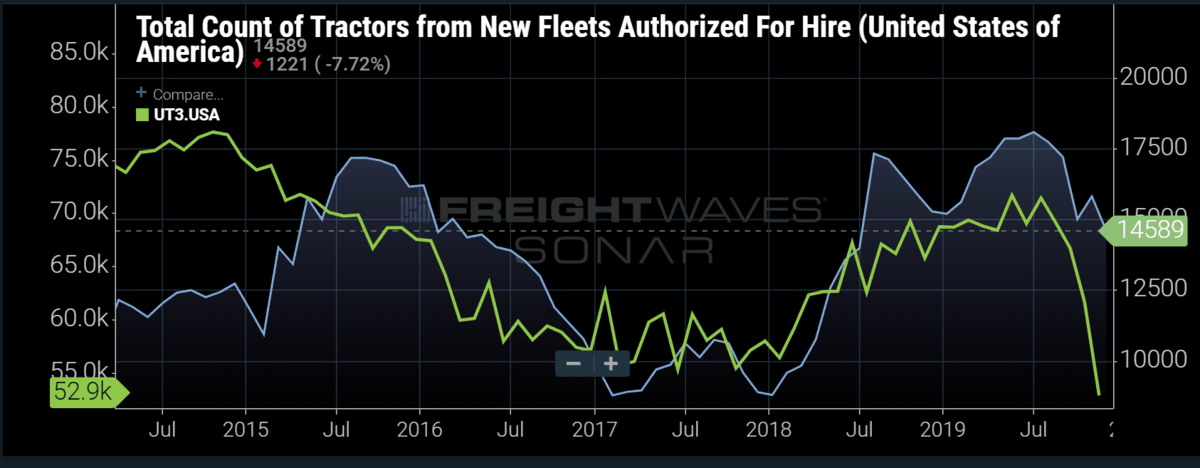

Chart of the Week: Total Count of Tractors from New Fleets Authorized for Hire, Used Truck Prices – 3 Year Old SONAR: TCFHN.USA, UT3.USA

Smaller fleets and new carrier growth have stalled according to the Federal Motor Carrier Association (FMCSA) data counting the number of tractors assigned to new for-hire fleets. Tractor count growth from new fleets started falling from a multi-year high of 9,559 trucks in July 2019 to 7,876 in November 2019. Used truck prices for class 8 trucks supports this by plummeting by almost $20K over the past six months.

Used truck prices are a good barometer for new and smaller fleet growth due to the fact many of the 500+ truck carriers have a large enough credit line to purchase new equipment and maintain a lower average aged fleet. New operators and smaller fleets that have not established a strong line of credit or have ample cash typically purchase older equipment, which is dramatically discounted off the initial sticker price.

A new Freightliner Cascadia — a common fleet truck — typically runs $150K+, while the average used truck price for a 3-year old truck over the last year runs around $63K. From July through November, the average price of a 3-year old used truck has fallen from $71,400 to $52,860 — an indication that demand has dropped quickly for used trucks.

Trucking is an extremely saturated market, with numerous players competing for limited freight. Over 93% of the fleets registered for operation in the U.S. have less than 20 trucks. The fleet count is important because each fleet represents a unit of competition, whereas tractor counts are an indication of overall capacity. Trucks within the same fleet do not compete with each other on price. When new operators enter the market, that means there is more competition, which puts downward pressure on shipping rates.

The overarching story-line for the freight market in 2019 was how far removed it was from the previous year. Soaring spot market rates in 2017-18 pulled contracted rates through the typical 0-4% annual increase threshold as carriers feasted on the opportunity to make more than pennies on the dollar for every transaction. Many operators took this opportunity to expand their fleets or start their own venture as owner-operators.

The trucking industry is notorious for having low margins. The average dry van carrier in the Truckload Carrier’s Association (TCA) profitability program averaged a 98% operating ratio in the 4th quarter, meaning for every $100 they made they spent $98 to operate or made $2 in margin to spend on either debt or reinvest in the company. When there is a rapid expansion in rates, such as in 2018, cash flows expand, and supply rises to meet demand.

Low barriers to entry in the trucking sector make it relatively easy for a driver to buy equipment and start hauling freight, unlike many other industries that require significant investment to enter the space.

Looking into 2020, the hangover from a soft 2019 will have the reverse effect of a strong 2018 as supply will inevitably fall to meet demand. Increasing costs outside of equipment, such as insurance and maintenance, and lower margins will make it more difficult for independent operators to enter the market.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real-time. Each week a Market Expert will post a chart, along with commentary live on the front-page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo click here.