PHOTO COURTESY OF CANADIAN NATIONAL RAILWAY

Canadian National Railway Company (NYSE: CNI) reported adjusted earnings per share (EPS) of C$1.17 (a Canadian dollar is currently valued at $0.74) per share for the first quarter 2019, 17 percent better than the same period a year ago. This result excludes $0.09 per share in increased depreciation and amortization expense related to its positive train control system.

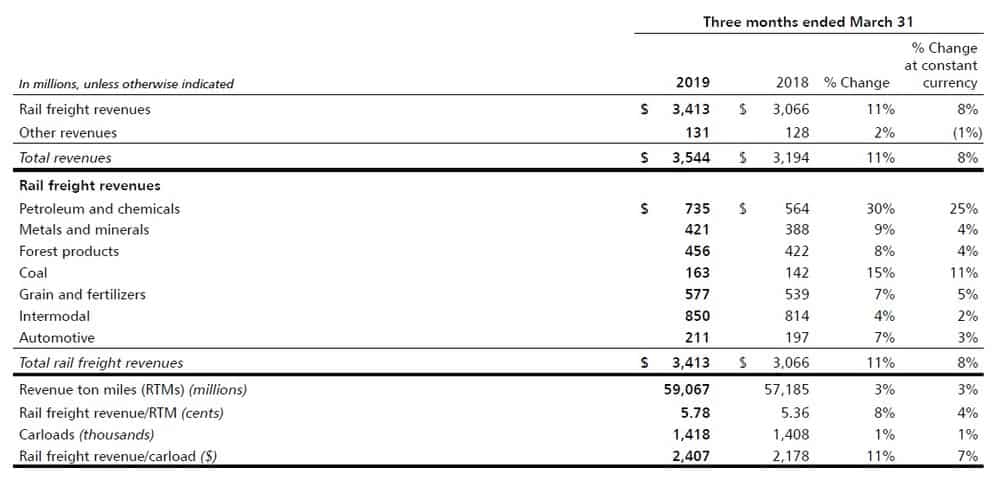

CN reported an 11 percent year-over-year increase in total revenue to C$3.544 billion as the company experienced a 1 percent increase in carloads and an 11 percent increase in revenue per carload.

From the earnings press release, “The increase in revenues was mainly attributable to the positive translation impact of a weaker Canadian dollar, freight rate increases, higher volumes of petroleum crude, refined petroleum products, coal and Canadian grain, and higher applicable fuel surcharge rates, partly offset by lower volumes of frac sand.”

The company reiterated its full-year 2019 EPS guidance calling for EPS growth in the low double-digit range this year compared to adjusted diluted EPS of C$5.50 in 2018. Further, CN’s guidance for high-single digit volume growth in 2019 in terms of revenue ton miles remains in place.

Management held a conference call to discuss these results with analysts. Much of the call focused on questions directed at revenue growth drivers for the company and how they would achieve high-single digit volume growth in 2019, specifically in regards to crude oil movements by rail.

The company said that the recent softness in crude shipments, since the December 2018 peak, was due to mandated production curtailments and the narrow spread between Western Canada Select and Maya West Texas Intermediate. Management said that once the spread reaches $15 U.S., volumes will increase more meaningfully. (Currently the spread is in the $10 to $12 range.)

CN said that it has the capacity to ramp to 300,000 barrels per day in crude movements, but only needs roughly half of that capacity currently. The company feels confident that it will be able to quickly re-deploy crew and assets when crude demand returns and noted that it has “some good contracts” that begin in July. Most importantly, management said that high-single digit volume growth can be achieved without a ramp in crude movements.

The 1 percent increase in total carloads was led by a 10 percent year-over-year increase in petroleum and chemicals. This carload growth was partially offset by declines in forest products (down 4 percent) and metals and minerals (down 3 percent). The biggest commodity type for CN by units is intermodal carloads, which were flat year-over-year at 624,000.

CN KEY PERFORMANCE INDICATORS

CN KEY PERFORMANCE INDICATORS

Rail freight revenue increased 11 percent year-over-year. The largest revenue generator for CN is intermodal carloads which saw a 4 percent increase in revenue/carload to C$1,362. The second-largest revenue producer, petroleum and chemicals, saw revenue per carload increase 19 percent to C$4,375.

Adjusted operating income increased 13 percent year-over-year to C$1.164 billion, which resulted in a 67.2 percent operating ratio, 60 basis points better than the first quarter of 2018. Operating expenses increased 14 percent. Management called out several expense lines like costs related to its Positive Train Control back office system, increased headcount mostly due to its recent acquisition of TransX (an intermodal and refrigerated trucking company) and increased costs from severe winter weather as headwinds in the quarter.

Extreme weather conditions resulted in a seven-week period in which Tier 3 or Tier 4 restrictions (Tier 3 restrictions are implemented when temperatures are below 35 degrees Celsius) were in place for nearly half of those operating days and train lengths were required to be reduced by half. Not surprisingly, train productivity (down 4 percent) and locomotive utilization (down 7 percent) were worse year-over-year.

CN STOCK PRICE CHART – SEEKING ALPHA

CN STOCK PRICE CHART – SEEKING ALPHA