Online market Freightos will have its container freight indices overseen and distributed by the maritime industry’s primary source for market pricing information, a big step toward allowing the 8-year-old company’s freight indices to be used in financial contracts.

The Baltic Exchange said it would make available and oversee the Freightos Baltic Index, a daily composite of 40-foot container shipping rates available for 12 different trade lanes.

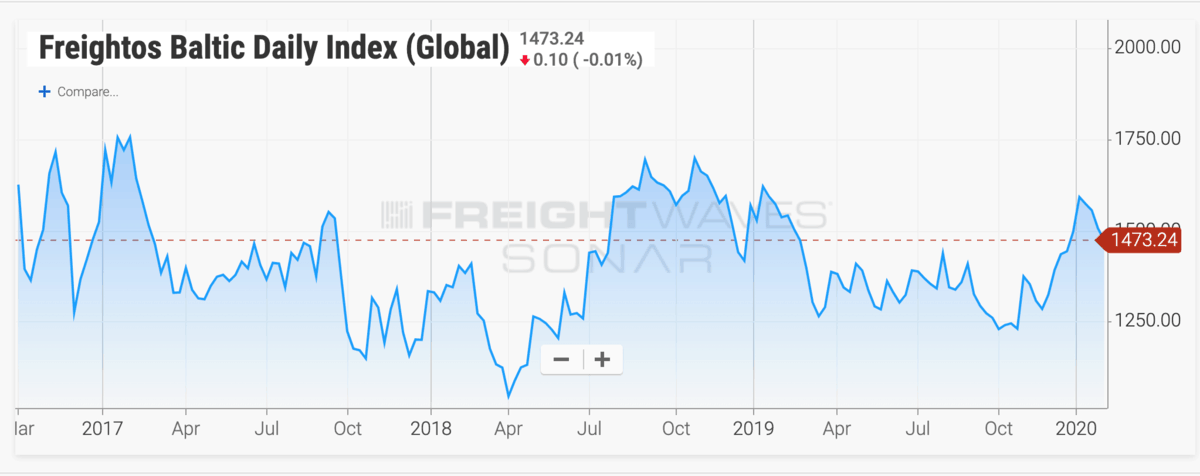

Freightos says the indices, available in SONAR under the FBXD ticker, are “rolling short term Freight All Kind (FAK) spot tariffs and related surcharges between carriers, freight forwarders and high-volume shippers.”

The prices are derived from pricing data for container slots done on Freightos’ online market, which has been live since April 2018. The index is a weighted average of its underlying regional route indices. Each individual index trade lane is represented by five to seven of the major ports of each region.

The Baltic Exchange, a 276-year-old group based in London, produces rate indices in other major maritime sectors, including dry bulk, gas and oil shipping. Its most widely known assessment is the Baltic Dry Index, a daily composite of global shipping rates for various classes of dry bulk shipping derived from shipbrokers.

The Freightos Baltic Index also complies with the guidelines issued by the International Organization of Securities Commissions (IOSCO), the Baltic Exchange said. IOSCO is a global regulatory body that oversees the methodology and legitimacy of price indices used to settle derivatives products, such as commodity futures and swaps.

In approving and overseeing the Freightos index for distribution to its members, “we have closely monitored the index’s production over the past 20 months and are confident [it] meets our strict criteria,” said Baltic Exchange Chairman Stefan Albertijn said in a news release.

Freightos CEO Zvi Schreiber, who developed the freight pricing platform out of his own frustration as a shipper dealing with opaque, non-standardized ocean pricing, said the indices is “positioned better than ever to provide a true pulse of the market in one of the world’s largest and most important industries.”

With the IOSCO compliance, the Freightos index can serve as “the foundation of index-linking and future derivatives which allow carriers, forwarders and importers/exporters to hedge their risk, as is already customary in other industries,” he added.

The container shipping industry has flirted with derivatives and hedging instruments previously but with limited uptake.

The Shanghai Shipping Exchange, a joint venture of the local government and China’s Ministry of Transport, started publishing a weekly freight rate index called the Shanghai Containerized Freight Index (SCFI) in 2005.

The SCFI became the underlying index for a derivative called the Container Freight Swap Agreement, which was launched in 2010. London shipbroker Clarksons, one of the early boosters on the swaps, forecast that traded volume for the swaps could amount to as much as 10% of the total volume of containers moved. But by 2013, Clarksons had exited the business.