-time high of 6.1 million b/d in December 2019.

More U.S. crude to Europe, less to Asia

The resurgence of America’s refined products exports to pre-pandemic levels coincides with rebounding crude exports. More U.S. crude is going to Europe and less is going to Asia, which is in turn buying more crude from Russia.

U.S. crude exports “continue to maintain consistency at around the 3.1 million b/d level, with strong volumes heading for Europe maintaining in July,” said I’Anson.

There are three main drivers of U.S. crude exports, according to ship brokerage BRS: the emergency Strategic Petroleum Reserve (SPR) release in the wake of the Ukraine-Russia war, recovering U.S. crude production, and limits to U.S. refinery intake capacity.

Erik Broekhuizen, head of tanker research and consulting at Poten & Partners, noted in a report on Friday that most of the SPR crude has gone to domestic refiners in the U.S., with only a small portion going overseas, mostly to Europe.

“However, it does not really matter where the SPR crude is being refined,” he explained. “The oil market is a global marketplace and prices are driven by worldwide supply/demand dynamics.”

As a result of the SPR release, higher domestic production, and “U.S. refineries already running flat out with utilization rates in the high-90% range, we expect most of the additional [non-SPR] barrels to hit the export market,” said Broekhuizen.

He predicts that U.S. crude oil exports could increase by 1 million b/d or more during the next six months, as the SPR release “turbocharges” exports even as the SPR crude itself is not exported.

Limits to US refinery intake

According to BRS, “U.S. refinery intake has oscillated around 16.5 million-16.7 million b/d over recent months, in line with the five-year average but roughly 1.4 million b/d below its historical high. There is little potential that [U.S.] refining throughputs should rise further this year given that 1.3 million b/d of U.S. refining capacity was shuttered over 2020-21.

“Indeed, we believe that there is more potential for unplanned stoppages over the coming months, either in the wake of hurricanes or from refineries being run so hard in the wake of soaring transport fuel crack spreads that problems emerge.”

In light of domestic refining limits, BRS expects U.S. crude exports to continue to rise this summer, potentially reaching 4.5 million b/d by the end of this year. It predicts U.S. crude exports will regularly reach 5 million b/d next year and will “occasionally touch 5.5 million b/d” — and that “the U.S. will be the largest source of incremental crude tanker demand this year and beyond.”

Click for more articles by Greg Miller

Related articles:

- In topsy-turvy commodity trades, small ships outperform big ships

- Tankers carrying diesel and gasoline rake in cash amid pain at the pump

- How new EU sanctions on Russia will shake up global energy trade

- Russia tanker business is alive and well. Oil exports ‘remain strong’

- The world is ‘crying out for diesel.’ Product tankers could win big

- US exports even more oil as domestic gasoline and diesel prices spike