Rising expectations for fast delivery of high-value products has fueled demand for near-airport warehouses and forced tenants to pay substantial rent premiums compared to other industrial spaces in large metropolitan areas, according to a new report from CBRE.

The Dallas-based commercial real estate services and investment firm found that average rents for warehouses within a 5-mile radius of major airports are 18.8% higher than the average for the region. The analysis covered the 20 busiest U.S. airports for airfreight.

Warehouses in close proximity to major airports are attractive to shippers needing to use the speed of airfreight to transport pharmaceuticals, jewelry, machinery, automotive components and other expensive goods. The supply of warehouses is limited in many densely populated airport submarkets that lack developable land, like those around John F. Kennedy International Airport in New York, Los Angeles International Airport (LAX) and Miami International Airport.

Those airport districts, along with Chicago O’Hare and Philadelphia, are experiencing rent premiums of 24% or more, according to CBRE’s analysis. Warehouses adjacent to LAX are nearly 37% more expensive than properties farther away. Rent growth will likely accelerate in these markets due to the highly constrained supply and elevated transportation costs.

Air cargo volumes mushroomed 9% in 2021. The pace of growth has slowed this year in the face of turbulent economic conditions exacerbated by the Russia-Ukraine war and COVID-19, but Boeing forecasts 4.1% compound annual growth until 2040 and Airbus has a 3.2% annual outlook for airfreight. A major driver of new business is the growth of express cargo, which Airbus pegs at 4.7%, resulting from the popularity of direct-to-consumer shipping of parcels.

Increased interest in shipping by air is partially due to wide scale supply chain disruptions, such as manufacturing shutdowns in China due to COVID and power outages, port congestion and ground transportation labor shortages. Flying goods that are critical or out of stock can make up for delays elsewhere.

Companies are locating distribution operations closer to international air gateways to minimize transportation costs and delivery time. Short distances to airport cargo terminals allow freight forwarders to offer later cutoff times to get shipments on a scheduled flight and to more quickly turn around inbound freight for the final delivery leg to customers.

The reshoring of some manufacturing operations has been another catalyst for warehouse demand in airport markets, CBRE said.

“The immediacy of e-commerce deliveries and the generally faster pace of business than in past decades, among other factors, have made airport warehouses a critical link in many supply chains,” said John Morris, CBRE Americas president of industrial and logistics, in a news release about the report. “Rents for these properties will continue to exceed their market averages for the foreseeable future.”

CBRE found that the largest share (42.7%) of leasing activity in airport-warehouse markets so far this year was conducted by third-party-logistics companies. That’s a greater share than 3PLs’ claim of overall U.S. warehouse leasing (35.6%). That’s because businesses often hire logistics providers to handle shipping of small-batch goods by air.

The second largest share of leasing activity near airports went to general retail and wholesale companies at 32.2%. Food and beverage companies are a distant third at 5.2%. Companies that focus only on e-commerce comprised less than 4% of near-airport leasing, CBRE said.

Some logistics providers are moving air cargo operations to cargo-focused airports outside major hub cities to avoid congestion, delays and high operating costs. Secondary airports that have attracted more all-cargo flights since the start of the pandemic include Rickenbacker International Airport in Columbus, Ohio; Rockford airport in Illinois; Pittsburgh; and Greenville-Spartanburg International Airport in South Carolina.

Logistics real estate red hot at ports

Airport districts are not alone when it comes to tight warehouse conditions.

The supply of distribution facilities overall, especially near seaports, is not keeping up with demand.

A recent analysis by commercial real estate services firm Cushman & Wakefield said short supply and keen competition for space resulted in a 16.4% year-over-year growth in asking rents from landlords in the second quarter. At $7.47 per square foot (psf), it was the second quarter in a row that national overall net asking rents for warehouse/distribution space surpassed the $7 mark. Average net leasing rates are actually exceeding asking rents as businesses bid to secure limited space.

The challenge for businesses is even more acute near large ports.

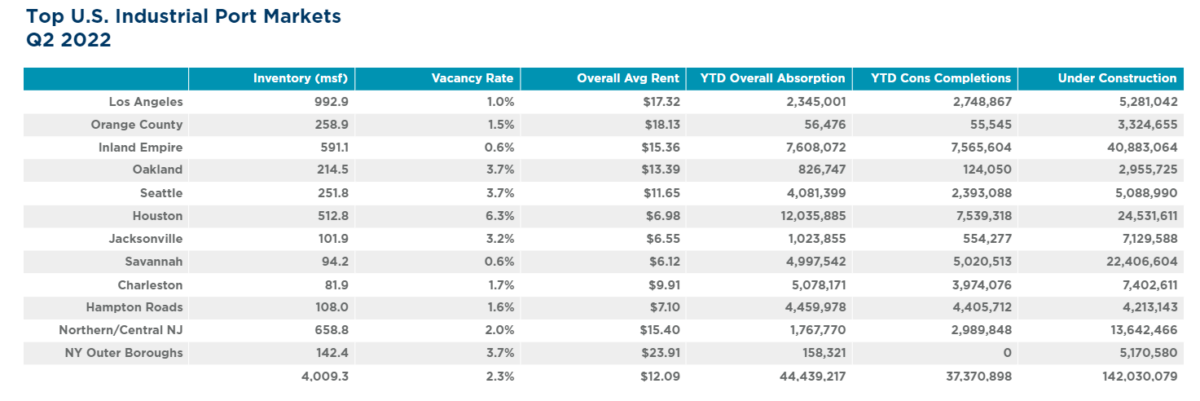

Seven major markets around major container ports saw vacancy rates of 2% or lower, as of June, including the Inland Empire near Los Angeles and Savannah, Georgia, at 0.6%. The average vacancy rate for all port markets is 2.3% — a key reason why only 1.1% of total available inventory nationwide was leased in these areas, according to a separate analysis last month by Cushman & Wakefield

With demand outpacing supply, rents for space near and around ports are also priced at a premium over other markets. At $12.09 psf, the average asking rent for port markets finished the second quarter 44.7% over the U.S. average of $8.36. The markets closest to the top seven container ports boasted double-digit rent increases.

In fact, industrial markets around the major cargo ports recorded six of the top 10 average asking rents in the nation for warehouse space. Taking rents for Class A logistics space in many cases were much higher, particularly within new construction projects in and around the ports, according to the Cushman & Wakefield analysis.

In New Jersey, taking rents have exceeded $20 psf in some cases and have even reached the $30 mark. On the West Coast, new developments in Los Angeles have secured rents in the high $20s psf, while the Inland Empire has seen some rents for new construction approach the $20 mark.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING: