Werner’s Q2 earnings: Too early for an inflection but promising signs ahead

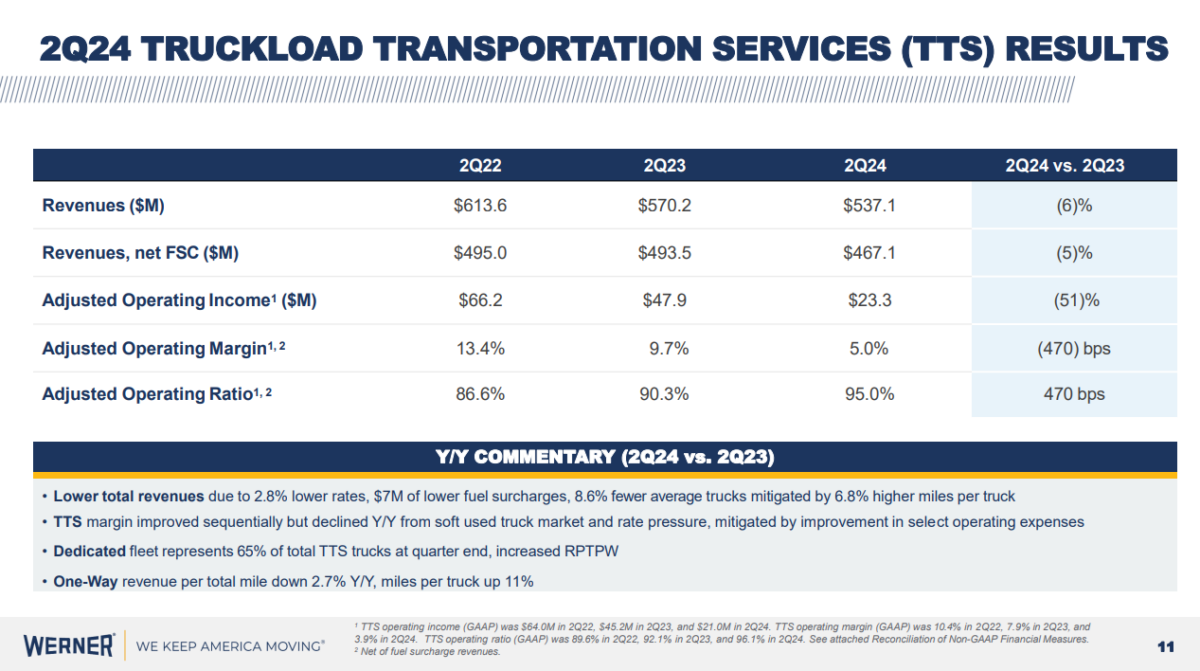

Werner Enterprises recently released its Q2 numbers which saw its Truckload Transportation Services, a combination of one way and dedicated, decrease by 8.6% in average truck count to net a 3% higher revenue per truck per week. The company’s operating ratio continued to fall, from 90.3% in 2Q23 to 95% for 2Q24, a decline of 470 bps. Year-over-year revenue fell 6% in the TTS segment from $570.02 million to $537.1.

Werner’s dedicated segment, which represents 65% of its TTS segment, saw a reduction in fleet count, as Werner is taking a more disciplined approach and walking away from opportunities that are underpriced. FreightWaves’ John Kinston writes, “In its Dedicated Truckload segment, the average number of trucks for the quarter was 4,901. A year ago, that number was 5,276, and in 2022 it was 5,184. The One-Way Truckload segment has seen an even larger decline. Average trucks in that segment were 2,730 in the quarter, down from 3,075 a year ago and 3,102 two years ago.”

Despite the declines, management was positive based on recent trucking trends and the return of seasonality. Derek Leathers, CEO of Werner Enterprises said on a conference call with analysts, “While it remains too early to call an inflection, we are encouraged by signs of tightening.” Leathers adds that freight demand in its One-Way segment improved midway through Q2 and continued into July during Roadchedk week. Those gains in spot rates held and continued through the last half of the quarter.

Another development to watch is the return of seasonality and growing activity on the west coast. Leathers added, “We experienced more seasonal freight trends with better demand on the West Coast related to certain projects. We expect typical seasonality leading up to peak season in the fall. Recent conversations with customers are encouraging relative to inventory levels.”

Knight Swift Q2 earnings saw worsening trucking conditions, expands LTL footprint

Knight-Swift recently released its Q2 earnings, which saw an earnings miss in part from a settlement from an auto liability claim and lower gains on equipment. Higher interest expenses and a higher tax rate were additional detriments. The Truckload segment which makes up 66% of Knight-Swift’s business saw $1.1 billion in revenue with an adjusted operating ratio of 97.2%. Compared to other truckload segments, Knight-Swift is more exposed to over-the-road at 47% versus 19% dedicated exposure. Total tractor count was 16,400 irregular routes and 6,500 dedicated tractors.

Similar to other truckload carriers, Knight-Swift believes better days are ahead. Adam Miller, CEO of Knight-Swift, told analysts on its Q2 earnings call, “We don’t want to be too quick to call it but I think we’re cautiously optimistic that certainly the trough is behind us and we’re on our way to building back.”

Revenue per loaded mile, excluding fuel fell, 8.5% year over year while miles per tractor excluding U.S. Xpress increased 3.5%. Part of that came from reducing the number of unseated tractors in their legacy business to reduce cost. The transformation of U.S. Xpress continues, with Miller noting, “U.S. Xpress experienced modest sequential declines in revenue in miles for the quarter as a result of some churn in its freight portfolio. However, sequential progress on revenue per mile and stable costs helped offset these challenges to hold the operating ratio flat with the first quarter.”

Knight-Swift also expanded its LTL presence through acquiring LTL carrier Dependable Highway Express (DHE), a Los Angeles based company with 14 service centers in California, Nevada and Arizona. FreightWaves’ Todd Maiden writes, “The additions come as the company continues to fill in the gaps of what will become a national network. Management said it would be disappointed if it couldn’t complete an LTL acquisition within the next 12 months.”

Market update: Q2 Freight Payment Index contracts at a slower rate

On Thursday, U.S. Bank released its Q2 Freight Payment Index data which saw a continued downward trend but at a lower rate than the previous quarter. The overall shipments index value fell 2.2% from Q1 to 85.6 points and is down 22.4% compared to Q2 2023. The spending Index saw a similar decline, down 2.8% from Q1 to 189.2 points and fell 23.5% y/y. When looking at the spending declines, falling diesel fuel surcharges are part of the spend, and can explain why spending fell more than volume from the April through June period.

A promising development came from its regional data, which saw three of the five regions posting sequential shipment gains compared to Q1 including the Northeast, Southeast and West region. The report notes, “For the first time since the second quarter of 2022, three of the five regions reported increases in quarterly shipment volumes, which might indicate that the freight market may be nearing its bottom.”

Another came from the West region, which had mixed results in Q1 but an uptick in shipments for Q2. The report adds, “Following eight consecutive quarters with declining shipment volumes, upticks in housing starts and West coast sea and land ports activity helped the region bounce back with a modest 1.5% gain in Q2.”

Looking ahead, the future remains in the hands of consumer spending, which the report notes impacted the shipments index downward as they continue to spend more on experiences than goods. Higher consumer debt and retail inflation are other factors to watch as households monitor their expenses.

FreightWaves SONAR spotlight: Spot rates stabilize but remain elevated from last year

Summary: Dry van spot market rates showed signs of stabilization in the past week but continue to perform better than at this time last year, according to recent data from the FreightWaves National Truckload Index 7-Day Average. NTI fell 1 cent per mile all-in week over week from $2.32 on July 22 to $2.31, but NTI daily movements recorded a spike to between $2.37 and $2.41 per mile in the past two days, as the end of July provided a small surge. Compared to this time last year, NTI is up 7 cents per mile from $2.24 on July 30, 2023, to $2.31.

For contracted freight, dry van outbound tender rejection rates followed a similar trend, remaining mostly flat at 4.48% compared to 4.73% on July 22, a decline of 15 basis points. Month over month saw VOTRI down 187 basis points from a July 30 reading of 6.45%. Recent Q2 earnings calls from truckload carriers’ management teams continue to highlight the challenging environment for RFPs with pricing pressure beginning to impact dedicated segments, which yield higher margins than over-the-road or one way. Compared to this time last year, the initial reporting average base rate per mile for van contract freight is down 2.1% from $2.36 to $2.31 as of July 16 – VCRPM1 follows a 14-day lag.

A potentially promising trend to watch will be if an increase in preliminary container import numbers to the U.S. West Coast provides some momentum for truckload carriers starved for volume. A rise in imports is also a boon to intermodal carriers, which, according to the Intermodal Contract Savings Index, is 12% cheaper than dry van. Whether this volume is absorbed by rail or transloaded into truckload remains to be determined and may impact contract-exposed carriers differently depending on their customer mix.

The Routing Guide: Links from around the web

Covenant’s CDL exemption approved over trucker objections (FreightWaves)

Shippers need contingency plans now, experts say (Trucking Dive)

Alberta mineral company buys own trucking fleet (Truck News)

Truckload contracts still falling despite increasing spot pressure (FreightWaves)

How to sell a trucking company: Maximizing buyer interest requires reducing perceived risk, analysts say (Commercial Carrier Journal)

Where do propane powered trucks fit in the energy transition? Ask New Jersey (FreightWaves)