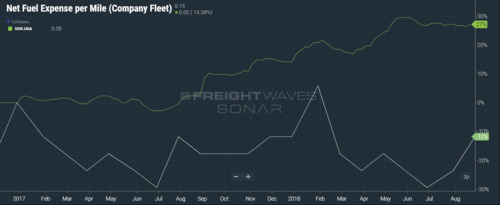

(CART: DATA FROM DEPARTMENT OF ENERGY AND TCA INGAUGE IN FREIGHTWAVES’ SONAR)

Even though the Department of Energy’s reported diesel per gallon price has risen 27% since early 2017, carriers have seen their net fuel expense per mile remain largely neutral, actually dropping 12% in that same time frame, according to TCA data inside FreightWaves’ SONAR.

Fuel surcharges are generally calculated by subtracting a base fuel cost, commonly around $1.25 per gallon, from current DOE diesel prices, then dividing by a base fuel mileage, often around 6 mpg.

Carriers have achieved this fuel neutrality thanks, in large part, to the introduction of more fuel efficient equipment to their fleets. As notoriously inefficient 2014 model trucks are cycled out and newer models are added, fleets are achieving record efficiency. This equipment comes at a cost, however, with new trucks often receiving price markups in the face of new Environmental Protection Agency regulations. For example, the addition of selective catalytic reduction technology to meet the NOx levels in 2010 added as much as $10,000 to the cost of a new truck. The EPA recently announced a new initiative aimed at reducing NOx levels again.

The North American Council of Freight Efficiency’s 2018 Annual Fleet Fuel Study found that the 20 participating fleets, including Werner Enterprises (NASDAQ: WERN) and Schneider National (NYSE: SNDR), averaged 7.28 mpg in 2017, up 2% over 2016.

The study also points to evidence that fleet performance will continue to improve significantly as carriers adopt 2018 model equipment.

“During this year’s data collection, NACFE did obtain and discuss some of the fuel efficiency results obtained by many of the fleets with respect to their 2018 model year equipment and how they operated in 2017,” the study reads. “This research concludes that these fleets are operating their latest vehicles in a range of 7.5 to 9.5 mpg. Some trucks were even found to deliver 10 mpg in certain routes, conditions and seasons.”

In addition to the fuel efficiency gained by newer equipment, the study found that the participating fleets improved efficiency by adopting fuel-saving technologies. The adoption rate for various technologies came in at 44% in 2017, up from 13% in 2003. Adopted technologies included telematics support, reefer support, liftgate support and battery HVAC support, according to the study.

“Manufacturers continue developing and improving technologies, evidenced in the pure number of technologies (85) studied in 2017,” the study reads. “They are delivering more advanced generations of existing technologies to speed up the payback and mitigate the challenges of adoption.”

Adopted technologies include both new products performing the same functions as older products and products addressing issues never considered in the past, according to the study.