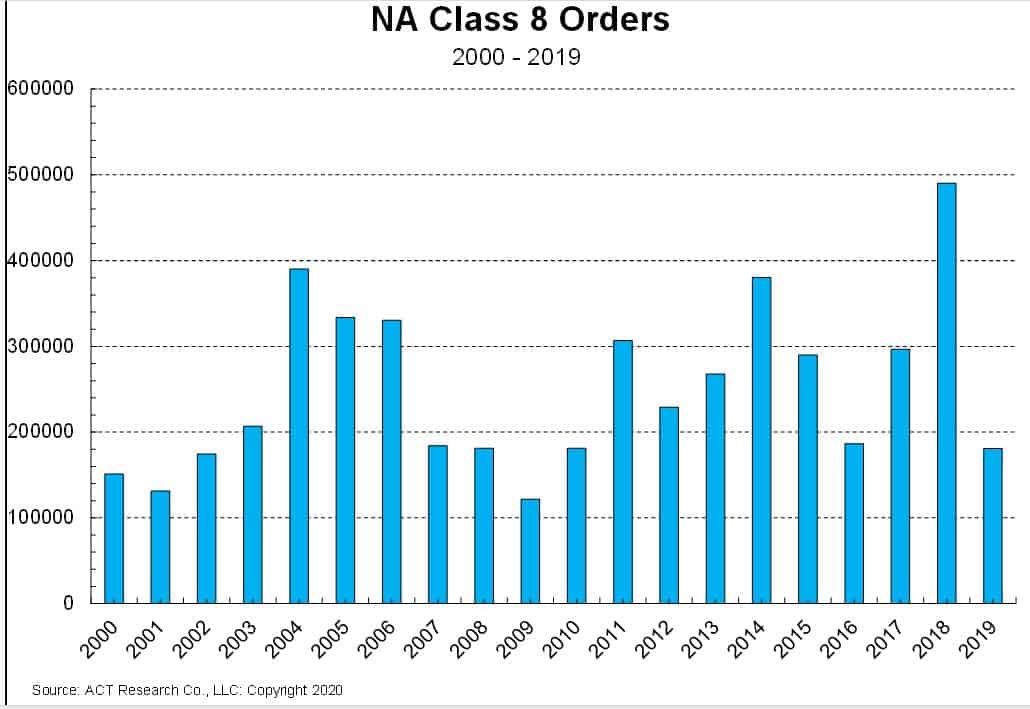

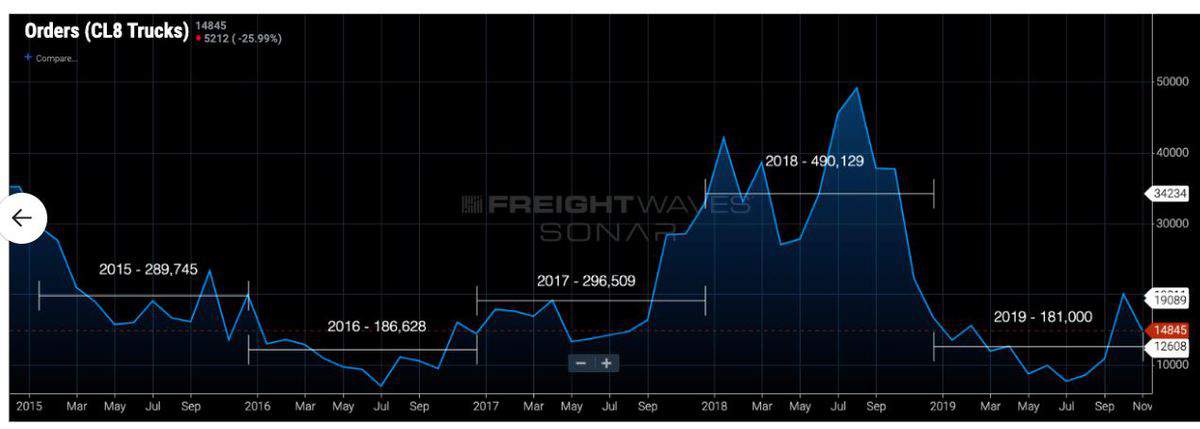

Orders of new Class 8 trucks tumbled to their lowest annual level in a decade in 2019 as a softening economy and a booking frenzy in 2018 combined to clobber orders.

Year-over-year new truck orders fell again in December, though the 20,000 bookings were up 14% over November, according to ACT Research.

“Overbuying through 2019 and insufficient freight to absorb the ensuing capacity overhang continued to weigh on the front end of the Class 8 demand cycle in December,” said Kenny Vieth, ACT president and senior analyst.

Truck makers saw the slowdown eat away at a record industry backlog of a year ago and cut production that resulted in thousands of job losses.

Daimler Trucks North America laid off 900 workers in October. Volvo Trucks North America is cutting 700 jobs this month. Paccar Inc. (NASDAQ: PCAR) trimmed 100 jobs at its Kenworth division in addition to attrition in November. Navistar International Corp. (NYSE: NAV) is laying off 1,300 workers this month.

The pinch also impacted major suppliers like engine maker Cummins Inc. (NYSE: CMI), which is cutting 2,000 jobs globally.

Mack Trucks, a Volvo Group unit, said in December it expects to lay off workers in January but declined to estimate how many. Mack lost two weeks of production to a United Auto Workers strike in October. It plans two down weeks late in the first quarter to adjust production and two additional down weeks in the second quarter for plant modifications.

“Recent industry orders have been running below replacement level,” Navistar CEO Troy Clarke said on the company’s fourth-quarter earnings call Dec. 17. “I believe the industry is working through a period of transition and then orders will pick up and recover in the second half of the year.”

If that doesn’t happen, more cuts may lay ahead.

The estimated number of trucks waiting to be built at the end of 2019 was about 123,000 compared with 297,000 in December 2018, Vieth told FreightWaves.

The year-ago December was the first month that orders began to fall after several record months in the second half of 2018, when carriers bulked up by investing savings from a cut in the federal corporate tax rate to 21% from 35%.

Year-over-year order comparisons are less extreme than earlier in the year. December 2019 orders were 6.5% below the same month a year ago, ACT said.

Deliveries of much of the equipment came in mid- to late 2019. Some fleets held off taking deliveries because of falling prices for used trucks.

“It will take some time for the used trucks they replace to be taken out of service,” Clarke said.

Retail sales, which follow orders and production, are expected to set a record of 310,000 to 340,000 when those numbers are tallied later in January. Most predictions call for about 100,000 fewer Class 8 sales in 2020.