(Updated March 12, 2023, 11 p.m. ET)

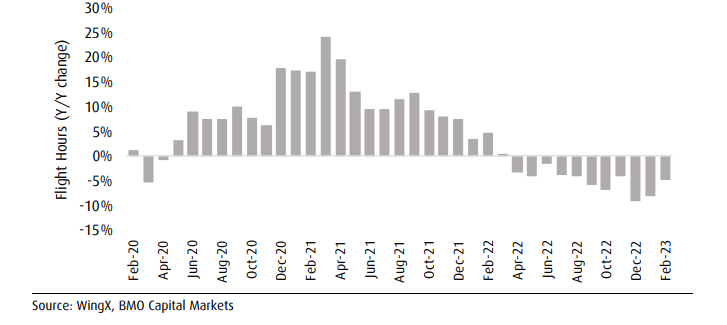

A decline in flight hours for all-cargo airlines is another data point to gauge the sagging airfreight market that is typically measured in volume by tonnage or weight by distance carried.

Freighter aircraft utilization fell an estimated 4.7% in February – an improvement from the 8.1% decline in January and a 9% drop in December, according to a recent report by investment bank BMO. The three-month moving average of flight hours declined 7.4%, the steepest drop in three years. Several airlines have recently reported diminished flight hours or said they expected slower operating activity this year.

The year-over-year contraction in flight hours, which accelerated last fall, is affecting most markets. The North America-Asia trade experienced an 11.8% decline in February while North America-Europe flight hours declined 15%, more than double the year-over-year decline in January, BMO Capital Markets said. Freighter utilization between Europe and Asia fell 1.3%, a marked improvement from the drop of 18.6% in January.

Domestic North American flight hours in January slid 4.8%, an improvement from the 11.1% decline in December but also a 3.6% decline from the same month in 2019. The December figure was impacted by the lack of peak season ordering as retailers worked off excess inventory and the fact that 2021 was a record for air volumes.

Still, global freighter usage is 18% above pre-pandemic levels.

The analysis also shows that flight hours declined 14.8% month over month in January, slightly worse than the average seasonality for that slow time of year, according to BMO’s research.

The analysts estimated FedEx’s flight hours dropped about 8% in February. UPS has also experienced lower air demand in recent months. Cargojet (TSX: CJT) was able to sustain utilization rates until recently. But in Monday’s earnings report, the Canadian contract carrier said the number of hours flown by its aircraft is expected to decline this year and that DHL has already pulled back on flight requirements.

FedEx announced late last year that it was paring back some routes and parking several aircraft because of the downturn in international shipping.

Last month, Atlas Air (NASDAQ: AAWW) said its aircraft usage was down 7.7% during the fourth quarter. Air Transport Services Group, the parent of ABX Air and Air Transport International, forecast cargo aircraft utilization will decline about 5% year over year in 2023 but still compare favorably to other periods. Major customers Amazon (NASDAQ: AMZN) and DHL Express began reducing their schedules late last year, although Amazon maintains schedule changes are related to maintenance. And the number of hours Sun Country (NASDAQ: SNCY) flew for Amazon decreased 4% during the fourth quarter.

Those examples are noteworthy because it shows that the soft market doesn’t just apply to general cargo but to trendy e-commerce as well.

The International Air Transport Association, which uses a different methodology based on cargo-ton kilometers, reported January volume declined 14.9% year over year. That follows declines of 13.6% in October, 13.7% in November and 15.3% in December.

With manufacturing in many countries contracting and high interest rates pressuring consumer spending, air cargo demand could remain subdued for some time. Meanwhile, more passenger aircraft with cargo space reentering service after the COVID crisis means more supply, creating less need for all-cargo jets and lower rates.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Amazon contractor ATSG expects cargo jet usage to dip 5% in 2023