The anticipated surge in over-the-road diesel prices because of IMO 2020 has not occurred. But that doesn’t mean that there aren’t impacts in other parts of the oil supply chain because of the new rule that goes into effect Jan. 1.

In its wide-ranging monthly report that covers the entire sweep of supply, demand and markets, the International Energy Agency spelled out where the oil market clearly is reacting to the mandates of IMO 2020. The rule will require all marine transportation to burn fuel with a sulfur content no more than 0.5% worldwide. The current limit is 3.5%. Shipowners can get around it by using scrubbers that remove the sulfur from higher-sulfur blends.

There had been a surge in some physical diesel markets for a few weeks in October, measured as the price of physical grades of middle distillates (including diesel) relative to dated Brent, the world’s crude benchmark. But that has been reversed — and then some. For example, based on data provided by S&P Global Platts, the price of ultra-low-sulfur diesel (ULSD) in the third week of September was about $17.25/barrel more than the price of dated Brent. It’s now about $15.10. New York harbor ULSD was $19.55; now it’s $18.42. Even marine gasoil (MGO), a diesel product that is expected to get a surge in demand because of IMO 2020, was $52.37 more than dated Brent in late September on the U.S. Atlantic Coast. It’s now about $2 less than that.

The most basic spread of all, that between the price of Brent on ICE and CME and the price of ULSD, peaked at about $22.55/barrel in mid-October. It’s now down to about $18.30/barrel.

But the IEA sees movement beyond this. The agency, made up of nations that are considered consuming countries with Western-style economies, sees the transition so far going smoothly as measured by getting ready to supply compliant fuel to shipowners. It notes that coming out of a heavy maintenance season this fall that cut a significant amount of refining activity, the return to action of a lot of capacity “sets the stage for a hopefully smooth implementation in January of the … regulations,” the monthly report said. “Ports, shipowners and refiners have stepped up their preparations. Major bunker hubs such as Fujairah, Rotterdam and Singapore are reported to have large volumes of compliant fuel available.”

The report also notes that high-sulfur fuel oil (HSFO) prices have plunged relative to the rest of the barrel. HSFO is the current fuel of choice for ships, but it will be noncompliant under IMO 2020. The spread between HSFO and LSFO is “nose-diving,” according to the IEA, blowing out to a $30/barrel level in Rotterdam, the widest in more than 10 years. About a year ago, it was $3.

So what does all this mean for where the market stands just six weeks or so until IMO 2020 is the law of the world? Where is the reaction in the diesel market?

The adequate supplies that the IEA refers to of compliant fuels could not have been produced without some input from diesel. There is an intermediate product called vacuum gasoil (VGO) that is going to be one of the key blendstocks to produce compliant VLSFO. That, combined with greater consumption of MGO, was always seen as the likely way to transition into a new 0.5% market from the current 3.5% standard.

But if VGO is being used, why isn’t there a drop in diesel supplies and a concurrent rise in diesel prices relative to crude? VGO can be used to produce diesel or gasoline, as well as the new blends of VLSFO.

That’s a tough one to answer, but that doesn’t mean there aren’t some things going on in the diesel market that might be pointing to higher prices eventually.

For example, just this week S&P Global Platts reported that the market price for barges of ULSD in the Amsterdam-Rotterdam-Antwerp hub were at a six-month high against the benchmark contract on the ICE commodity exchange for gasoil (which is a middle distillate, like diesel). The spread was $1.75/metric ton, up from $1 just a day earlier. It’s the highest since May, but note that back then the spread was $2.50. So it has moved up, but it isn’t in never-before-seen territory.

One of the reasons cited for the increase in European ULSD prices was a report from a company called Insights Global that ULSD inventories were at eight-month lows in that Rotterdam region. That would be in keeping with other inventory numbers showing tight diesel supplies. U.S. total distillate inventories — which are mostly ULSD — are 14 million barrels less than the five-year average. That’s about a 12% deficit.

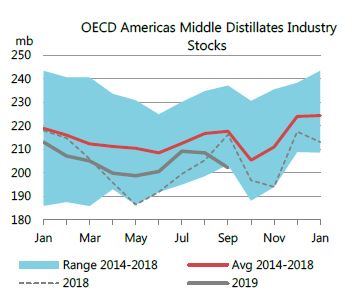

Back to the IEA report: It sees tight inventories of middle distillates all over the world. The IEA reported that in September, the last full month for which it has data, inventories of all petroleum products drew 25.8 million barrels compared to a usual September decline of 5.7 million barrels. But it was the distillates that drew the hardest: 16.9 million barrels, which the IEA says is “over three times the usual decrease owing to the a counter-seasonal fall in the Americas and a larger decrease in Europe driven by the lower refinery runs.”

Refining operations worldwide did have a heavy maintenance season in September and October. That certainly contributed to the lower inventory levels. The question is whether it was just maintenance that led to those significant draws in inventories or whether a diversion of feedstocks like VGO into making compliant marine fuels played a part. (U.S. distillate production numbers published by the EIA are not showing that.)

Although we noted that the price of ULSD on the CME had weakened relative to Brent, a sign that IMO 2020 was not hitting prices, the market is in a relatively steep backwardation. A backwardation is a market structure in which the highest price is found in the contract for the most immediate delivery, in this case December. And it’s a structure that develops if inventories are tight. (A perfectly balanced market has the price rise over the course of the calendar, to reflect the cost of storage and the time value of money. That structure is known as contango.)

On Nov. 15, the spread out to next January was about 7 cts, with December 2020 priced about 7 cts less than December 2019. That is a fairly steep backwardation. It steepened by about 1.5 cts just over the course of the week, a move that also could be considered significant.

Truckers and other transportation professionals concerned about IMO 2020 have every right to be breathing a sigh of relief so far. There were predictions that the market might be shooting up by now. It hasn’t happened and it might not. But there are still plenty of things to keep an eye on and watch for the danger coming over the hill.

Noble1

….

There was an interesting report written by IATA in July concerning the “potential” impact on the maritime sulfur limit on aviation titled:

“IMO 2020 Understanding the potential impact of the maritime sulphur limit on aviation”

One key point I would like to quote is :

“Nevertheless, it is important to keep in mind that the demand for middle distillates is generally highly correlated with the state of global economy. If the economic backdrop remains strong in 2020, demand from the transport industry will remain robust, accelerating any shortages in the middle distillate market (as bunkers will compete for middle distillates with other modes of transport).

By contrast, with weaker than expected economic growth and potential escalation in trade tensions, demand would ease, limiting the upward pressure on prices stemming from the new regulation. Given current market economic indicators, it is widely believed that the global economy may have passed its peak in this economic cycle.”

Re-quote:

“By contrast, with weaker than expected economic growth ”

“demand would ease, limiting the upward pressure on prices stemming from the new regulation. ”

Another interesting article was released on November 14 2019 titled : IMO 2020 is coming(in International Shipping News) .

I would like to quote a small part which I believe to be significant .

“Distillate demand remained buoyant in PADD 1 for 2019 versus previous years. Our Supply Side Prime Normalized data – where daily rack activity is adjusted via EIA Prime Suppliers to reflect full rack market coverage – showed monthly demand up 1.7 percent and 2.4 percent for September and October, respectively, vs. EIA Prime Suppliers in 2017. Elsewhere in the US, fall distillate demand contracted in PADD 2 amid a weaker crop harvest season. PADD 3 experienced changes in demand due to declining rig counts and demand for diesel to transport drilling equipment, materials, and produced crude. As a result, total US diesel demand for October was 3.6 percent below 2017 levels, according to our Supply Side data.”

Re-quote:

” As a result, total US diesel demand for October was 3.6 percent below 2017 levels, according to our Supply Side data.”

Here is another article on the diesel demand subject :

Nov 16, 2019, New Delhi

Quote:

“Diesel demand falls 7.4% in October partly due to economic slowdown

Accounting for a share of 40% of the country’s total oil requirement, demand for diesel has reported to plunge 7.4% in October from a year ago which is the biggest monthly fall in three years. Economic slump, extended monsoon, auto sector slowdown… ”

Another interesting article titled : “Flood of Oil Is Coming, Complicating Efforts to Fight Global Warming”

In conclusion:

The economy is indeed contracting as the Cass freight index report clearly demonstrates and has been demonstrating .

In my humble opinion ……………….

…

Noble1

Check this out :

” Shell Traders Post $1 Billion Profit in Fuel Oil Market ”

Quote:

“Royal Dutch Shell Plc has made $1 billion from trading fuel oil this year, making it one of the standout winners from rules designed to make the shipping industry greener.

Shell said last month that it made substantial money in fuel-oil trading in the third quarter, but the company didn’t disclose the size of the profits. Shell traders celebrated hitting the $1 billion mark so far, likely the biggest by any one company in fuel oil this year, by ringing a bell on the company’s trading floor in London earlier this month, people familiar with the matter said.”

Quote:

“Although better known for its oil fields, refineries and pump stations, Shell runs an in-house trading business that’s larger than the better-known independent oil traders like Vitol Group, Glencore Plc and Trafigura Group, handling 13 million barrels of oil equivalent per day. The company describes itself as “one of the largest and most experienced energy merchants in the world” with major trading floors in Houston, London, Dubai, Rotterdam and Singapore.”

Quote:

“It’s unclear exactly how Shell’s traders made their profit, but premiums for fuel that’s lower in sulfur have surged this year, potentially benefiting those companies that produce more of the product. Shell’s refining system is a relatively sophisticated one, something that could put the company in a better position as the regulations enter into force. The margin to produce high-sulfur fuel oil in Europe recently slumped to a more than 10-year low, according to the International Energy Agency.”

You should read the article , LOL !

In my humble opinion ……………

Noble1

….

Quote:

” There were predictions that the market might be shooting up by now. It hasn’t happened and it might not. ”

For the record , my prediction per my comments on Freightwaves based on technical and seasonal patterns & cycles was quite the contrary and it has materialized . Most of the time it’s best to cut out the media mumbo jumbo noise . The patterns were clear and panned out .

In technical parlance : NY Harbor ULSD Crack Spread began widening with “a thrust out of an ED” at the end of a 5 wave affair in August 2019 , and then reversed and tightened once typical targets for that pattern were attained within the typical seasonal cycle(pattern) .

The recent thrust that peaked in October 2019 suggests that it’s a proregressive move(upward correction to the preceding downtrend) until proven otherwise . This opinion of mine is based on the pattern that manifested between the peak in late May 2018 and the trough in August 2019 which slightly undershot the ED .

The range of the crack spread between the recent August trough and the October peak , and the range between the October peak & November low suggests a high probability that a widening bounce would occur at the recent low in November(78.6% retracement), which has recently occurred . In other words , these “moves” in price are not random . They can be forecasted & calculated practically to the penny .

It was quite entertaining to see mainstream media (including most freightwaves articles on the topic) reporting to run for the hills and that truck drivers should run to the pump , LOL !

In my humble opinion …………

…

Noble1

Quote:

” There were predictions that the market might be shooting up by now. It hasn’t happened and it might not. ”

For the record , my prediction per my comments on Freightwaves based on technical and seasonal patterns & cycles was quite the contrary and it has materialized . Most of the time it’s best to cut out the media mumbo jumbo noise . The patterns were clear and panned out .

In technical parlance : NY Harbor ULSD Crack Spread began widening with “a thrust out of an ED” at the end of a 5 wave affair in August 2019 , and then reversed and tightened once typical targets for that pattern were attained within the typical seasonal cycle(pattern) .

The recent thrust that peaked in October 2019 suggests that it’s a proregressive move(upward correction to the preceding downtrend) until proven otherwise . This opinion of mine is based on the pattern that manifested between the peak in late May 2018 and the trough in August 2019 which slightly undershot the ED .

The range of the crack spread between the recent August trough and the October peak , and the range between the October peak & November low suggests a high probability that a widening bounce would occur at the recent low in November(78.6% retracement), which has recently occurred . In other words , these “moves” in price are not random . They can be calculated practically to the penny .

It was quite entertaining to see mainstream media (including most freightwaves articles on the topic) reporting to run for the hills and that truck drivers should run to the pump , LOL !

In my humble opinion …………

John Kingston

Drop ne a line at jkingston@freightwaves.com and we can talk further.