The fear voiced by Port of Los Angeles Executive Director Gene Seroka earlier this year was that “we will still have vessels at anchor come midsummer,” when terminals pivot to handling the peak season rush starting around Aug. 1.

It is now midsummer. There are still vessels at anchor — a lot of them.

Logistics consultant Jon Monroe warned Thursday, “Now we have a myriad of charter carriers all introducing vessels into a China-Pacific Southwest service at the same time the large carriers are adding extra loaders. Expect the West Coast to be slammed the entire month of August. We are entering gridlock plus.”

Déjà vu in San Pedro Bay

The number of container ships at anchor in San Pedro Bay off the ports of Los Angeles and Long Beach rose back to 30 on July 23. There were 27 at anchor on Friday.

The all-time record — 40 — was set on Feb. 1. Beginning in mid-March, San Pedro Bay anchorage numbers gradually declined as ship arrivals were curbed, both intentionally by carriers to get schedules back on track and unintentionally because their ships fell too far behind.

The 2021 low — nine container ships at anchor in San Pedro Bay — was hit on June 18, as fallout from the port closure in Yantian, China, further pared arrivals.

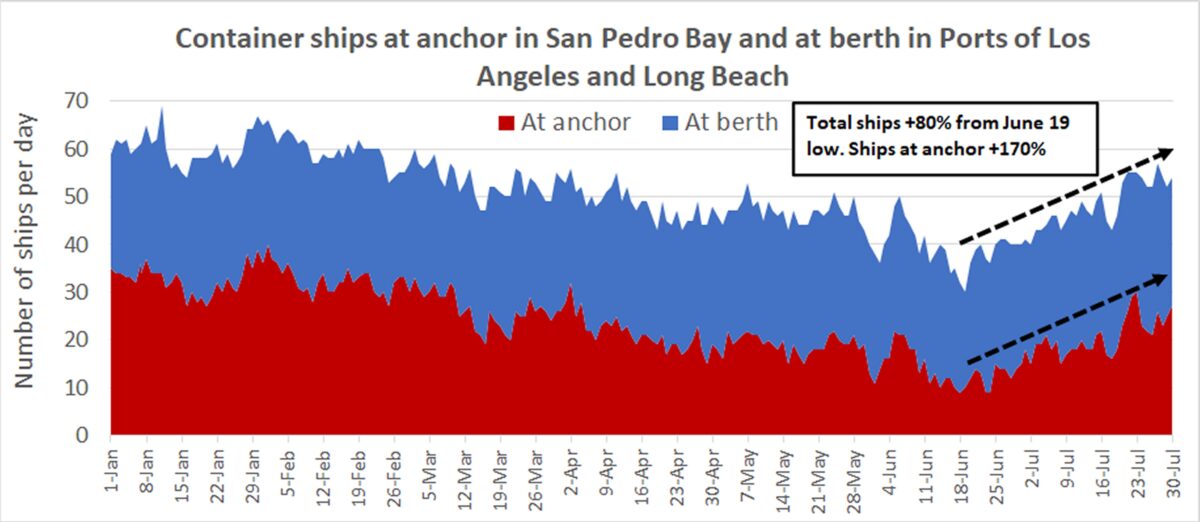

The following day was the turning point. On June 19, the total number of ships in the complex (at berths in Los Angeles and Long Beach, and at anchor) fell to 30. It hadn’t been that low since mid-October, when the anchorages first started to fill.

After June 19, the respite ended. Delayed Yantian cargo started to arrive. Import demand heading into peak season brought more ships. Between June 19 and Friday, the total number of ships in the complex increased 80% and the number of ships at anchor jumped 170%.

The data confirms that more ships calling in Los Angeles/Long Beach (both at berth and anchor) equate to a higher percentage of ships at anchor. Since the trend reversed on June 19, the share of ships at anchor versus the total has risen back up to 45%-55%, moving in the direction of the 60%-65% peak seen in the first quarter.

Anchorages across US

In the second quarter, as congestion temporarily eased in Southern California, the numbers grew in Northern California: in San Francisco Bay off Oakland, and in the Pacific, where a large number of container ships were drifting, awaiting Oakland berths. Between anchored and drifting ships, more than 20 container vessels were frequently waiting for berths in Oakland in the second quarter.

The situation in Northern California has improved, at least for now. As of Friday, automatic identification system (AIS) ship-tracking data from MarineTraffic showed only three container ships drifting in the Pacific and six at anchor in San Francisco Bay.

Further to the north, the situation is not good. According to MarineTraffic AIS data, there were 16 ships scattered in various anchorages in the Pacific Northwest on Friday awaiting berths in Seattle or Tacoma: one each off Everett, Victoria, Port Angeles and Vashon Island; two each off Seattle and Bellingham, and three each off Manchester, Bellingham and Whidbey Island.

Over on the East Coast, where dredging slowed the cargo flow at the Port of Savannah over the past month, there were 17 container ships at anchor off Georgia’s Tybee Island on Friday afternoon, according to MarineTraffic AIS data.

Just to the north in South Carolina, off the port of Charleston, three ships were at anchor on Friday.

On the Gulf Coast, yet another cluster of ships was at anchor, awaiting berths. In the wake of a two-and-a-half-day closure of Houston’s Bayport and Barbours Cut terminals due to a “hardware failure,” MarineTraffic AIS data showed seven container ships at anchor in the Gulf of Mexico on Friday afternoon.

Altogether, around 80 container ships are awaiting berths at ports on all three U.S. coastlines. And peak season is now set to begin in earnest, implying even more congestion ahead.

Click for more articles by Greg Miller

Related articles:

- Full steam ahead: Why container ships are racing across the Pacific

- Los Angeles port braces for Yantian catch-up, peak season combo

- Mounting evidence that container crunch will persist into 2022

- California’s massive container-ship traffic jam is still really jammed

- Inside container shipping’s COVID-era money-printing machine