One of the myriad coronavirus-related concerns is that container-shipping services on the backhaul routes to Asia could be impaired.

With Chinese factories still largely shut down and land transportation to ports constrained, the volume of containerized cargo flowing on the two main headhaul routes — China-U.S. and China-Europe — will decrease. Or rather, it will not pick back up as previously expected following Chinese New Year.

Container lines are blanking (canceling) sailings of various vessels that had been scheduled to serve these routes, to better align fronthaul shipping capacity with actual volumes.

The consequence of this is that there will be fewer ships serving backhaul runs from the U.S. to Asia and from Europe to Asia.

Sea-Intelligence, the Copenhagen-based container-shipping consultancy, reported in the latest edition of its Sunday Spotlight that carriers had already blanked 31 sailings, 21 in the trans-Pacific and 10 in the Asia-Europe trade.

Sea-Intelligence CEO Alan Murphy warned shippers to “brace for the backhaul rate spike.” He predicted that “the raft of new blank sailings is likely to cause capacity issues for backhaul shippers in Europe and North American in March and April. They need to start preparing for this situation as well as for a possible spike in freight rates.”

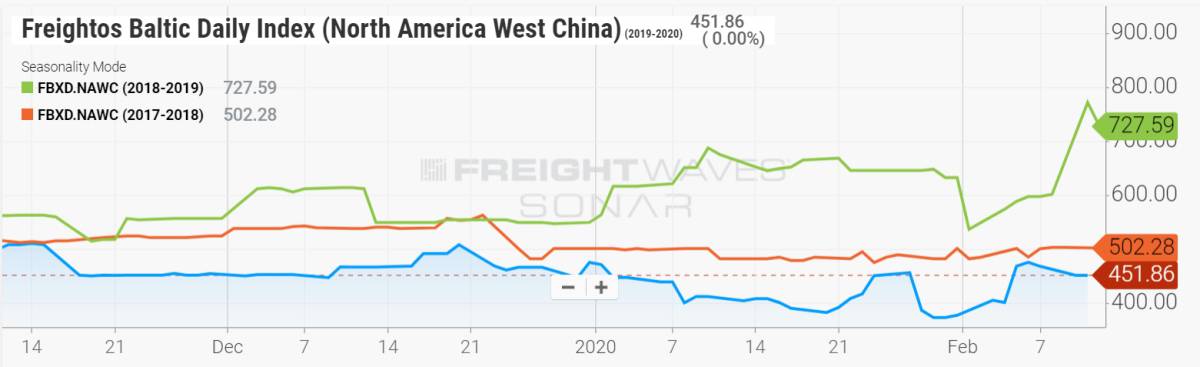

If U.S. and European exporters are concerned about this possibility, they might front-load Asian-bound cargoes soon, which should cause rates to increase. Freightos tracks the daily price to ship a forty-foot-equivalent (FEU) container along these routes.

The U.S. West Coast-to-Asia index (SONAR: FBXD.NAWC) is not yet showing a major price increase. There has been a small recent gain, but rates are still below those in the last two years.

Theoretically, the pricing from the East Coast to China might increase sooner, given the longer transit time. That index (SONAR: FBXD.NAEC) also shows recent gains, but still, nothing extraordinary rate-wise compared to the prior two years.

The Freightos index covering North Europe to China (SONAR: FBXD.NERC) shows rates for Asian-bound cargo actually falling, so clearly, concern over future backhaul availability is not yet translating into increased demand in this lane.

In general, the backhaul issue is not showing up in the rate data. It’s too early. The same is true for loaded forty-foot container rail volumes from Chicago to Elizabeth, New Jersey, (SONAR.WORAIL40L.CHIEWR) and Chicago to Los Angeles (SONAR.WORAIL40L.CHILAX).

If there were any rush to export, these would be up, but rail volumes on these routes over recent weeks are flat to down.

Thus, the potential for a coronavirus backhaul rate spike remains something to watch, but still hypothetical.