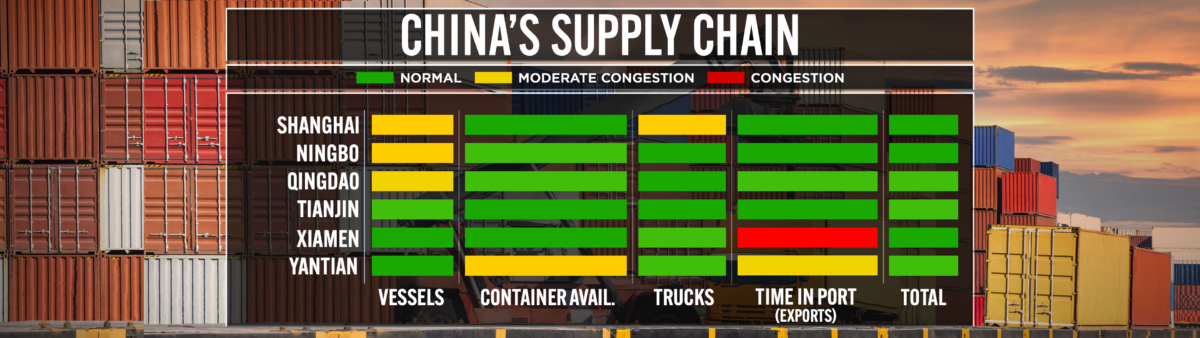

The jaws of the supply chain vise are squeezing trade so tight that the headache it is creating will be a whopper for logistics managers this peak season. Port congestion is growing again as a result of labor and equipment inefficiencies. Trade requires people, and what we see in the CNBC Supply Chain Heat Maps is the people component in trade is behind this latest squeeze.

Shanghai is still in the process of reopening, and while there are more green lights on the screen, the supplying of drivers and people to move and make the product is slower than normal. This is affecting the delivery of critical medical devices.

“The manufacturing plant in Shanghai was down for 75 days because of the ‘zero-COVID’ restrictions,” explained Gerry LoDuca, president of Dukal, which sells infection-control products and has manufacturing plants in Shanghai, Wuhan and Xingtai, China. “They are now operating 24/7 and they will be caught up by the end of July. Then the products will need to be packed up, shipped to Shanghai port and moved by vessel.”

Unfortunately, this delay is one of many being experienced by global importers.

Another vise squeezing trade is Europe.

Labor strife between the German trade union ver.di and the Central Association of German Seaport Companies (ZDS) is white-hot. Almost all ports in the German Northern Sea were impacted by a second warning strike last week that lasted 24 hours.

According to sources, a final offer of a wage increase of up to 11% in 18 months was offered. Some hope for a conciliation procedure in which politicians or a neutral person become involved in mediation.

The delays created by the latest warning strike have added to the congestion already plaguing the German ports. Container ships are currently delayed by several weeks at some German ports. Logistics executives are concerned the congestion is going to get worse, as will the availability of empty containers to be filled with trade.

“The overall situation in North European ports is deteriorating,” warned Andreas Braun, EMEA ocean product director for Crane Worldwide Logistics. “Port congestion is on the increase as well as yard occupancy. The first shipping lines like MSC are reacting to the current scenario with emergency storage surcharges for both imports and exports. These surcharges will be applied after exceeding the standard storage free time and are in addition to the standard tariffs. Although this surcharge is currently limited to Dutch ports only, and to date only MSC has circulated communication relating to the additional fees, we can assume that other ports and shipping lines will follow.”

Ocean carrier Hapag-Lloyd issued a notice on the increased demand on trucks as a result of this labor slowdown. And Maersk reported it would “absorb” the stoppage at its German terminals, telling customers that “in the interest of minimizing any further disruption to your supply chain, we will be keeping a close eye on developments up to and during the next round of meetings between trade union ver.di and ZDS, acknowledging that further strike action is possible.”

The U.S. logistics system continues to have its own host of issues with the persistent rail problems, chassis shortages and warehouses at capacity.

“Consumer trends are changing,” explained Spencer Shute, senior consultant at Proxima. “Buying patterns have shifted from home, electronics, casual apparel to more services. We are seeing buying apparel for travel and cosmetics coming back to pre-pandemic levels. Luggage, sunscreen, bug spray, these are items in higher demand because consumers need them in their experience pursuits. Larger appliances are not being purchased anymore. It’s an interesting dynamic to see how quickly the consumer has flipped considering what is going on in the economy.”

Despite the historic volume of containers, a pullback is expected as future orders for Chinese manufacturing have dropped anywhere from 20% to 30%, according to shippers surveyed. Lumber orders have been cut along with orders for furniture, appliances and DIY products.

“But for other sectors like garments, sporting goods and e-commerce, they are still seeing strong demands,” explained Akhil Nair, senior vice president of products for Asia-Pacific at Seko Logistics.

Steve Lamar, CEO of the American Apparel and Footwear Association, explained the continued strength in orders is a result of consumers looking to outfit themselves for experiences like back to school, back to in-office work and travel. But despite this demand, the impact of inflation is a top worry.

“We remain deeply concerned that persistently high prices — in our sector and throughout the economy — will begin to dampen consumer spending and harm American families,” Lamar said. “That is why, with consumers still being a driver for economic growth in our economy, we continue to push for the [Biden] administration to avail itself of all its own inflation-cutting tools, including relief from the high and regressive tariffs that are currently being charged on products in our industry.”

Alan Baer, CEO of OL USA, tells American Shipper the decrease in container volume is being seen.

“We are seeing drops by some customers from 30-50 FEU per week down to 10 FEU per week,” Baer said.

The squeeze is on. Time to pop that aspirin.

The CNBC Supply Chain Heat Map data providers are artificial intelligence and predictive analytics company Everstream Analytics; global freight booking platform Freightos, creator of the Freightos Baltic Dry Index; logistics provider OL USA; supply chain intelligence platform FreightWaves; supply chain platform Blume Global; third-party logistics provider Orient Star Group; marine analytics firm MarineTraffic; maritime visibility data company project44; maritime transport data company MDS Transmodal UK; ocean and airfreight benchmarking analytics firm Xeneta; provider of research and analysis Sea-Intelligence ApS; Crane Worldwide Logistics; DHL Global Forwarding; and freight logistics provider Seko Logistics.