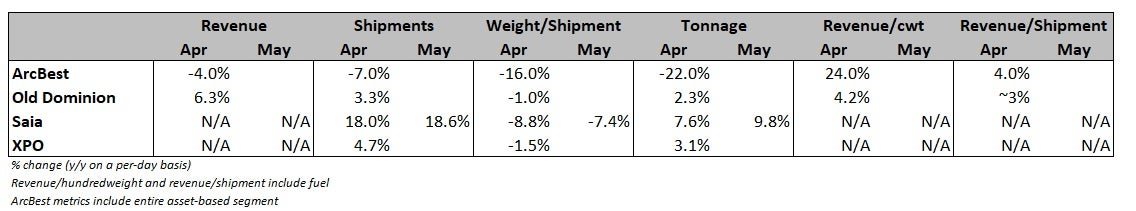

Less-than-truckload carrier Saia saw an acceleration in daily shipment counts through the first two months of the second quarter. After the company logged a 15.7% year-over-year (y/y) increase in shipments during the first quarter, a Tuesday midquarter report showed the carrier’s shipments finished April 18% higher y/y and were up 18.6% y/y in May.

Saia (NASDAQ: SAIA) and other national LTL carriers continue to benefit from the freight left behind following Yellow Corp.’s (OTC: YELLQ) shutdown last summer.

Saia’s weight per shipment was down 8.8% y/y in April and 7.4% in May. That, combined with the changes in shipment counts, produced tonnage increases of 7.6% and 9.8%, respectively, for the first two months of the second quarter.

Yellow’s shipment weights were approximately 300 to 400 pounds lighter than those of peers in the quarters leading up to its demise.

Saia’s two-year stacked tonnage comparisons accelerated in April and May as well, up 6.5% and 7.8%, respectively, after averaging a 1% monthly increase in the first quarter.

Of note, the industry didn’t get the normal seasonal demand uptick it usually does in March. Management also said on its first-quarter call that the timing of Good Friday, which fell in March this year versus April last year, likely positively skewed the April metrics by 1 to 2 percentage points.

The company previously forecast second-quarter revenue would increase by a mid-single-digit percentage sequentially from the first quarter, which implies a roughly 15% y/y increase. That appears achievable as tonnage is up nearly 9% y/y so far in the quarter (11% higher sequentially), requiring only a roughly 6% y/y increase in yield to bridge the gap. It booked a 7.6% y/y increase in revenue per hundredweight, or yield, in the first quarter (10.5% higher excluding fuel surcharges) with contractual increases averaging 9.2% in the period.

Saia doesn’t provide revenue-based metrics in its midquarter updates.

The company is using terminals acquired from Yellow to accommodate the increase in throughput throughout its network. It acquired 28 terminals, including 11 leased sites, from Yellow. It will open 15 to 20 new terminals this year and relocate other sites into bigger or better locations. Its $550 million 2024 real estate budget is expected to increase door count by 12% to 14%.

Shares of SAIA were up 13.6% at 9:35 a.m. EDT on Tuesday compared to the S&P 500, which was down 0.4%. Shares of other LTL carriers were up by mid-single-digit percentages on the news, clawing back a small fraction of the selloff that was prompted by weak first-quarter reports.