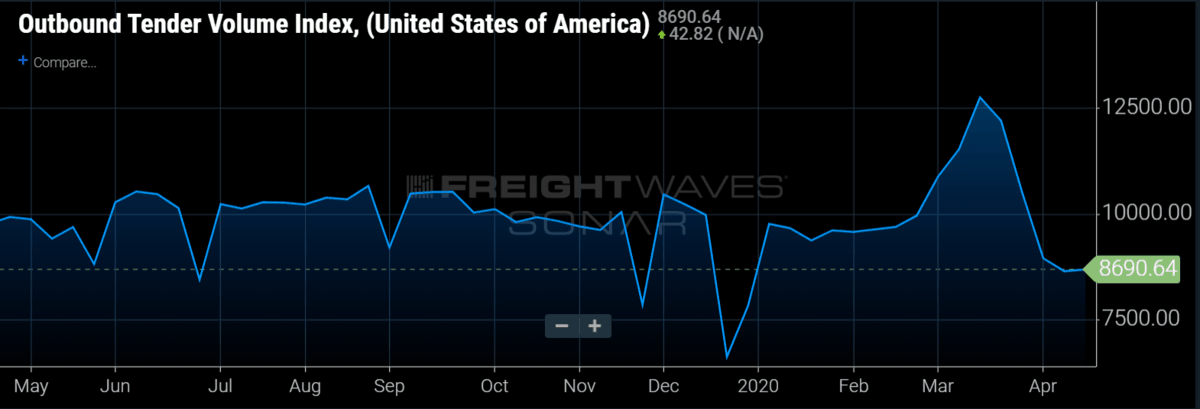

National freight volume movement has nearly come to a halt over the past week. The outbound tender volume index (OTVI) has been flat for more than 10 days within the 8,500-8,700 range. The current freight volume is at a level that would be typical for a national holiday like Independence Day or Labor Day. The current OTVI reading is the lowest of any non-holiday value in its three-year history.

There are sectors of the economy and regions of the country that are beginning to come back online. This week, Tennessee, Georgia and South Carolina all announced plans to open some businesses in the coming week. Unfortunately for the freight industry, many of these businesses are service-related and do not move much freight.

OTVI is reported as a seven-day moving average in order to smooth out day-to-day volatility. The index is currently in limbo and we believe looking at the weekly change (OTVIW.USA) will give better insight into the strength of any volume momentum swings.

The reopening of service industries will be positive for freight volumes, but not nearly as significant as when the retail, manufacturing and industrial sectors come back online. Currently, all public manufacturing data is very weak: the Empire State Manufacturing Index posted its lowest reading in history for April at -78.2; and Markit’s Flash Purchasing Managers Index also reported a new series low for April at 27.4. So while it is constructive for freight volumes that service industries open back up, volumes will continue to underperform as long as the backbone industries are shuttered.

On the positive side, 11 of the 15 major freight markets FreightWaves tracks were positive on a week-over-week basis. This ratio is a dramatic improvement from recent weeks. The markets with the largest gains in OTVI.USA were Memphis (26.27%), Laredo, Texas (18.26%) and Seattle (14.27%). On the downside, this week saw a decline in Dallas (-10.83%), Savannah, Georgia (-2.99%), and Houston (-2.77%).

Tender rejections continue to fall, now at an all-time low

Outbound tender rejections have fallen from the previous series low last week to a paltry 2.87%. This is well below any point in the index’s three-year history.

The index has previously found a support level around 4%, meaning it tends to bounce and does not fall below this level. This is the longest time OTRI has been under that support line, and with volumes at national holiday levels, there is not much pointing towards a rebound.

Since peaking at 19.25% on March 28th, OTRI has plummeted by 85%. OTRI is a measure of carriers’ willingness to accept loads at contracted rates and currently, carriers are moving whatever freight they can find. Contract volumes are at Independence Day levels, and spot rate volumes from Truckstop.com are in the Christmas Day range for most major lanes.

In terms of pricing power, it is not constructive to either shippers or carriers when volumes are this low. So, to grasp where the power is in this underperforming environment, we must look to pre-crisis capacity, which was already excessive. Although we believe bankruptcies and company failures will accelerate during the second quarter, capacity is still very loose right now. Until volumes pick back up, or a swath of drivers leave the market, that environment will remain.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com.

Check out the newest episode of the Freight Intel Group’s podcast here.