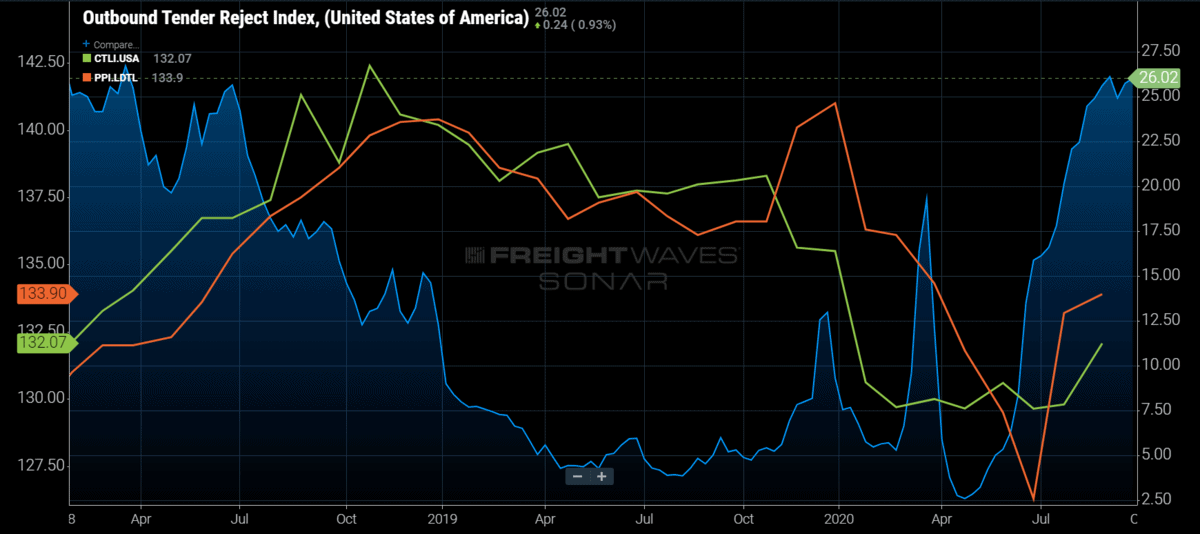

Chart of the Week: Outbound Tender Rejection Index, Cass Truckload Linehaul Index – USA, Producer Price Index – Long Distance Truckload SONAR: OTRI.USA, CTLI.USA, PPI.LDTL

One of the biggest questions surrounding transportation is how spot rates will affect next year’s contracts, as rates averaged 20% to 30% higher than 2019 over the past three months.

Tender rejection rates — the rate at which carriers reject electronically tendered load requests from shippers — have been a strong leading indicator in the past on what happens to contracted rates in the future. There are some (2020 buzzword alert) uncertainties that make forecasting the precise amount an interesting exercise.

The Cass Truckload Linehaul Index and Producer Price Index (PPI) for long-distance trucking provides us with a general idea of the movement of transportation costs associated with truckloads each month.

The Cass Linehaul Index is derived from a variety of shippers utilizing freight invoices while the PPI is a number generated from the Bureau of Labor Statistics (BLS) based on survey results outlining the cost of purchasing transportation from a producer or shipper standpoint. They are in essence measuring the same thing, which is why they move similarly.

Both Cass and the PPI increased throughout 2018 and plateaued through 2019 before falling dramatically in early 2020, while FreightWaves’ national Outbound Tender Rejection Index (OTRI) fell through the end of 2018 and did not increase for any long period of time before the past several months.

The OTRI is a daily value, whereas the other two indices are monthly indicators. This works well because they are both used for very different purposes. Cass and PPI are good indicators for contracted freight rates because they represent larger company transportation spend, which mostly moves under an annually agreed upon price and does not move for 12 months.

OTRI is a measure of carrier compliance to those rates. When carriers reject freight tendered by their customers, it is mainly for two reasons:

- They do not have a truck in the area.

- They have a better option for a truck that is in the area.

Once a carrier rejects a shipper’s request for capacity, the odds of that load falling into the spot market for a rate negotiated above their contract rates increase. This is the reason for the strong connection between OTRI and spot rates.

Since many contracts are negotiated on 12-month cycles, contracted rates do not adjust toward the market value more than once per year in general. This is the reason Cass and the PPI remained elevated through 2019 before falling in early 2020 when many new contracts were executed — they have a much higher percentage of contracted freight included in the mix.

Tender rejection rates averaged roughly 20% in 2018 and 6% in 2019, while the Cass Linehaul Index averaged 4% higher in 2019 versus 2018. The PPI, which appears to have more spot market influence than the Cass counterpart, increased 1.6% from ’18 to ’19.

Cass and the PPI for long-distance trucking fell roughly 6% and 4%, respectively, from 2019 to 2020 until increasing in July for the PPI and August for Cass. We do not have history for OTRI prior to 2018, but we can start to roughly define the relationship between OTRI increases and decreases and contracted rates.

OTRI has averaged 12% YTD but nearly 22% since July 1. Based on the past three years, which admittedly is probably not long enough of a sample, rate increases should be in the range of 4% to 6% depending on how the fourth quarter pans out.

A double-digit rate increase does not seem likely at this point looking at the data alone, but there will be a lot of questions answered in the coming months around continued stimulus, the election, and unemployment that may swing this figure in either direction.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo, click here.