No one predicted a U.S. import surge in the middle of a pandemic — but it’s happening. The big question now is: How long can this last? The answer has key implications for ocean spot freight rates and contract renewals, port throughput, and landside volumes for trucking and rail.

Investment bank Jefferies issued an exceptionally bullish report on Wednesday implying that import flows should remain heavy all the way into 2021. Inventory restocking isn’t about to peter out. It’s just getting started, according to Jefferies.

“We are just at the beginning of what is likely to be one of the biggest restocking cycles — if not the biggest inventory restocking cycle — in U.S. history,” maintained Jefferies Chief Economist Aneta Markowska on a conference call held Thursday to discuss the report.

Consumer demand surprise

“What’s behind this is one of the biggest post-recession recoveries in the goods economy, including consumer goods as well as housing,” she said.

While the service economy has been “heavily impaired” by COVID and remains so, goods demand is growing both at the expense of services as well as due to “tremendously supportive fiscal policy.”

“Goods demand is now 6% higher than it was prior to the pandemic. We’re seeing a similar trend in the housing market, for both new and resale markets.

“We’ve had this surge in demand and the supply side of the economy has not kept up,” she continued. This is “both because of supply chain disruptions and because producers, retailers and homebuilders were just caught off guard.

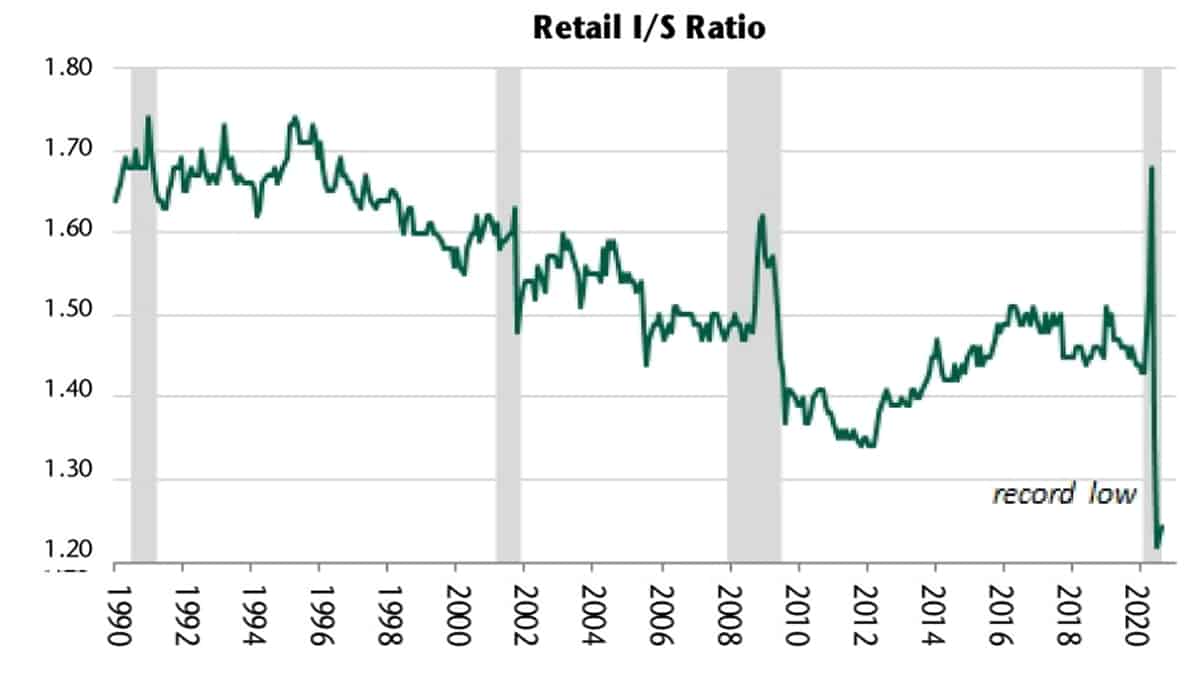

“Nobody anticipated demand to be this strong this quickly. As a result, we have inventory-to-sales [I/S] ratios today that are at absolute record lows.”

Beyond the need for inventories to catch up, said Markowska, “You could make a very, very strong case that producers will increasingly target much higher levels of precautionary inventory as they shift from ‘just in time’ to ‘just in case.’” If so, “they may actually overshoot pre-pandemic I/S ratio levels,” she said.

Restocking cycle timing

“This is really just the start of a [restocking] cycle that I think could take two or three quarters,” said Markowska. She noted that “this inventory cycle in the U.S. is skewed towards consumer goods. A lot of those are produced in Asia, so we’ve seen U.S. imports surging already. And there will be more to come.”

Jefferies analyst Andrew Lee, who covers container lines in Asia, said during the call, “Carriers, shippers and industry contacts are talking about forward bookings being stronger. It does seem that forward demand is looking to be strong into the end of this year and into early next year. This is definitely beyond seasonal strength. This year is completely unique with how COVID has affected inventory restocking. You can’t use past cycles to understand it.”

According to David Kerstens, the Jefferies analyst covering European container lines, “The outlook for the fourth quarter is much better than we previously expected. The seasonal downturn will likely be less strong.”

As previously reported by FreightWaves, container-equipment lessors are seeing strong demand all the way into the first quarter of 2021. They also report that container factories are sold out until February.

But what about future demand?

U.S. companies have announced over 100,000 job cuts in just the past few days. Bankruptcy filings are on pace for a record year. In major cities like New York, streets are rife with shuttered storefronts and the homeless. State and municipal governments across the country face unbridgeable budget gaps. Government support for the unemployed is waning. Commercial real-estate debt is a ticking time bomb. Many investment decisions are on hold until there’s more clarity on the pandemic and the election.

With that backdrop, why should the I/S ratio necessarily revert to prior levels in the next few quarters? And what if sales fall? Would U.S. businesses suddenly pull back hard on imports, just like they did in late March?

In response to a caller question on macroeconomic concerns, Markowska responded, “The labor market took a massive beating during COVID. But fiscal stimulus was so massive that it more than offset it, with more than 100% income replacement. Personal income was up 4.7% year-on-year in August. Fiscal policy essentially erased the recession if you look at just total personal income.

“We’ve seen fiscal stimulus fading and [consumer demand] does depend critically on what happens with fiscal policy,” she acknowledged.

However, she said that Jefferies’ inventory restocking thesis “is not built on consumer demand staying strong. It’s based on what has already been spent and how much supply has lagged. To get those I/S ratios in retail back to normal levels, you’ll need a lot of production and a lot of imports.”

Peak season’s peak?

Whether Jefferies’ report is right or wrong has major implications for rates. Stratospheric spot freight rates from Asia to the U.S. West Coast appear to have leveled off, at least temporarily, around the $4,000 per forty-foot equivalent unit (FEU) level.

The Freightos Baltic Daily Index for that route (SONAR: FBXD.CNAW) was at $3,891 per FEU on Wednesday.

Drewry puts this week’s Shanghai-Los Angeles rate at $4,062 per FEU, down 0.5% from its previous weekly assessment. Flexport estimated the route’s rates for this week at $3,800 per FEU. It expects rates to fall by $100-$200 per FEU by midmonth.

According to Eytan Buchman, chief marketing officer of Freightos, “With China-U.S. West Coast prices already triple last year’s and flirting with $4,000 per FEU — a threshold carriers may be hesitant to cross — and growing scrutiny from multiple governments, we may have reached peak season’s peak.”

Some shippers paying record-high trans-Pacific spot rates might hope that regulators step in. Carrier executives were called in for a surprise meeting with the China Ministry of Transportation and Communication (MOC) last month, eliciting hopes that rates would fall.

According to Lee, “What we hear is that there were a lot of small customers without annual contracts who were complaining to the MOC. That’s why the MOC called the carriers in.

“But what we heard from the [people in the] meeting themselves was that it wasn’t about them [regulators] saying, ‘You’ve got to cut the rates.’ They were saying, ‘Let’s make sure the rates are not going to jump another 30-40% from current levels.’ It was: ‘Let’s be sensible. Carriers are making a lot of money on the trans-Pacific at the moment. Let’s not push it much higher.’”

Contract rate rise looms

Kerstens noted on the Jefferies call, “Spot rates on the trans-Pacific are almost double the level of what was agreed in the 2020 trans-Pacific contracts and about 20% higher on Asia-Europe [for spot than contracts]. That bodes well [for carriers] for the upcoming contract renewals in December and January for the Asia-Europe trade lane and in April-May for the trans-Pacific. We’ll likely see much higher contract rates going forward.”

Lee added, “When we look at [carrier] earnings, we’re not focusing on spot rates increasing another 20-30% from current levels. If anything, spot rates are high. But we think next year’s contract prices have upside. They could be significantly higher.”

Oslo, Norway-based Xeneta tracks contract rates. Its global XSI index and U.S. imports index were essentially flat in September versus August, down 0.1% and up 0.5%, respectively. However, that’s about to change.

Xeneta warned Wednesday that it “already sees substantial increases for contracted rates for the fourth quarter of 2020 and even more so are expected for the first quarter of 2021.”

According to Xeneta CEO Patrik Berglund, “The trans-Pacific eastbound is on a historic high and it’s the worst time-to-market for shippers looking to secure new long-term rate agreements in Q4 and Q1.

“If rates stay high, the impact will trickle into the main tender cycle for this period come Q1-Q2,” said Berglund. “We already see long-term rates with 30% increases coming into the Xeneta platform — and expect more to come on this corridor the longer the spot market remains high.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINER SHIPPING: Chinese container factories sold out until next February: see story here. Container rates are on fire; how can you invest in that? See story here. Red-hot ocean rates could spark government intervention: see story here.