Temperature-controlled warehouse operator Americold Realty Trust (NYSE: COLD) sees a healthy demand environment for cold storage continuing.

During its fourth-quarter 2019 earnings conference call, the Atlanta-based real estate investment trust’s (REIT) management team said it expects new facility development starts to be in the range of $75 million to $200 million during 2020. The company’s total project pipeline stands at $1.2 billion.

Further, management expects same-store warehouse revenue to increase 2-4% year-over-year in 2020 as there are “lots of occupancy opportunities” in their core markets, especially during peak produce seasons.

Management expects a continuation of the “strong” demand environment for temperature-controlled warehousing as consumption and population growth remain steady. Additionally, management said consumer preference continues to favor fresh and healthy food options that require cold storage.

Americold reported fourth-quarter 2019 core funds from operations (FFO) of 33 cents per share, 2 cents below analysts’ expectations.

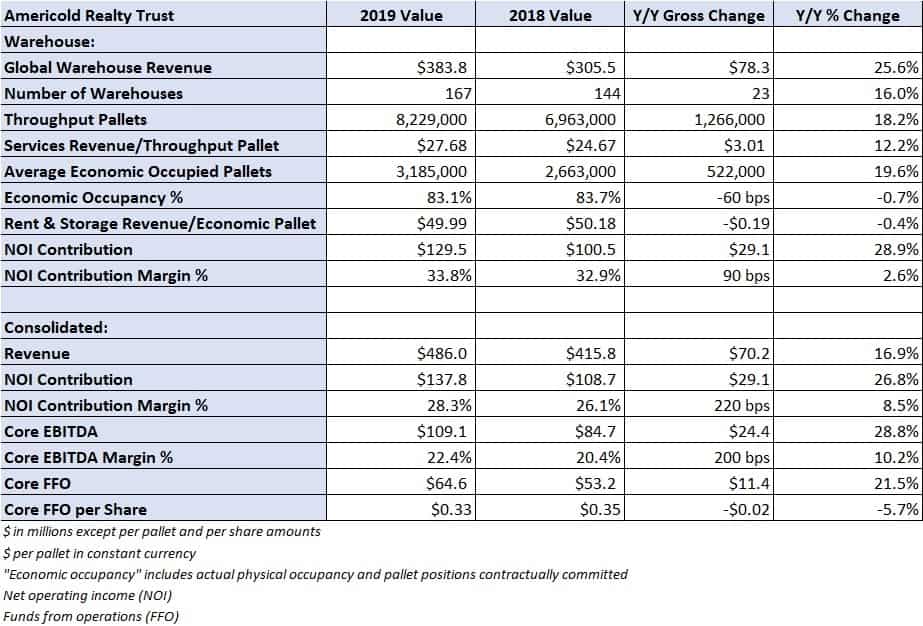

In the fourth quarter, Americold reported a 26% year-over-year increase in global warehouse revenue at $384 million. The average number of economic occupied pallets, or the total pallet space actually physically occupied or committed to its customers under contract, grew 20% to 3.2 million pallet positions. The occupancy rate of these pallets declined 60 basis points to 83.1% with revenue per pallet declining 19 cents to $49.99. Net operating income (NOI) contribution from the warehouse segment increased 29% to $130 million.

The bulk of the company’s growth came from prior acquisitions as warehouse revenue on a same-store comparison was slightly more than 3% year-over-year.

Americold made some large purchases in 2019. In May, the company acquired Cloverleaf Cold Storage in a $1.25 billion deal and announced an agreement to purchase Canadian-based cold storage facility operator Nova Cold Logistics in November for a little more than $250 million. That deal closed on Jan. 2.

In January, the company purchased an Upper Midwest temperature-controlled facility operator, Newport Cold Storage, for $56 million. In conjunction with Thursday’s financial report, Americold announced a 15% joint venture investment, $28 million, in SuperFrio Armazéns Gerais, a temperature-controlled storage operator in Brazil. SuperFrio operates 16 facilities with a combined total of 35 million cubic feet of refrigerated storage space.

Americold ended the year with $1.9 billion in total debt, $1.7 billion of which is real estate-related. The company’s primary debt leverage ratio — net debt to expected core earnings before interest, taxes, depreciation and amortization (EBITDA) including recent acquisitions — stood at 4.2x, slightly up from the end of the third quarter level of 4.1x.

The company ended 2019 with $1.4 billion in liquidity to pursue future acquisitions and facility projects.

For 2020, management’s guidance calls for adjusted FFO of $1.22-$1.30, compared to the current consensus estimate of $1.33 and the $1.17-per-share result it reported for full-year 2019.

Americold Realty Trust’s real estate portfolio includes 178 temperature-controlled facilities, including 11 facilities in its third-party managed segment, with more than 1 billion refrigerated cubic feet of storage in the United States, Australia, New Zealand, Canada and Argentina.