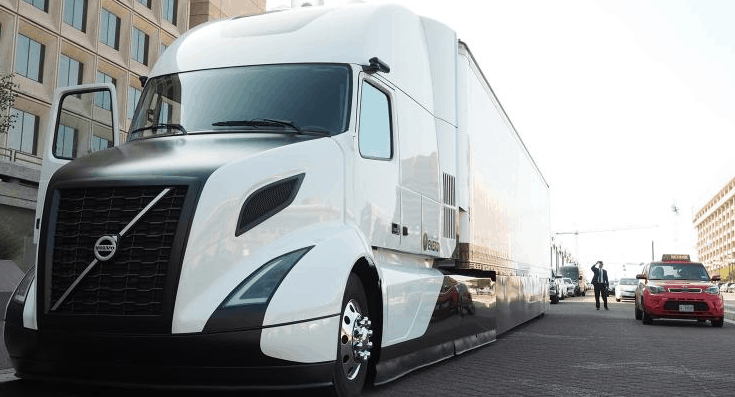

This year will see Volvo and Daimler put electric Class 8 trucks to test, as start-ups still have few commercially available models.

The busiest truck hub on the U.S. West Coast said that while major truck manufacturers and start-ups have made progress on battery-electric Class 8 trucks, the technology is still two years away at best from becoming more commercially viable for fleets.

Natural-gas powered engines have made the most progress to date in commercial viability. As for advanced diesel, fuel cell and hybrid electric technologies, those were not deemed ready now and may struggle to become so even by 2021.

The findings from a study commissioned by the Ports of Los Angeles and Long Beach impact the future spending plans of the approximately 100 drayage operators that operate roughly 12,000 trucks in the busiest North American import gateway.

The Southern California ports, which already have strict rules on trucking emissions, are working on ways to bring emissions to near zero.

The report provides a snapshot on where major truck manufacturers and start-ups stand in offering Class 8 trucks powered by batteries. So far, Volvo (Nasdaq OMX: VOLV) and Daimler (FRA: DAI) are closest to the commercial launch of battery-electric trucks by 2021.

As for the start-ups, China’s BYD (SZSE: 2594) is offering a battery-electric truck in the U.S. market. But its limited range and the company’s lack of full-scale manufacturing means its still in the early stages. As for Tesla (Nasdaq: TSLA) and Nikola Motors, they have “good potential to build and sell” battery-electric trucks, but neither has a commercially available product at this time, the report concluded.

Tesla Semi loaded up

— Tesla (@Tesla) April 1, 2019

Consulting firms Tetra Tech and GNA found that natural gas-powered trucks were the most commercially viable replacement for diesel trucks today in terms of range, drivability and maintenance.

Natural gas is hardly new, having been in use in drayage fleets since 2007. But after an initial surge of interest, the number of natural gas-fueled truck has fallen from around 8 percent of the active drayage fleet at the start of the decade to around 3 percent currently.

Natural gas-fueled trucks have played a declining a role due to the lack of horsepower in the first generation of engines. But Cummins (NYSE: CMI) introduced a more powerful natural gas engine in 2015 that can handle drayage applications.

The major truck manufacturers all offer models that can handle the latest generation of natural gas engines. Natural gas trucks, though, face the roadblock of limited refueling options in Southern California. But state incentive programs aim to foster more widespread adoption of natural gas.

Natural gas trucks are also the farthest along in the testing process, with a study of 20 drayage trucks using the Cummins engine expected to be available this year. Local drayage operator Total Transportation Services said the Cummins-powered natural gas trucks “performed very well in our operations.”

But battery-electric technology is the one with the most testing interest in southern California, with some 65 trucks being tested. This month, Daimler will be operating 20 Freightliner electric trucks, including seven Class-8 e-Cascadia model tractors for drayage.

Third-party logistics firm NFI is also beginning tests of 23 of Volvo’s battery-electric trucks starting this year in the southern California market.

As for fuel cell technology, Toyota (NYSE: TM) and the Kenworth division of Paccar (NASDAQ: PCAR) are involved in a test project in southern California. But fuel cell-powered engines, which start-up Nikola is also championing, is unlikely to achieve commercial viability “until well past 2021” barring any breakthrough in the technology.