XPO Logistics reported quarterly earnings one last time as a transportation conglomerate providing less-than-truckload, truck brokerage and other services under one roof.

A spinoff of its brokerage segment, RXO, is planned for Tuesday. The remaining XPO entity will become a pure-play LTL provider, following the divestiture of its European transportation unit at a later date.

XPO spun off its contract logistics business, GXO (NYSE: GXO), last year.

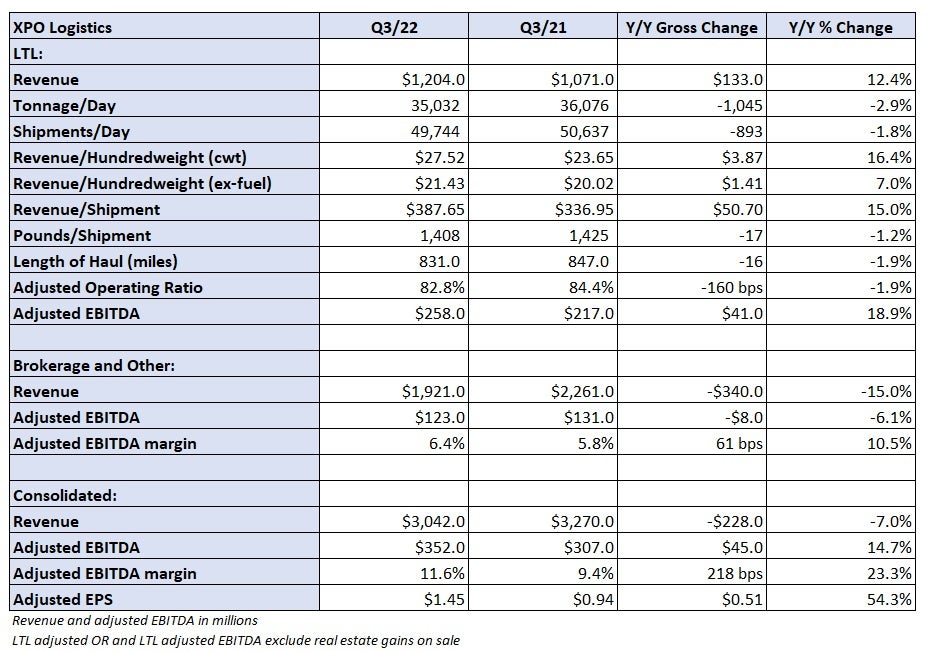

Before the market opened Monday, XPO reported third-quarter adjusted earnings per share of $1.45, 10 cents ahead of the consensus estimate and 51 cents better than the year-ago number. Revenue, margins and operating metrics were in line with ranges preannounced two weeks ago.

Consolidated revenue increased 3% year over year (y/y) excluding results from an intermodal business, which was sold earlier in the year.

LTL takes share, costs mount

Revenue in the LTL segment increased 12% y/y to $1.2 billion. Tonnage was down 3%, but revenue per hundredweight, or yield, increased 16% (7% higher excluding the impact of fuel).

Management said tonnage improved on a y/y comparison as the quarter progressed, turning positive in September with October seeing an even higher growth rate. The changes in tonnage outperformed normal seasonality and bucked moderating trends seen throughout the industry.

Management said XPO is winning market share as it has added or expanded terminals in some markets and grown its sales force by 7% since the beginning of 2021.

“As an example, we opened up the terminal in Atlanta six months ago, and in the month of September we’ve seen tonnage in the Atlanta market go up 38% on a year-on-year basis,” said Mario Harik, who runs the LTL segment currently and will become CEO of XPO following the Tuesday separation, on a call with analysts.

Harik said the company added several new customers in the quarter that could potentially become top 10 accounts over time. LTL tonnage was guided to increase y/y by an undisclosed percentage again in the fourth quarter, with yield increasing by a low- to mid-single digit percentage y/y. A “tough comp” (up 11% y/y in the 2021 fourth quarter excluding fuel) and later implementation of an annual general rate increase were cited as reasons for slowing yield growth.

“Generally, we continue to see a very rational pricing environment,” Harik said. “Our contract renewals, for example in the third quarter, were still up high-single digits. … Again, we see a rational environment, but this is what the trend looks like as we head into Q4.”

An 82.8% adjusted operating ratio in Q3 was 160 basis points better y/y when stripping out gains on real estate sales. The OR was 85% when excluding pension income and other items.

Management is guiding 120 bps of OR improvement in Q4, however, off an 87.5% mark recorded in the 2021 fourth quarter. The implied unfavorable change in margin from the third to fourth quarter reflects higher costs in areas like wages, maintenance, parts and facilities. Like other LTL carriers, XPO’s margins have also benefitted from elevated fuel surcharges in recent periods.

The LTL segment is expected to generate at least $1 billion in annual adjusted earnings before interest, taxes, depreciation and amortization, which includes real estate gains of up to $50 million during the fourth quarter.

XPO is in the process of reducing its third-party linehaul capacity by using in-house assets, which provide a cost savings of 30% to 40% per mile. The company previously doubled its capital expenditures budget for 2022 to a range of 9% to 10% of revenue. The LTL fleet was nearly 6 years old on average at the end of the quarter. The goal is to get below 5 years over time to reduce maintenance expenses and improve fuel economy.

The capex budget is expected to increase again next year.

Brokerage staying in growth mode

Revenue from brokerage and other declined 15% y/y to $1.92 billion. The sale of the intermodal business was the primary reason for the drop. Truck brokerage revenue was down 2% y/y to $686 million. Volumes were up 9% y/y, with September seeing an all-time high for average loads per day. However, lower spot rates led to an undisclosed decline in revenue per load.

The mobile app has now been downloaded 850,000 times, and 10,000 carriers were added to the platform during the third quarter. The unit created or covered 81% of truck brokerage loads digitally in the period.

Brokerage had a 73%-27% contract-spot mix in the quarter.

“That’s exactly where we wanted to be during this market. It allowed us to operate at strong margins, continuing to take market share and do it profitably,” said Drew Wilkerson, head of North American transportation at XPO and soon to be RXO CEO.

Gross profit margin increased 490 bps y/y to 19%, with gross profit dollars climbing 31% y/y.

Wilkerson said the unit will see volume growth again in the fourth quarter despite a “muted peak season.” However, the gross profit margin could dip from the third quarter given softness in the TL spot market and “very strong” contractual bid activity, which has pushed contractual pricing “slightly down.”

Adjusted EBITDA is expected to be level sequentially in the fourth quarter, but that number doesn’t include the costs associated with being a stand-alone entity.

“I thank our shareholders for their long-standing support of the company we began building in 2011 and the new public companies we’ve created,” said Brad Jacobs, who will assume the role of XPO’s executive chairman and become the nonexecutive chairman of RXO. “XPO was the seventh-best performing stock of the last decade on the Fortune 500, and I’m proud that our evolution into XPO, RXO and GXO is serving the best interests of our shareholders.”

Shares of XPO were up 2.2% at 1:03 p.m. EDT compared to the S&P 500, which was down 0.8%.

Prior to the report, the stock was down 17.3% since XPO reported second-quarter results on Aug. 4. By comparison, the MerQube FreightWaves Supply Chain Tech Index (SCTI) was down 12.2% over the same time. The SCTI measures share price performance of tech-enabled supply chain services providers like XPO.

More FreightWaves articles by Todd Maiden

- Ruan acquires Michigan-based dedicated carrier NTB

- Forward Air sees further growth in 2023 as macro cools

- Old Dominion says volume weakness could clear by spring