Yesterday afternoon, FreightWaves CEO Craig Fuller, Chief Economist Ibrahiim Bayaan, and Senior Meteorologist Nick Austin conducted a monthly freight market update webinar.

Florence impacts

The conversation began with the impacts of Hurricane Florence on southeastern freight markets. “The flooding has really been the big issue: it’s closed sections of interstates and other roads. It just rained so hard for three to four days straight, you’re going to get major flooding, and the rivers are still rising. It’s been a problem getting supplies in there,” said Austin.

“It was unusual that North Carolina got a direct hit for a hurricane,” Austin continued. Austin discussed health and environmental issues, including chemicals and biohazards contaminating the water system due to flooding.

Fuller pointed out that the area of southern coastal North Carolina most impacted by flooding had a high concentration of hog production, and that lean hog futures had risen 15% in the month of September. The industry was affected in two primary ways: the drowning/destruction of the actual agricultural commodity and the flooding and breaching of hog waste lagoons.

“We’re seeing this priced into the market; people are assuming there will be a pork shortage or at least tighter supply related to what happened there,” said Fuller.

Fuller displayed SONAR data showing trucks in market in Raleigh, North Carolina. “What happens in these storms are three processes. You have the run-up including people staging relief supplies in warehouses and military bases prior to the hurricane hitting, then you have the storm itself, and then the relief project. But we’ve wondered how this actually shows up in the data,” said Fuller. Raleigh’s trucking activity dropped 30% in a two day stretch. In Atlanta, on the other hand, activity was up 12% as government officials pushed freight into the Carolinas.

Atlanta is currently the largest outbound market in the U.S., with 4.5% of all market share. We saw a significant surge in Charlotte’s outbound tender market share, and the biggest increase was right after Hurricane Florence was upgraded and the storm track became more precise.

Right as the storm hit, the Carolinas switched from a headhaul market to a backhaul market, meaning that there was much more freight going in than out, and we expect that trend to hold for four to six weeks. The Carolinas will be producing less freight as the region recovers from the storm, but consuming more.

The estimated damages from Hurricane Florence are $15-20B (to put this in perspective, 2017’s Hurricane Harvey was a much more severe disaster and caused roughly $125B in damage). Some of the economic disruption won’t be made up, like restaurant revenues, but a lot of the damage translates directly into construction activity.

Macroeconomic situation

“The key thing to remember is that we’re in a slight weaker economic environment in the third quarter than we were in the second quarter,” said Bayaan, but still projected 2.8% growth. Positives included strong business investment, expectations that inventory building will pick back up, and solid consumer spending (retail is up 6.5% YOY). On the other hand, the United States’ international trade deficit is still widening and housing activity remains weak. “Everything’s not firing on all cylinders right now,” said Bayaan, but he noted that industrial production is nearing 5% growth YOY for the third quarter, with a lot of the strength in mining and drilling sectors.

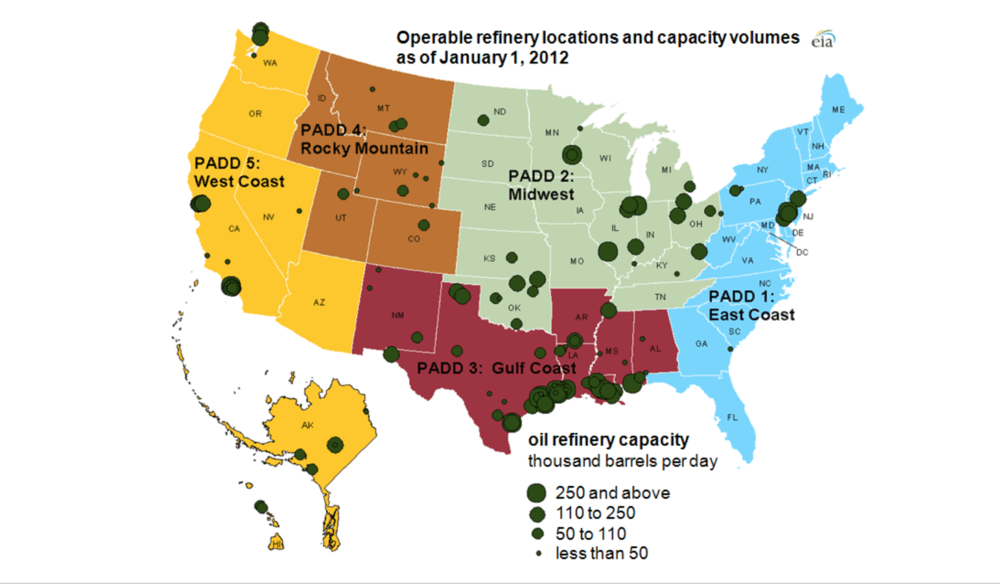

“We don’t think a lot, in the United States, about how important energy [oil, natural gas, coal] is to freight, but it’s a huge driver of freight demand. The other, of course, is agriculture,” said Fuller.

Employment data suggests that the trucking industry may be adding capacity in the long distance for-hire segment, adding 3,000 jobs in June and 2,600 jobs in July.

IMO 2020 impacts

Finally, the FreightWaves team discussed the possible impacts of the International Maritime Organization’s new fuel regulations taking effect January 1, 2020 (referred to as IMO 2020). Maritime lines will be required to use fuel containing 0.5% sulphur or less, a substantial reduction from the current limit at 3.5%. Steamship lines will have to change fuel sources—demand for bunker fuel, or heavy fuel oil, will rapidly decline—but there’s still a large degree of uncertainty as to which fuel the maritime carriers will settle on.

It comes down to the carriers’ attitudes toward scrubbing technology: if the carriers opt to install the expensive equipment to clean their ships’ emissions, they will be able to use low sulphur fuel oil (LSFO), but if they shy away from the high upfront and maintenance costs of the scrubbers, they will be forced to buy marine diesel. Marine diesel competes with ultra low sulphur diesel for refining capacity, so if the maritime industry does not embrace scrubbers, the trucking industry could see extraordinary volatility in fuel prices.

“It is showing up a little in the price of diesel, if you look at the forward curves,” said Fuller. “By a couple of pennies, in some markets, as much as 20 cts per gallon, but we’re not seeing a draconian impact that some people were concerned about. You’ll certainly see some of the companies like Maersk implement fuel surcharges on international container freight.” Fuller said that the speculation about the IMO 2020 impact reminded me him what ELDs did to trucking—the short term was worse than expected but eventually it will edge out.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.