Avocado supplies are expected to return to normal after a summer shortage sent prices skyrocketing in July.

Prices spiked in mid-July due to imports of avocados from Peru and Mexico tightening. In addition, the summer avocado harvest from California growers was down this season because of a heatwave in 2018, industry professionals said.

“Peru imports are dropping, exiting the market, as well as California, and it happened to coincide with what we call the early bloom in Mexico, the end of the flora loca harvest,” said Aaron Acosta, head of corporate relations at Villita Avocados in Pharr, Texas.

The company is an importer of Mexican avocados and a subsidiary of Mexican avocado exporter AgroExport Avocados LLC. Villita Avocados also grows avocados in Peru and Texas.

Acosta said avocados were around $30 per case in May, but were as high as $65 to $70 per case in July.

At the supermarket, the cost for one avocado was $2.10 nationally on July 5, compared to $1.26 in July 2018, according to data from the U.S. Department of Agriculture.

As of August 16, the national average for one Hass avocado at retail was $1.94 and various other “greenskin” avocados were selling for $1.46.

Hass avocados are the most popular and common in U.S. supermarkets and are grown predominantly in California, Mexico and Chile.

Mexico’s flora loca (often called “off-bloom”) crop is winding down and will be followed by the aventajada crop in September.

Avocados grown in Mexico bloom four times per year, from July through May. The blooms are called flora loca, aventajada, temporada and marcena.

Acosta added that “once the aventajada avocado bloom begins in September, we’ll get back to normal volumes, normal pricing,” because they expect strong volumes for the harvest.

“It will be good for everyone,” Acosta said. “We want avocados to be affordable for everyone, not a luxury item that only a few can afford.”

More than 80 percent of avocados consumed in the U.S. – over 2 billion pounds annually – are imported from Mexico, and more than 60 percent of those come in through the Pharr-Reynosa International Bridge along the border, according to data from the Texas A&M University AgriLife Extension Service.

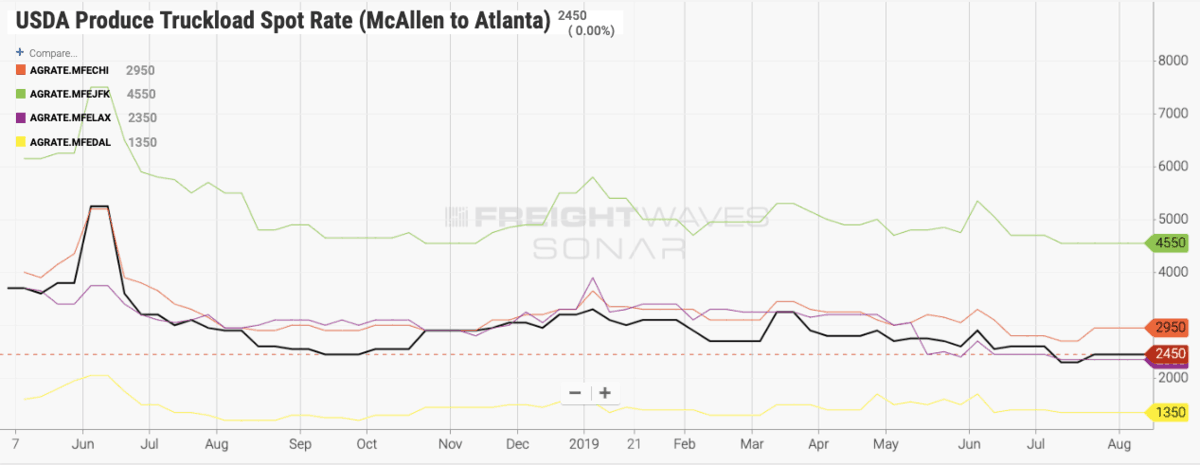

For brokers and shippers, truckload rates for produce were down in the 5 percent to 7 percent range, compared to the same week last year as a result of more capacity in the market, according to data from FreightWaves SONAR.

As of August 18, McAllen, Texas – which includes the Pharr-Reynosa market – saw a 13 percent increase in outbound load counts.

The average length of haul on the outbound side is 540 miles and mid-haul tender rejections (250-450 miles MOTRI.MFE) are higher at 15.17 percent – capacity is much tighter on loads in the radius, whereas there is more capacity/lower rates on 450-800 mile loads (TOTRI.MFE).