YRC Worldwide, Inc. (NASDAQ: YRCW) announced that it completed a refinancing of its term loan debt, entering into a $600 million term loan agreement. The new deal provides additional liquidity and provides less restrictive financial covenants.

The company believes this will provide an “operational runway” for its multi-year initiatives aimed at returning the less-than-truckload (LTL) carrier to sustained profitability.

“The new term loan agreement provides the company with increased liquidity through the elimination of annual principal amortization and the ability to reinvest cash proceeds from certain property sales back into the business. To successfully execute the company’s multi-year strategy, it is essential we have a capital structure in place that provides added liquidity to invest in the initiatives we have planned and better positions the company to navigate through cyclical economic environments,” said YRC’s chief financial officer Stephanie Fisher.

The new financing agreement eliminates annual principal amortization of 3%, which is estimated to save $18 million in cash annually. The interest rate is lowered 100 basis points to LIBOR plus 7.5% and the new maturity is June 2024 (from July 2022). The new leverage covenant requires YRC to maintain last 12 months (LTM) earnings before interest, taxes and depreciation (EBITDA) of $200 million. If YRC were to exceed $400 million in LTM EBITDA, it would receive a 1% step down in the term loan rate (to LIBOR + 6.5%).

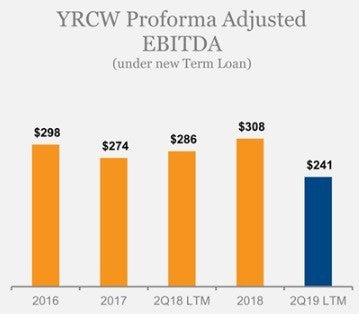

The press release provided a reconciliation from net income to adjusted EBITDA. For the LTM prior periods provided, the last one being the second quarter 2019 close on June 30, the carrier has exceeded the $200 million threshold. The high was $308 million LTM adjusted EBITDA for all of 2018. The low was the company’s most recent quarter. YRC reported $241 million in LTM adjusted EBITDA at the end of second quarter 2019.

For the first half of 2019, YRC has reported $80 million in adjusted EBITDA compared to $146 million in the same period in 2018. YRC’s operating profit, as most LTL carriers, are back-half loaded with the first quarter of each year being the weakest.

Importantly, the company is able to reinvest cash proceeds from specified property sales in the future. One hundred percent of the net cash proceeds from the sale or disposal of assets outside of its normal business operations are required to be returned as debt repayment. However, the first $40 million in trucking terminal property sales is excluded.

YRCW has been shuttering service centers with plans to close 25 facilities by the end of the year. It has already closed its New Lebanon, Pennsylvania, headquarters of regional unit New Penn Motor Express and consolidated corporate functions at its Overland Park, Kansas, headquarters. The service center closures are expected to generate cash proceeds of $25 million, with a similar amount in savings expected to come from the consolidation moves at its headquarters.

“The execution of this refinancing is an important milestone for YRC Worldwide and a critical next step in our journey. This completes two of the five foundational elements of our multi-year strategic roadmap announced earlier this year. We have accelerated our efforts around these initiatives and securing the new financial structure allows us to move rapidly toward the $60 to $80 million in profit expansion we have targeted in 2020,” said YRC’s CEO Darren Hawkins.

In an 8-k filing with the Securities and Exchange Commission, YRC provided additional detail on other proceeds repayment carve out provisions. The company has to return the first third of net cash proceeds received if subordinate debt is acquired and 100% of net cash proceeds (up to a $30 million maximum) from any equity issuances. In the past, YRC has used new equity issuances as a means to alleviate itself from excessive debt burdens and its union pension obligations.

The company ratified its new national labor contract in May 2019, which provided it with an “improving mix of hourly wages with the use of part-time workers.”

Apollo Global Management, LLC (NYSE: APO), through affiliates, acted as the lead lender on the deal.

“I am pleased with the rapid progress we have made in 2019 as critical foundational elements are now in place. Through the remainder of the year, we will be aggressively moving forward with the implementation of our operational flexibilities, the network optimization plan and improving customer engagement, which we believe will lead to improved profitability for the company,” said Hawkins.

Shares of YRCW have been as much as 25% higher on the day.