The flow of trade is not that difficult to analyze. The problem is the lengths that economists and other “smart money” types go to in order to convolute it.

They complicate matters when, in reality, the situation is quite simple. This bad analysis and data are magnified by those with deep pockets who have the ability to buy loudmouth propaganda.

Unfortunately, after two years of logistics hell, the world wants to believe things are getting better — yet these declarations are just empty prophecies.

How to prove they are wrong? Just check the data that the flow of trade is providing.

These “smart money” economists have a track record of being late in their supply chain analysis.

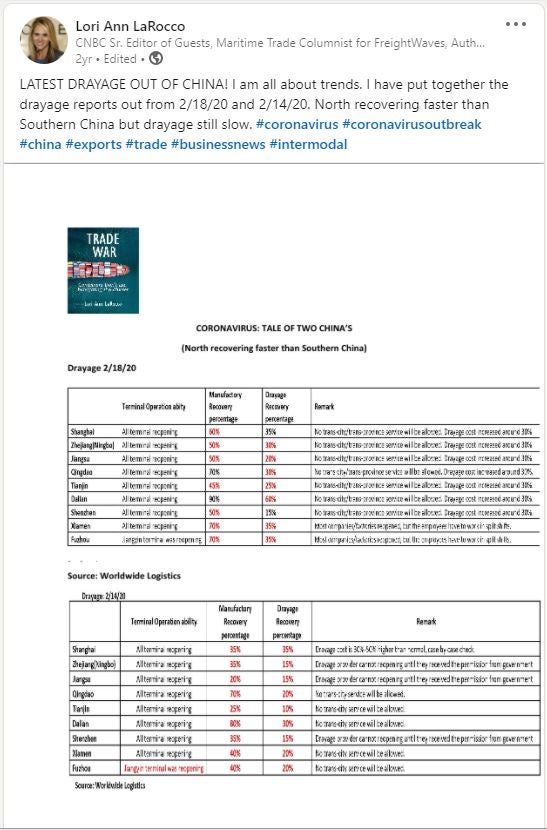

The perfect example of this started approximately two years ago: They were 10 days late declaring China was back open in March 2020 as evidenced by the buildup of smog. (Full disclosure: I reported on Feb. 18, 2020, that China was back up and running using drayage. Why? Because it takes people to move trade and a pandemic impacts people. The trucks being driven by people helped create that pollution.)

Time is money in the world of investing and logistics.

The congestion continues to impact vessel capacity.

New project44 intelligence quantified a whopping 23.35% drop in TEU capacity year-over-year in January. This capacity casualty has expanded around the world: the Middle East route dropping by 14.67%, the EU by 11.52% and North America by 14.19%, while Asia suffered the most with a 28% drop in nominal TEU capacity.

“Only every fifth container leaving Los Angeles carried export cargo,” explained Josh Brazil, vice president of supply chain data insights at project44. “We found that every month in 2021, carriers loaded more empty containers than full exports from Los Angeles and Long Beach. In fact, full exports represented only 21.4% of all outbound containers from Los Angeles and 31.3% from Long Beach.

“Carriers prioritized empty containers over full exports to ensure Asian manufacturers had adequate containers for exports to satisfy US demand.”

American Shipper reviewed logistic reports describing vessel availability, a forward-looking indicator of pricing. Prepare to keep that wallet open.

Words such as capacity at “full tilt” for the ports of Hong Kong, Xiamen, Fuzhou, Tianjin and Taiwan filled the screen in red, while the status “remains tight” for Shanghai, Nanjing, Shenzhen, Nansha, Qingdao, and Dalian written in bold red dominated the updates.

Despite factories in China getting back up and running post-Lunar New Year, the vessel delays and blank sailings have constricted capacity, which has solidified a floor in the pricing levels.

The demand for vessels is especially tight for the ports of Los Angeles and Oakland. For the Dalian port, it was noted, “In order to push new contracts at a high rate level, carriers don’t want to accept too many bookings after the CNY, they are trying to stabilize markets.”

For the markets of Shanghai, Nanjing, Shenzhen and Taiwan, many carriers are only accepting “premium bookings” on the West Coast. “Premium bookings” were only available for Shenzhen, Nanjing and Fuzhou for East Coast-bound containers.

Meanwhile, the high price does not guarantee swift transit.

For the other Asian trade routes, things are even more challenging.

The blank sailings to Vietnam, Malaysia, Thailand, Indonesia, Cambodia, Korea and the Philippines have created a situation where space on existing vessels is either at capacity or tight.

Logistics sources tell American Shipper, the North and West terminals at Port Klang has a shortage of gantry crane drivers due to the pandemic, which is resulting in vessel delays. This is especially impacting direct call vessels with huge capacity because they are unable to complete loading and unloading on time.

In Malaysia, the average delay for vessels calling long haul is around three to five days. The delays for feeder service or vessels calling between Malaysian ports are up to six to 10 days.

Unfortunately, Russia’s invasion of Ukraine has added further uncertainty to the global markets. This will only increase economic volatility.

Drewry cited in its latest report: “… the outlook for container shipping is intrinsically tied to the global economy and it is a near certainty that Putin’s gambit will lead to more economic volatility, heaping even more inflation on to people all over the world still reeling from the pandemic. … Drewry would expect to see much stiffer economic downgrades if the situation were to escalate and western allies of Ukraine step in, something which Putin ominously said would lead to ‘consequences greater than any you have faced in history.’

“How consumers react to the high levels of inflation is one of the biggest wildcards when trying to predict the outlook for the container market … . There are some dark timelines ahead, including one in which China feels emboldened to copy Putin’s playbook in Taiwan, something that would hit shipping very hard.”

So don’t pull that cork. Your champagne will fall flat when you can actually pour that glass.