Container freight rates have surged over the last fortnight and shippers should expect more hikes in the coming weeks, according to one leading analyst.

After a mostly tepid October, spot freight rates on mainline Asia-Europe and trans-Pacific services spiked by 12-30% at the end of the month as lines found traction with November 1 General Rate Increases.

Last week FreightWaves asked whether carriers would be able to hold on to their gains. Early indications suggest the resounding answer is ‘yes,’ at least in the short-term.

The Freightos Baltic China/East Asia to North America West Coast 40-foot container index rose 9.5% week-on-week to reach $1,529 per 40-foot equivalent unit (FEU) on November 10.

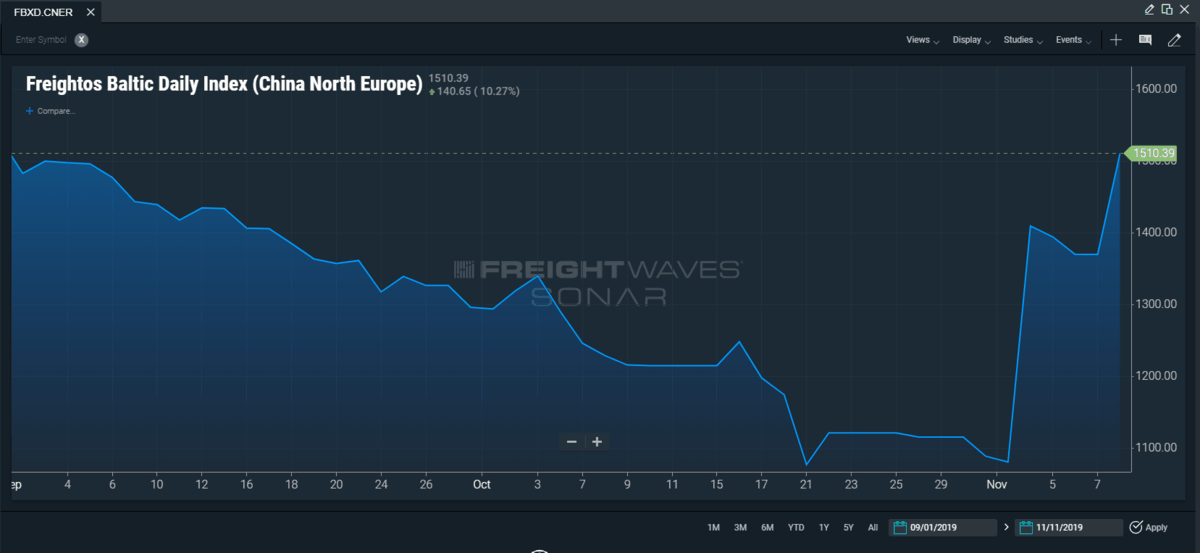

And, while rates from China/East Asia to the North America East Coast made only a marginal gain over the week, the Freightos Baltic China/East Asia to North Europe 40-foot container index also recorded a significant jump, up 4.71% week-on-week to $1,467 per FEU on November 10.

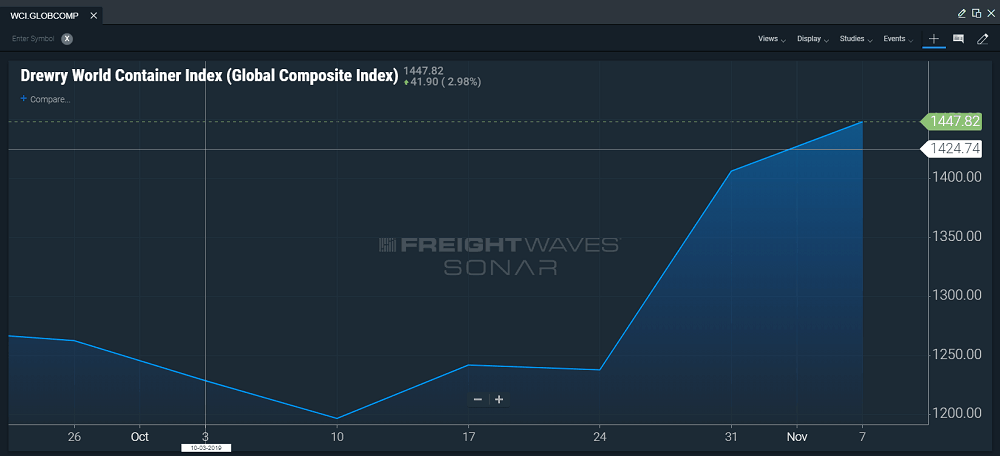

Similarly, Drewry’s World Container Index – a composite of eight major East-West trades – has risen $210 in the last two weeks, helping lines claw back the losses suffered over the prior two months.

Drewry now expects rates to further increase, arguing that capacity cuts by carriers and higher bunker surcharges as IMO 2020 low sulfur fuels are phased in will continue to fuel rate inflation on the key Asia-Europe and trans-Pacific trades.

The analyst notes that the recent rebound has had little to do with demand and everything to do with supply.

“Volumes were moribund in the third quarter peak season and judging by the continued heavy use of void sailings by carriers, that situation hasn’t changed dramatically,” Drewry noted. “Instead, it is changes on the supply side that are driving the upwards momentum.”

The current idle container fleet has surged to just over 1 million TEU, or 4.5% of the total cellular fleet, as of the first week of November.

“That represents an extra 400,000 TEU added to the inactive fleet in one month, which can be attributed to more ships being sent to dry-dock for exhaust scrubbers in readiness for the new IMO 2020 low-sulfur fuel regulations,” said Drewry.

While a bigger idle fleet does not automatically produce higher freight rates, Drewry believes that demand is now strong enough to ensure that capacity cuts translate into “more positive utilization and freight rates.”

Adding to the inflationary momentum is the fact that carriers are beginning to transition to higher new bunker surcharges related to IMO 2020.

“This process is expected to ramp up for December and should contribute to a strong end to the year for carriers, running contrary to what was seen at the end of 2018,” noted Drewry.

However, the analyst cautions that the “extraordinary” events of the last 18 months or so – most notably the U.S.-China trade war and looming IMO 2020 regulations – have rendered direct year-on-year comparisons “almost worthless,” making it difficult to accurately assess the true strength of the market by looking at freight rates alone.

“While carriers will welcome the upturn in prices, they will also be mindful that it is slightly illusionary as it required a substantial – and temporary – removal of tonnage and a costly new fuel regulation to achieve,” concluded Drewry.

“Freight rates will continue to rise on account of higher bunker surcharges, but for carriers the true measure of success will be whether or not they rise sufficiently to cover the additional costs.”

More articles by Mike