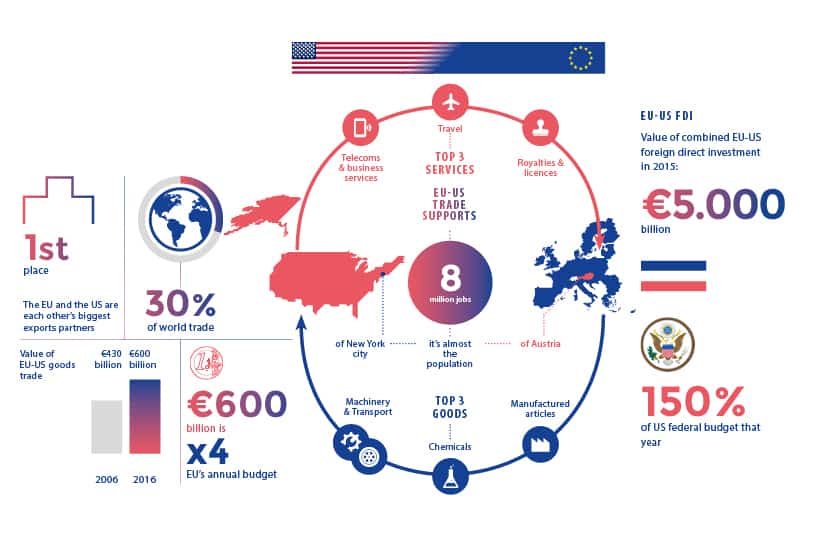

On April 9, President Trump and the U.S. Trade Representative’s Office (USTR) announced plans to implement $11 billion in tariffs on the European Union (EU). The aim is to force the resolution of a 14-year dispute before the World Trade Organization (WTO) concerning subsidies the U.S. claims the EU provided Airbus when it launched the A380 and A350XWB aircraft. The $11 billion figure represents the calculation the U.S. has made for lost sales by U.S. manufacturers such as Boeing due to Airbus subsidies by EU members.

The proposed U.S. tariffs adds a second major front to the U.S.-Europe trade discussions. U.S. imports of European automobiles is the focus of the other possible action, and awaits a Trump Administration decision on a U.S. Department of Commerce recommendation from February 2019.

In the most recent action, the USTR identified 317 tariff line items valued at $21 billion for potential tariffs of up to 100 percent ad valorem, nine of which are aircraft- and parts-related to be applied specifically against France, Germany, Spain and the U.K. The balance of the line items are spread across and expected to touch many major European industries. In the end, what ends up on the final $11 billion list and what the final tariff level will be are still to be determined, dependent on public input that is due in May, and whatever further back-and-forth negotiations occur between the U.S. and the EU.

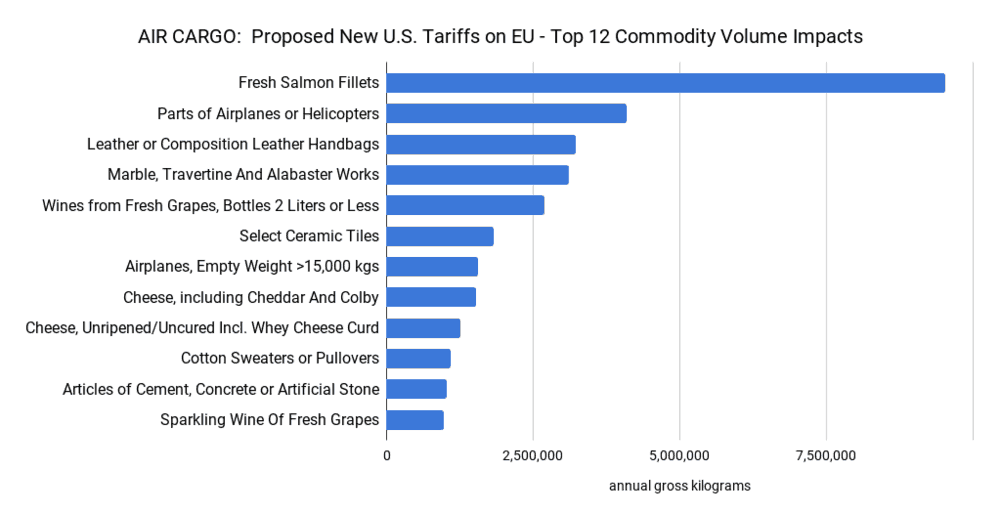

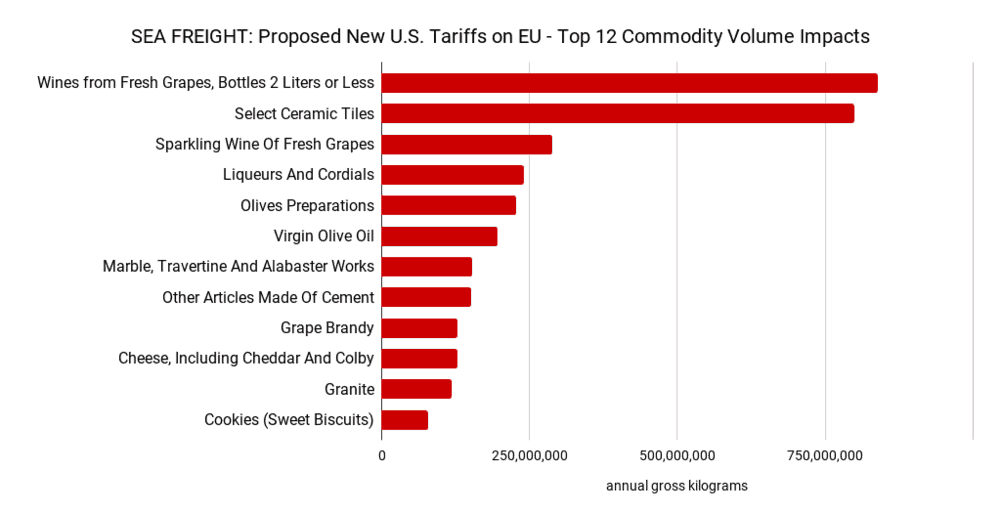

FreightWaves analyzed the initial list of 317 tariff candidates from an air and ocean cargo standpoint to determine the top commodities potentially impacted by tonnage for both modes.

Using 2018 air cargo figures, FreightWaves found nearly 50 million kilos of Europe-U.S. air cargo at risk, approximately 3.1 percent of the total trade between the regions. There were 28 line items with 300 metric tons of air cargo or more in 2018. The top 12 air commodities from a tonnage standpoint are shown above. For ease of use, FreightWaves simplified the descriptions from the full tariff reporting name. While part of the impact is clearly targeted at Europe’s aviation industry in the four countries that own stakes in Airbus, the proposed tariff actions that potentially impact air cargo are far broader and touch many different well-known European export industries selling seafood, foodstuffs, wines and fashion goods to U.S. buyers.

For sea freight, FreightWaves calculates the commodities at risk add up to 4.1 million metric tons, or 3.2 percent of the Europe-U.S. sea freight tonnage total in 2018. Wines, ceramic tiles and champagne comprise the lion’s share of this amount, representing 46 percent of the 4.1 million tons, with liqueurs, olive oil and other olive products comprising the next tier impacted. There are 35 potentially impacted line items with 5 million or more kilos each of ocean tonnage on the list.

For air and ocean carriers that are looking for any kind of increase in the slow-growing trans-Atlantic market, any further threats to existing tonnage and trade lanes are a concern.

For some of the larger items, the proposed tariffs do not affect all of the imported commodities, rather just enough to be noticed and have a noteworthy impact on the industry. For example, according to the U.S. Census Bureau, there are 10 different 6-digit tariff codes for salmon products the U.S. imports from Europe. However the proposed tariffs impact just two of the 10 items, worth a significant 34 percent of the value of all salmon products. But in other cases such as grape and grape-related products (wines, champagnes) and olives and olive-related products (olive oil and preparations), the proposed tariff line items cover a very large spectrum of what is exported to the U.S.

The message is clearly targeted well beyond the Airbus stakeholder group, touching products produced in both Airbus-shareholder countries and non-Airbus shareholder countries to raise the stakes and the urgency further.

According to Bloomberg, the EU’s initial response last week to the $11 billion threat from the U.S. was that the dollar amounts were “greatly exaggerated” and counter-tariffs against the U.S. were being prepared. On April 15, the EU referenced the more positive language from a July 2018 meeting and agreement between President Trump and President Juncker of the EU in which automobiles and cutting tariffs on industrial products were the focus. The EU indicated its readiness to enter into formal talks regarding eliminating tariffs on industrial goods and a conformity agreement “to make it easier for companies to prove their products meet technical requirements on both sides of the Atlantic.” The EU statement indicated there was an opportunity to slash tariffs and potentially generate another 26-27 billion Euros ($29.3-$30.5 billion) – or 8 to 9 percent – in exports by each side to the other by 2033.

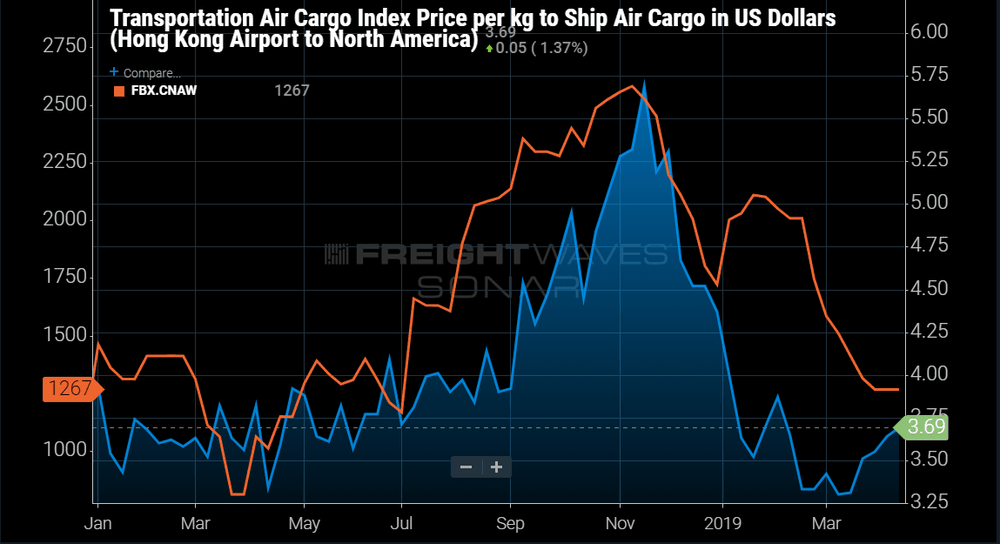

As these various negotiations play out, FreightWaves will continue to closely monitor them and FreightWaves SONAR indices covering Europe-U.S. trade. As observed in the 2018-19 tariff threats in the U.S.-China talks, the advance inventory stocking by U.S. buyers of Chinese goods by both sea and air freight in advance of any proposed tariff implementation dates had significant pricing, capacity and logistics impacts not only out of greater China, but within the U.S. trucking industry as well. The SONAR chart below (AIRUSD.HKGNOA, FBX.CNAW) displays these large increases in air cargo and ocean container rates during the third and fourth quarters of 2018, using the TAC Index for air cargo rates in U.S. dollars per kilogram and the Baltic Index for sea freight in U.S. dollars per 40-foot dry container. Will the same happen from Europe, distorting traffic flows and tightening up space and pricing? While the overall $11 billion scale of proposed U.S. tariffs is much less than the proposed tariffs aimed at China, traders learned what they needed to do to watch out for bottom lines with threats of higher tariffs out there. FreightWaves will keep a close eye on the same metrics from Europe.