The June freight surge happened, but the volumes were not as large as freight brokers expected and capacity remained manageable.

National freight volumes (OTVI.USA) are in a healthy place – the highest they’ve been since last summer – but still down about 6 percent compared to this period in 2018, which had a more pronounced volume peak. Spot rates climbed this month out of Los Angeles and Atlanta, but are starting to soften as capacity returns to the market following Road Check week.

“In the reefer world, this week Georgia is getting cheaper – we’re definitely seeing rates come back to earth out of Georgia,” said Michael Feig, chief operating officer at White Plains, New York-based Capital Logistics. “Arizona is not as tight as it was; we’re able to source equipment at more reasonable rates.”

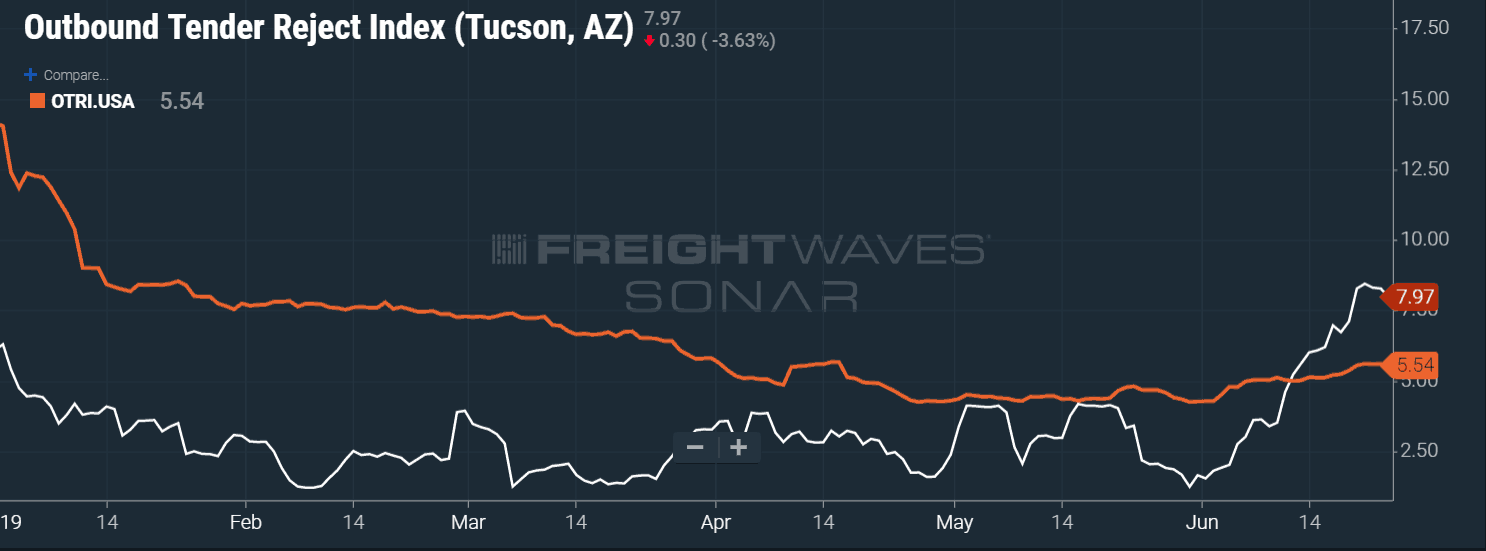

Still, Arizona is one of the few places where Capital is getting substantial secondary work, or loads that have been rejected by the primary carrier. Reefer tender rejections out of Tucson (RTRI.TUS) are higher than the national average (OTRI.USA):

Some markets are still recovering from Road Check week. Freight brokerages with high volumes of contracted freight had a choice to make – honor their commitments to their shipper customers or reject the freight in fear of a market for trucking capacity that was suddenly surging upward after spending months in the doldrums.

FreightWaves spoke to representatives of several brokerages who committed to moving their customers’ freight despite steep losses. The executives, some off the record, said that in some cases they felt they had no choice but to move the loads because they expected the market to return to a baseline of loose capacity in the weeks following, and they couldn’t afford to lose their customers.

A Chicago-based broker described his shop’s negative margins during Road Check week as “obscene.” Another brokerage CEO said, “We took a blow to the stomach financially.”

One theory heard from the executives during the channel checks was that cash-strapped carriers, suffering through an oversupplied market and struggling to make ends meet on spot rates that are in many cases below operating costs, were more risk-averse this year during Road Check. Instead of betting that elevated spot rates would more than make up for potential fines incurred during inspections, financially stressed carriers stayed off the road and let their trucks sit.

Ironically, enforcement during this year’s Road Check was noticeably light, and many drivers reported a conspicuous absence of law enforcement officers performing on-site inspections.

“We’re still feeling some of the effects of DOT week,” said Jamie Teets, chief executive officer of Chicago-based Transportation One. “Rates have only gradually come down. We didn’t recover from the DOT week as we’ve seen in the past.”

Transportation One has found capacity a little harder to source in cross-border markets like El Paso, Laredo and McAllen, as well as Midwest states like Arkansas, Kansas and Missouri. Freight volumes in Little Rock (OTVI.LIT), Joplin (OTVI.JLN) and St. Louis (OTVI.STL) have spiked dramatically in June.

“We’re moving freight pretty steadily – I don’t want to say easily,” Teets said.

Teets agreed that contracted volumes have been a bit disappointing in June as shippers keen to save money move freight into the spot market immediately after it is rejected by the primary carrier. He said that on 28 major lanes across nine different customers, he’s seeing lower volumes than he moved in January.

Feig also said that peak season was “not as busy as we thought it would be.” Feig hasn’t seen a pre-holiday push ahead of July 4 yet, and said that large refrigerated carriers out West had more available capacity than he expected for this time of year. Teets was also unsure as to how carriers would treat the mid-week holiday.

“It could be interesting,” Teets said. Some drivers have told Transportation One they plan on taking most of the week off.

Speculation abounds in the freight brokerage industry about how fast capacity will leave the industry and whether markets will meaningfully tighten in response. If a macroeconomic downturn, or even a freight recession, causes a large drop in demand, then rates could stay down even as more and more capacity leaves.

FreightWaves tracks trucking carrier failures (EXIT.USA), which experienced a sharp rise in the first quarter of 2019. In the fourth quarter of 2018, there were 75 exits; in the first quarter of 2019, that number jumped to 225, the highest number since the third quarter of 2014. Those numbers are not bankruptcies per se, because small trucking companies sometimes do not file for bankruptcy protection when they go out of business, sometimes opting to simply shut down or liquidate their assets directly.

Instead, the EXIT index tracks write-downs by companies of bad debt owed by trucking carriers – it effectively measures the number of trucking companies that have stopped paying their bills. And that number is at a multi-year high.