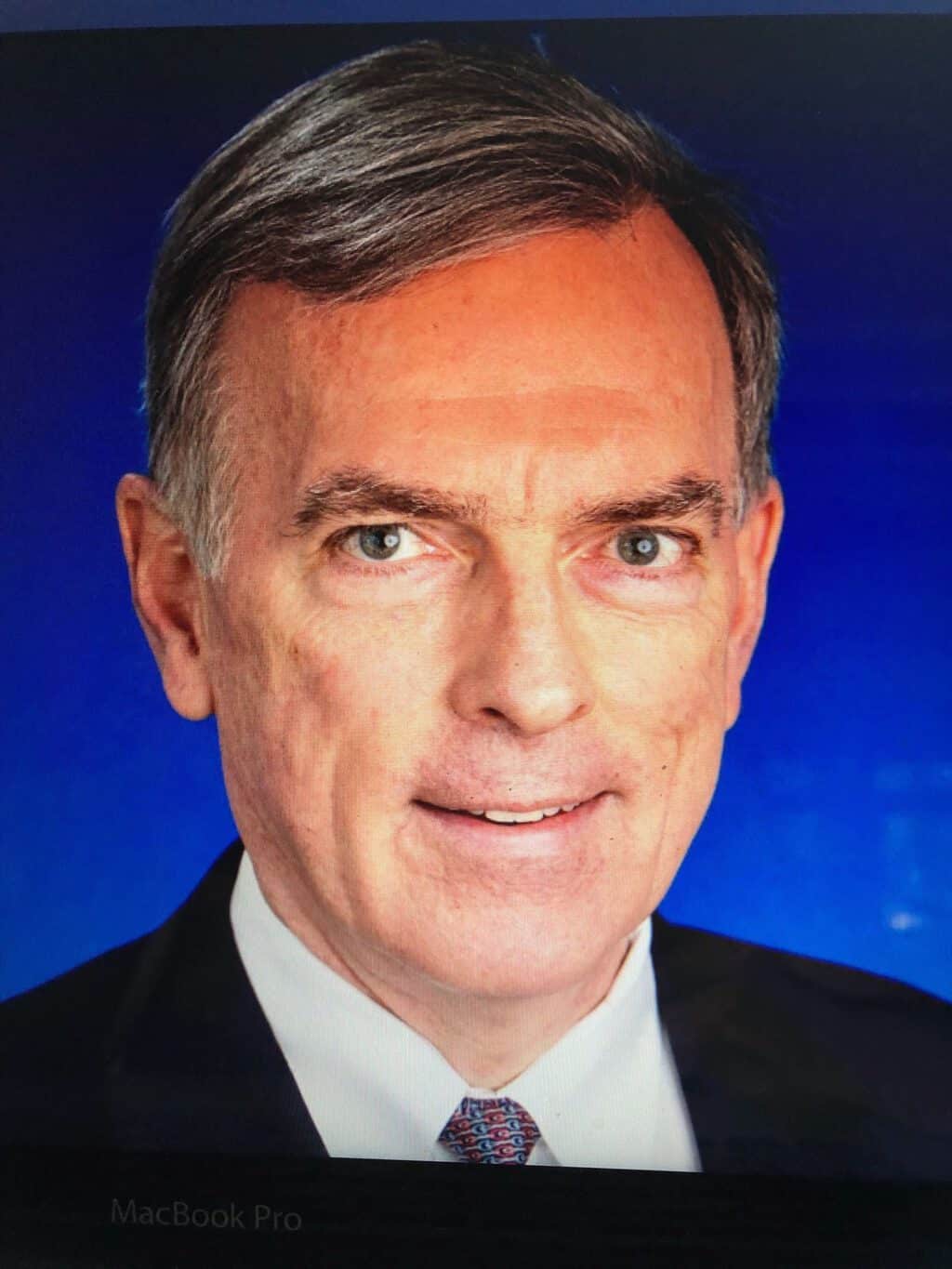

John G. Larkin, who became a transportation analyst in 1986 and has been part of the industry’s embroidery ever since, has joined Clarendon Capital, LLC, a Potomac, Maryland-based private equity firm that is one of the few, if any, firms that invest only in transportation and logistics companies.

Larkin will remain in Dallas, Texas, where he has lived since moving in 2014 from Baltimore, where he lived for more than 30 years. He was most recently an investment banker at the mid-market firm Stifel, which was formerly Legg Mason Wood Walker, which along with Alex Brown & Sons had been the cornerstones of Baltimore’s high-finance community.

Larkin, who was named operating partner at Clarendon, will help source transactions and generally work to raise the profile of the company, which has been around for 15 to 20 years.

Clarendon has only 10 employees, and it is putting the finishing touches on its first private equity fund. It looks primarily for smaller companies that, in a perfect world, have an asset-light profile, a high growth rate and are generally non-cyclical, Larkin said. Asset-intensive businesses like trucking would be a tough sell, he said. Most of Clarendon’s potential targets are companies that typically fly under the radar.

Larkin’s resume is unique in that he migrated from research to investment banking while staying in transportation and logistics throughout. Larkin’s deep knowledge of the industry imbued him with a knowledge base, not to mention a formidable rolodex, that stood him in good stead among other investment bankers.

Lifestyle change was a key factor behind Larkin’s decision, he said. The cutthroat, all-consuming world of investment banking is “not for the faint of heart,” he said. After several years of very long hours, incessant travel and weekends either away on business or working on a project, Larkin – known for his laconic humor – said he was informed by his wife, Nancy, that the status quo was “unsustainable.” The new job, while demanding, will not be anywhere near the hours or the travel involved while at Stifel, he said.

Larkin concurred with several others in saying that valuations of non-asset-based or asset-light businesses have grown quite pricey. He attributed much of that to the very low (by historical standards) cost of capital and the flood of funds into the space in recent years. Private equity investors have a lower threshold these days to meet their cost of capital requirements, but they are playing in a multi-billion dollar space that seems ripe for disruption and where investors hope to find opportunities to capitalize on digitization, industry consolidation and the e-commerce phenomenon. This, in turn, has pushed up valuations, he said.