Average retail diesel prices in the U.S. are at a level not seen since September 2014.

The Department of Energy/Energy Information administration price for January 24 was up 5.5 cents per gallon to a posting of $3.78 a gallon. That marks the highest level since a posting of $3.804 a gallon on Sept. 22, 2014.

It also is the third consecutive week of increases, and that trio of higher levels has added 16.7 cents to the benchmark price since Jan. 2.

The higher price posted this week marks a catch-up from earlier increases in wholesale levels, as retail prices previously had not kept up with recent rises in commodity and wholesale prices. Those increases included a stretch of 11 consecutive days of higher prices posted in the ultra low sulfur diesel (ULSD) contract on CME, only the second time in the more than 40-year history of that contract that a streak of 11 days of gains has been recorded.

However, the increases in commodity and wholesale prices largely stopped last week and into Monday, as the price of ULSD settled Monday at $2.6274 a gallon. That marked roughly a 5-cents-per-gallon decline from where ULSD settled Tuesday, the first day of last week’s trading week. (There was no settlement last Monday because of the Martin Luther King Jr. holiday.)

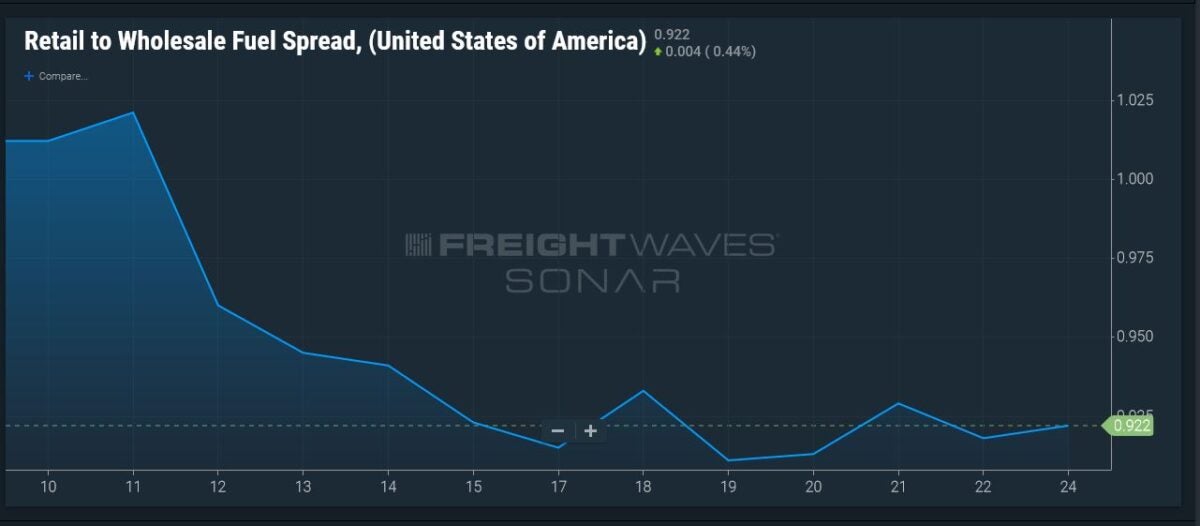

But retail prices had not kept up with prior increases in wholesale and commodity prices, as evidenced in the sharp fall in the FUELS.USA data stream in SONAR. That data represents a simple difference between wholesale and diesel prices, and it fell roughly 10 cents per gallon between Jan. 11 and Monday. That much of a decline usually signals an imminent rebound in retail prices to compensate for the higher wholesale prices that retailers pay to supply their outlets.

Price spreads between commodity diesel and crude have remained relatively steady, suggesting diesel prices are not significantly stronger than crude. But price reporting agency Argus Media, in a recent article, wrote about the physical diesel market, which it said is particularly strong.

“Middle distillates are staging a vigorous rally, outpacing even the big crude price rises of the past month,” Argus wrote on Friday. “Diesel crack spreads are $2-3/bl higher than they were at the start of this year.”

One of the reasons for the tightening diesel market, according to Argus, is natural gas. High natural gas prices, particularly outside the U.S., have led to an increasing amount of oil, including middle distillates like diesel, to be used for heating and electricity generation.

But Argus noted another factor: desulfurization. To meet environmental specifications, diesel must have most of its sulfur removed. Desulfurization involves hydrogen, which is made through a process using natural gas. And the high price of natural gas around the world has hurt the economics of refining due to the costs of desulfurization.

“European refiners, which typically increased crude runs by 250,000 b/d in December before Covid-19, cut them by 450,000 b/d last month,” Argus wrote. “Rising crude prices are part of the reason. But many are hamstrung by higher prices for natural gas needed to make the hydrogen essential to [desulfurize] diesel. Hydrogen costs in northwest European refineries are $3-4/bl, up from roughly $1/bl a year ago.”

The rise in the DOE/EIA benchmark diesel price came even as commodity prices dropped sharply Monday, in sympathy with weak equity prices, which only bounced back after spending most of the day in the red. The Monday ULSD settlement of $2.6274 a gallon on CME was down 6.38 cents. That was the biggest one-day drop in price since New Year’s Eve, when the price fell 6.58 cents a gallon.

More articles by John Kingston

BasicBlock is building path to same-day factoring, for free

TriumphPay calls out achievement of first fully automated factoring payments

Weil’s controversial Wage and Hour Division nomination heads to Senate