Swiss freight forwarder says 2021 strategic plan should make Ceva worth more as independent company.

Ceva Logistics (SWX: CEVA) stated that it will not recommend that shareholders accept a buyout offer from CMA CGM, saying the ocean carrier’s $1.7 billion offer undervalues the Swiss logistics player by one-third.

The rejection of the tender offer is the latest twist in a three-month saga that has seen Denmark’s DSV court Ceva shareholders with a $28.19 per share offer in October 2018 that was also rejected.

That opened the door to a multi-prong deal between Ceva and CMA CGM announced in October. Along with increasing its ownership in Ceva to 33 percent, CMA CGM made a $30.48 per share offer for the remaining Ceva shares. CMA CGM also said it would sell its logistics business, CCLog, to Ceva for $105 million.

But in a review of CMA CGM’s offer, Ceva’s board of directors said it will not recommend the offer after an independent review of Ceva’s business “indicates midpoint value significantly above offered price.”

The independent review indicated a midpoint value of $40.64 per share, or $2.26 billion, for the company. Ceva Logistics shares were last trading at $30.48 per share.

In rejecting the offer, Ceva’s board said shareholders could realize higher value in the company remaining independent thanks to the strength in its underlying business and the acquisition of CMA CGM’s logistics business.

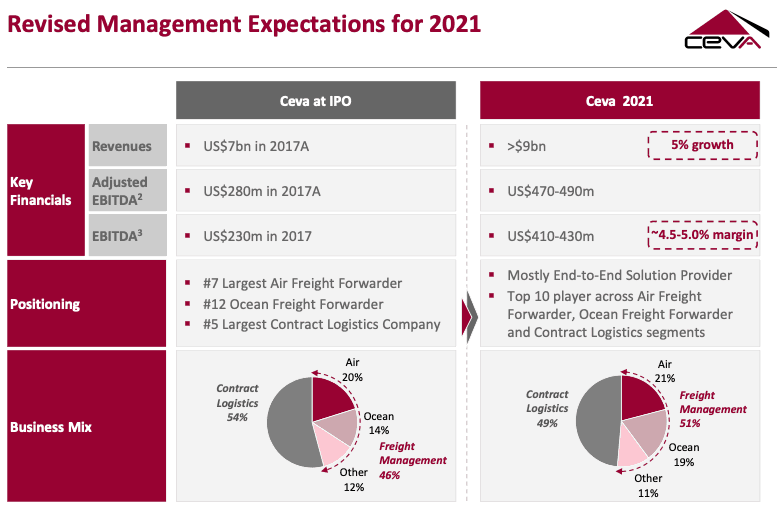

The board’s recommendation assumes Ceva is able to meet ambitious financial targets the company set out last November. Those goals include revenue of $9 billion, which would represent annual revenue growth of 5 percent between now and 2021. Ceva’s previous revenue growth target was 4 percent.

It also expects adjusted operating profit to reach $470 million to $490 million by 2021, representing 6 percent annual growth.

Ceva expects CMA CGM’s logistics business, which saw revenue of $650 million last year, to contribute $50 million to the increased operating profit, with $30 million stemming from cost-cutting and joint procurement of services.

CMA CGM logistics’ operating subsidiaries that were purchased by Ceva include California-based USL Cargo Services, which leases and operates warehouse space across North America and China, and LCL Logistix, one of the top freight consolidators in India.

The execution of that plan would make Ceva an “end-to-end” solution provider in the logistics industry and pushes Ceva into a top 10 player across air, ocean and contract logistics markets.

Currently, Ceva is the seventh-largest forwarder in air freight and the twelfth-largest in ocean freight.

In a statement, Ceva’s chairman Rolf Watter says the board “fully trusts Ceva’s management team in its capability to successfully execute the plan.”

He added, “For those reasons, management and the Board will not tender the shares and do not recommend shareholders to tender either.”

Yet with the acquisition of the CCLog business, Ceva will remain closely aligned with CMA CGM in terms of customers and cross-selling of services. Ceva said it plans to target up to 700 accounts for joint marketing of services with CMA CGM.

Those services include additional ocean freight services between Mexico and the U.S., expedited ocean service in the trans-Pacific market, rail and truck services between China and Europe and an increased presence in the refrigerated freight trade from Latin America.