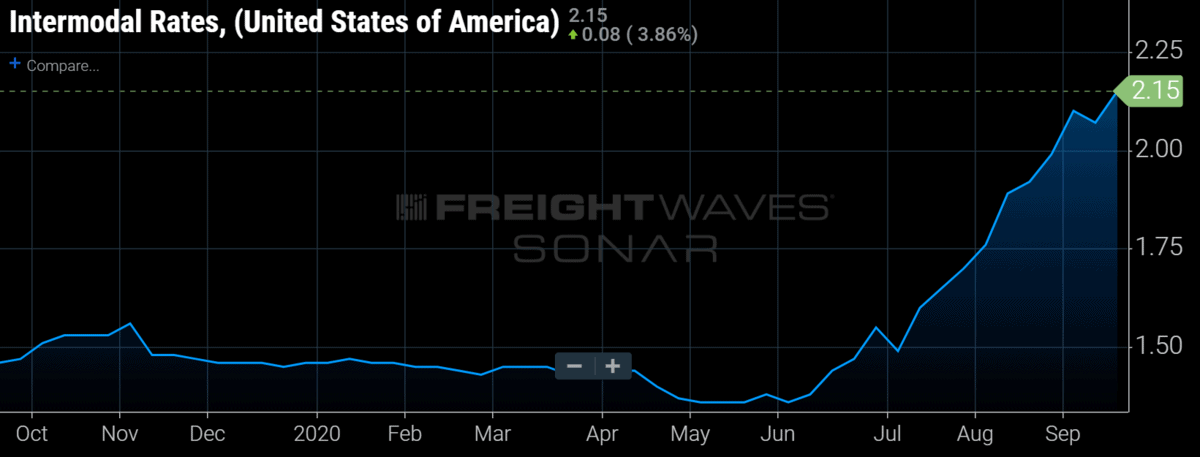

Chart of the Week: Intermodal Spot Rates – USA SONAR: INTRM.USA

The average national spot rate for intermodal shipments by rail have increased 58% since early June, or $0.79/mile. The normally rational intermodal market, a safe haven for many shippers, has succumbed to the pressure of the surging freight volumes arriving on the West Coast. What is more impressive than the absolute rate, which is the highest in five years, is the rate of increase.

It has taken only three months for the U.S. average intermodal spot rate to increase beyond the 2018 peak level, which was the previous multiyear high. It took rates over a year to increase the same amount in 2017-18, or about four times as long.

Unlike trucking, which has seen capacity tighten in every corner of the U.S., the rise in intermodal rates has largely been driven by the surging demand on the West Coast. Rates from Los Angeles to Dallas are exceeding trucking spot rates by $0.30/mile, according to Truckstop.com.

By comparison, westbound rates in lanes like Kearny, New Jersey to Chicago and Kearny to Los Angeles remain relatively suppressed, averaging slightly higher than the same period in 2019 and well under the current dry van truckload spot rate moving in a similar direction.

Mike Baudendistal, intermodal and rail market expert at FreightWaves, states, “Due to the record volume at the LA ports, there is a greater imbalance than usual, with too many containers going eastbound and not enough loaded containers going back westbound so rates are high to discourage more eastbound moves and low to encourage more westbound moves.”

Empty containers typically signal increasing demand when they are heading into a market. Empty trailers have tripled moving into the LA market since early June, an indication that carriers are expecting increasing demand or already experiencing container shortages.

Rail carriers have implemented peak season surcharges for customers operating outside of normal contracts. These surcharges are as much as $1,500 per container, which means only the most desperate shippers will utilize the service.

The fact that shippers are willing to pay more for rail than trucking is a strong indicator that the market has lost most of its rationality. Rail moves tend to take longer and involve more transitions.

Getting the container to and from the railyards involves drayage providers who specialize in short-haul moves from ports and railheads and adds to the days of service. Essentially, shippers are willing to pay more for less in this scenario, which is why you typically see about a 15% to 20% discount on rail moves versus dry van truckload.

With rail monetarily refusing freight and peak retail season around the corner, trucking rates should remain elevated throughout the fourth quarter from an annual perspective. There are still concerns over a still-high unemployment figure and unsettled stimulus packages, as well as how much early-season spending ate into holiday budgets.

Whether the consumer comes through this November, the shippers’ preparations are driving the market at the moment.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo, click here.