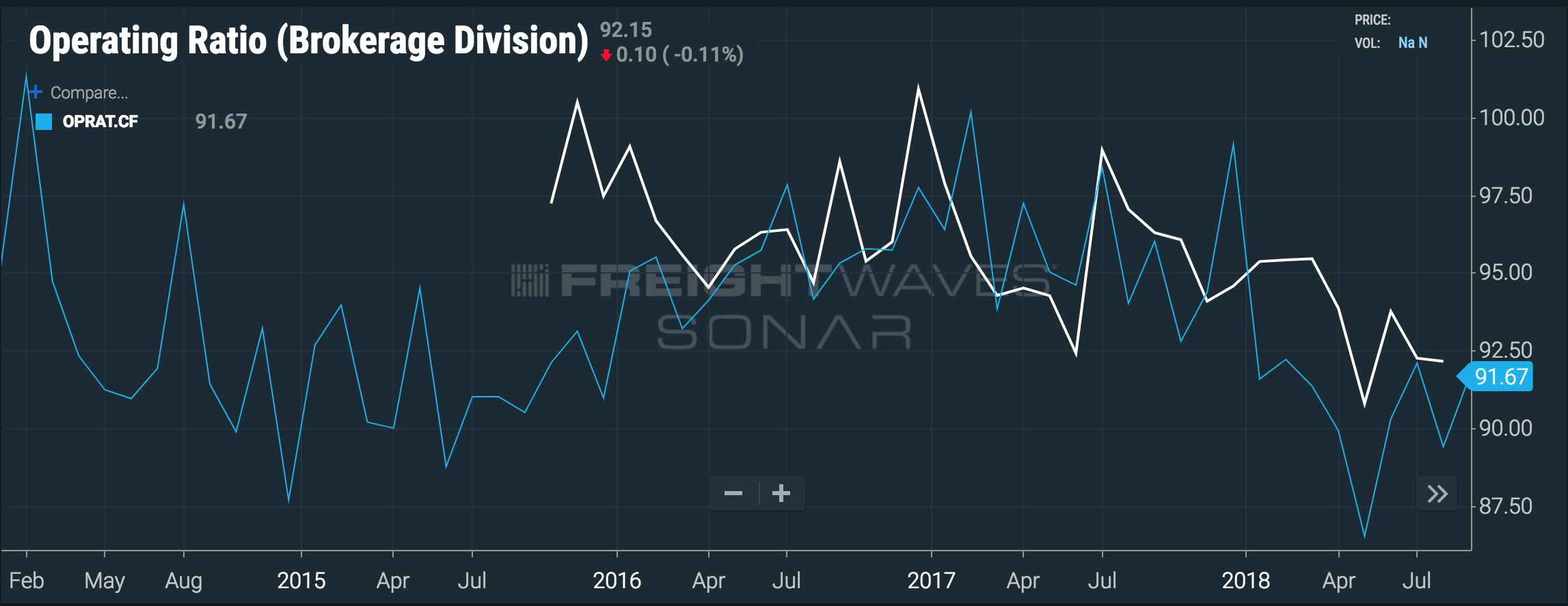

(CHART: DATA FROM TRUCKLOAD CARRIERS ASSOCIATION INSIDE FREIGHTWAVES’ SONAR)

Roughly 65% of Truckload Carrier Association member fleets have structured brokerage operations, estimates Chris Henry, program manager of the TCA Truckload Profitability Program (TPP), but very few companies have insight into how their asset-light division stack up against their peers.

The TCA is issuing a call to its members with brokerage operations to participate in a new brokerage Best Practice Group, where companies can provide anonymized data and benchmark their brokerages’ performance against industry peers. Further, through quarterly virtual meetings and one annual group meeting (which coincides with TCA Annual Convention), members will be able to share best practices and network with like-minded brokerage execs.

On the data side, TPP is aggregating data, which drives 39 (and growing) KPIs uniquely suited to brokerages, including total load counts, positive and negative margin moves, benefit expenses as percentage of margin, total margin per load, total loads per employee per day, new carrier counts, tender lead time, and agent sales cost per load.

“Our existing Best Practice Group members (all asset-based carriers), have established a mandate for TPP to enhance the profitability and operational efficiency for all facets of their diverse businesses,” Chris Henry said. “Brokerage revenue among TPP members as a percentage of overall company revenue has grown in every quarter over the past 24 months. Developing Brokerage groups is a natural extension of successful Best Practice Groups to ensure optimal margins are achieved, while limiting overall business risk.”

Approximately a decade ago, truckload carriers began setting up asset-light businesses to ensure they could provide their shipper customers the highest service levels—the idea was that if the carrier didn’t have an available truck, it would be willing to go out and hire one in order to keep the shipper’s volume. Since then, the role of the asset-based brokerage has evolved into a kind of spot market hedge: in a softening market when rates plummet and the carrier’s operating ratio soars, the brokerage side can find cheap capacity and improve its margins.

In the past few years, the role of the asset-based brokerage started undergoing a new wave of evolution. Economic, regulatory, and demographic factors have made it very difficult to recruit and retain professional truck drivers, and fleets have had a hard time growing their truckload businesses organically. At the same time, strong economic growth, tighter supply chains, and changing customer demands have placed a renewed emphasis on the services provided by freight brokerages and 3PLs. According to Goldman Sachs, in the past ten years the proportion of all loads handled by brokers has quadrupled.

Those forces have opened up a new opportunity for truckload carriers to expand their brokerage operations beyond what’s needed to service their customers into a sales force that can make margins on spot market volatility. In recent weeks, we’ve spoken to mid-sized truckload carriers who expect their brokerage divisions to account for more than 50% of total revenue in the next year or two.

Running an asset-based brokerage well can be tricky because of the way the asset and asset-light divisions interact. The fleet may be tempted to flush undesirable or unprofitable freight through its brokerage, while at the same time expecting that the brokerage pass through its margins on well-priced loads to the asset side. For those reasons, it’s vital that the industry builds accurate, widely-sourced benchmarking metrics so that truckload carriers can verify that their brokerage operations are achieving appropriate results.