Inventory replenishment, federal stimulus and increased vaccinations had management from Werner Enterprises (NASDAQ: WERN) calling for favorable freight fundamentals to continue through the back half of 2021 on a call with analysts Wednesday evening.

The Omaha, Nebraska-based transportation and logistics provider reported first-quarter adjusted earnings of 68 cents per share after the close, 5 cents ahead of the consensus estimate and 28 cents better than the year-ago quarter.

An increase in the tax rate compared to the 2020 period was a 2-cent-per-share headwind and management estimates that weather was a 7-cent-per-share hit to the quarter. However, these items were more than offset by lower insurance expense and higher gains on sale.

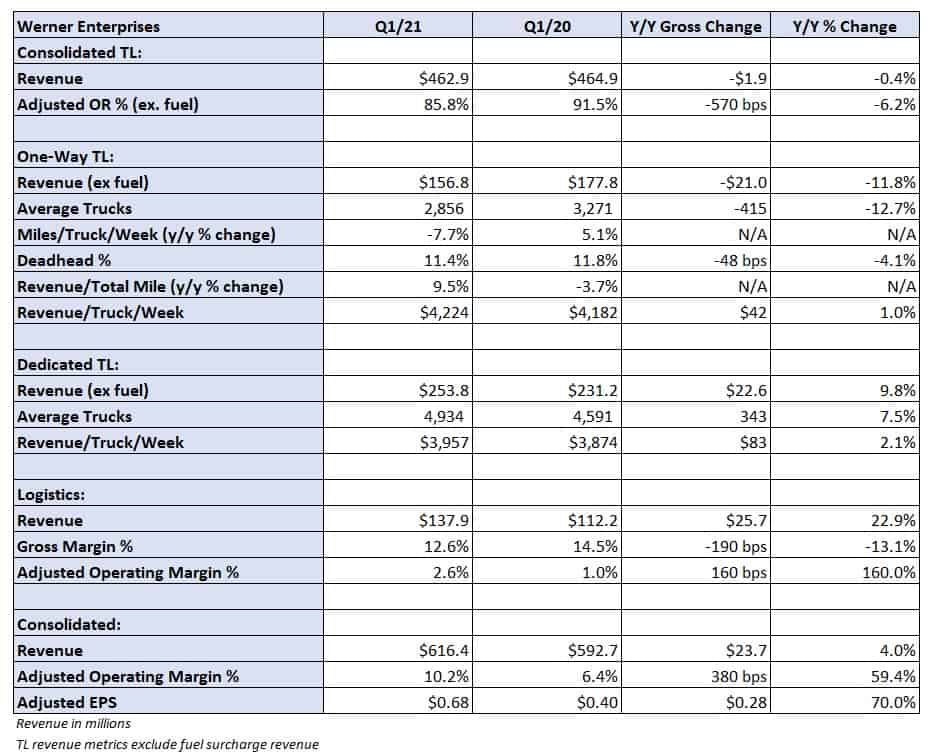

Werner reported a 4% year-over-year increase in consolidated revenue to $616.4 million, primarily due to a step higher in logistics revenue. Adjusted operating income was 68% higher year-over-year at $62.7 million, a first-quarter record.

The company’s one-way segment reported a 1% year-over-year increase in revenue per truck per week, 2% higher in the dedicated segment.

Revenue per total mile, excluding fuel surcharges, increased 9.5% in the one-way fleet, which was at the high end of management’s prior guidance range of 7% to 10% for the first half of the 2021. Given the continuation of tight capacity and elevated truck demand, guidance for the pricing metric was raised to a range of 13% to 16% for the second quarter.

The comparable metric for the dedicated unit came in 2% higher year-over-year, and management extended its 3% to 5% guidance to include the full year versus only the first half previously.

Werner is halfway through contract renewals and rates have been increasing by an average of high-single- to low-double-digit percentages on its one-way and TL brokerage contracts.

The TL adjusted operating ratio was 85.8%, 570 basis points better year-over-year as TL rates increased and insurance and claims expense declined. The first quarter of 2020 included $10 million in insurance and claims expense related to a serious accident. Additionally, gains on sale were $8 million higher year-over-year in the first quarter of 2021, an 8-cent-per-share tailwind.

Werner now expects gains on equipment sales of $17.5 million to $20.5 million during the first half of 2021. The prior guidance called for gains on sale of $12 million to $15 million for the entire year.

The logistics segment recorded a 23% year-over-year increase in revenue to $137.9 million. TL logistics revenue was up 20% as a 22% increase in revenue per load was partially offset by a modest decline in volumes. Intermodal logistics revenue grew 30% with volumes and yields up 23% and 6%, respectively.

Gross margin in the segment fell 190 bps to 12.6% as spikes in spot TL and drayage rates outpaced contractual increases.